The crypto market is up today, Dec. 10, as investors await the Federal Reserve’s final interest rate decision of the year. Bitcoin rebounded to $93,000, while the top gainers were coins like Artificial Superintelligence Alliance (FET), Zcash (ZEC), Cardano (ADA), and Avalanche (AVAX).

Crypto Going Up as Fed Rate Cut Bets Rise

The crypto market is rising today as investors bet that the Federal Reserve will cut interest rates by 0.25% at its final meeting of the year. Such a move will bring the official interest rate to between 3.50% and 3.75%.

The rate cut comes a few days after the Fed ended its quantitative tightening policy, which drained trillions in assets from the global market. It also comes as the Secured Overnight Financing Rate (SOFR) remains near its lowest level this month.

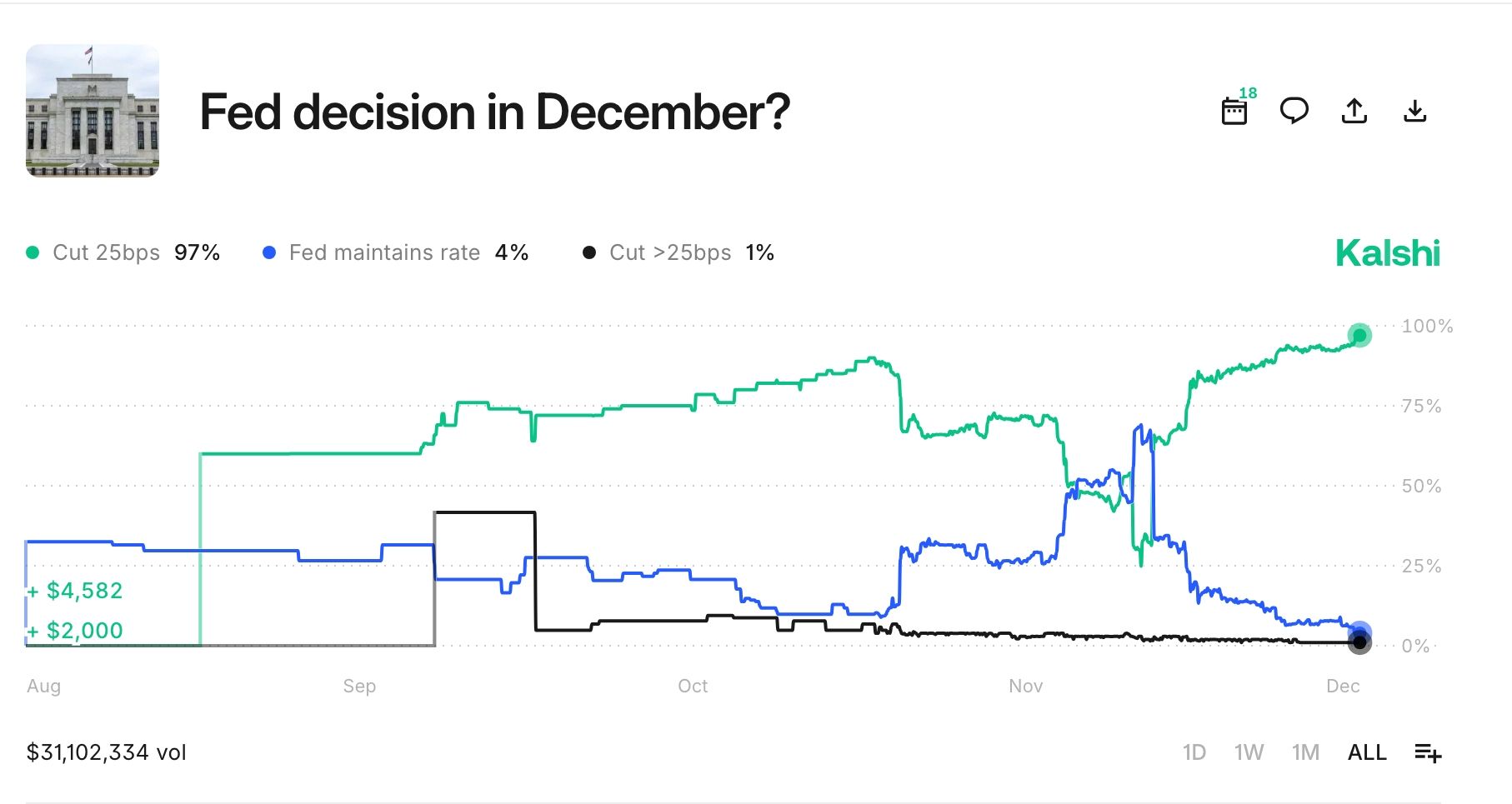

Data on Polymarket and Kalshi show that odds of a cut have now jumped to 97%. Therefore, the biggest surprise would be if the Fed’s hawks could convince the doves not to cut rates.

In most cases, the crypto market performs well when the Fed cuts interest rates, as this typically leads to a risk-on sentiment among users.

