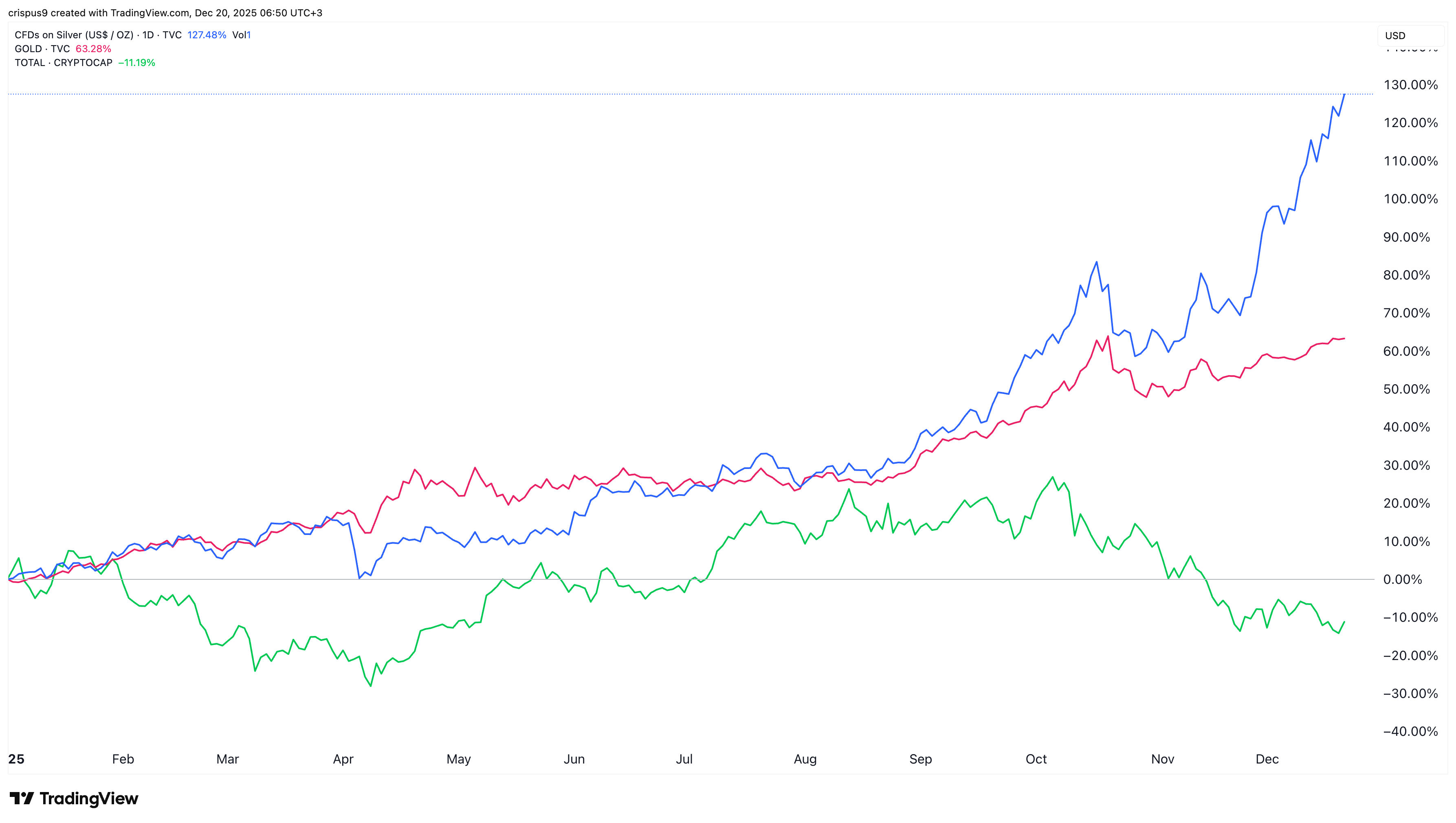

Silver price surged in 2025, becoming one of the top-performing assets, rising from $28 in April to $67.15 today. It soared by 133% this year, outperforming gold