However, as we warned on Tuesday, there is a possibility that crypto prices will retreat after the Federal Reserve interest rate cut, as investors sell the news since it is already priced in. A good example of this is the XRP price pulling back after the ETF approvals and ongoing inflows.

Crypto Fear and Greed Index Crawling Back

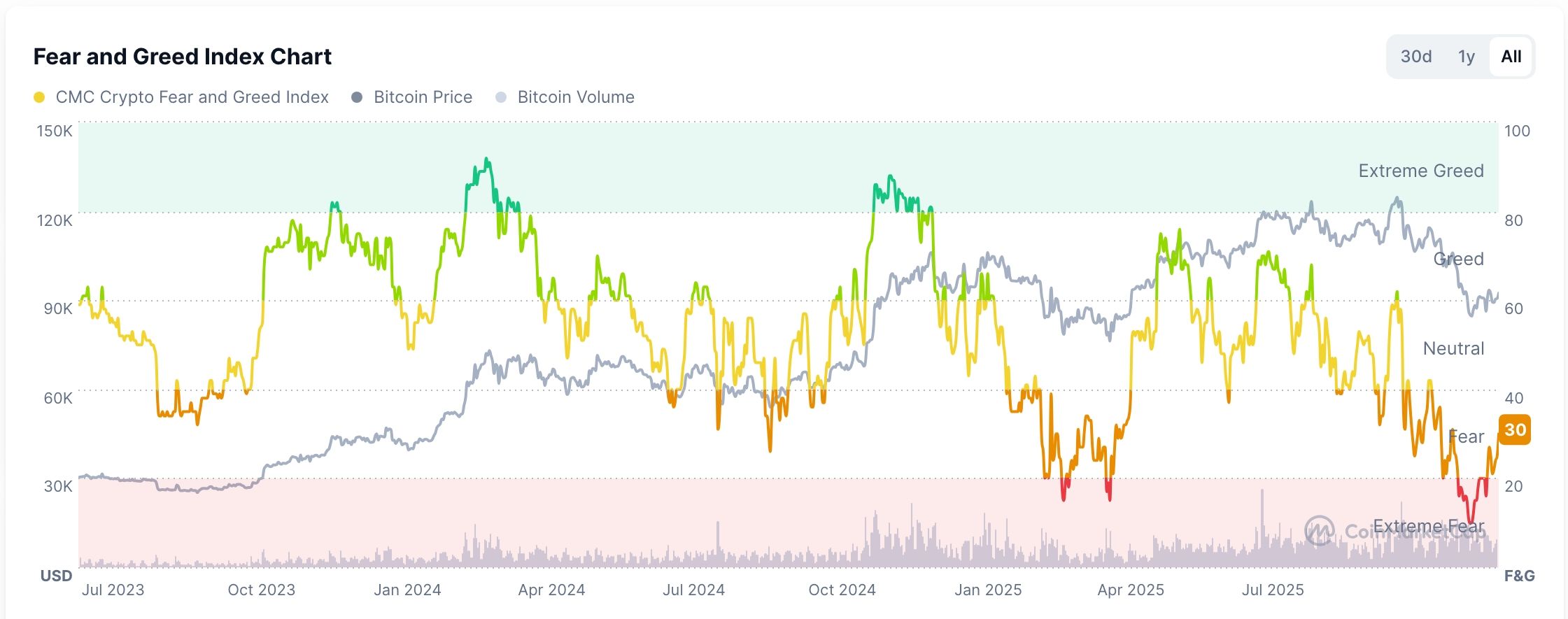

The other main reason the crypto market is rallying today is that investors are no longer as fearful as they were a few weeks ago.

Data compiled by CMC shows that the Crypto Fear and Greed Index has moved from last month’s low of 8 to the fear zone of 30. If the trend continues, the figure will soon rise to the neutral point.

In most cases, crypto bull runs usually start when the index moves to the extreme greed zone, which has already happened.

One sign that the fear is ending is that investors are starting to deploy leverage, albeit gradually. The futures open interest rose by 3.6% in the last 24 hours to $133 billion. The jump also happened as shorts worth over $434 million were liquidated in this period.

READ MORE: LUNA, USTC, LUNC Prices Soar Ahead of Do Kwon Sentencing: Brace for a Crash

Crypto ETF Inflows Rising as Strategy Buys

Meanwhile, there are signs that the recent outflows from Bitcoin and altcoins are about to end. Data shows that Bitcoin and Ethereum ETFs generated inflows on Tuesday as the crypto market rally started.

More data show that other altcoin ETFs, such as XRP, Solana, and Chainlink, continued to see robust demand from American investors, with XRP inflows crossing the critical $1 billion milestone less than a month after launch.

Meanwhile, Strategy and Tom Lee’s BitMine Immersion have continued to accumulate Bitcoin and Ethereum, a sign they expect a comeback. Strategy bought coins worth over $900 million last week, while BitMine has continued to grow its Ethereum hoard.

Still, the main risk in the crypto market is that the ongoing comeback is part of a dead-cat bounce, which is a temporary rebound that happens when an asset is in a freefall.

READ MORE: Canton Network Price Jumps as RedStone Beats Chainlink for Oracle Role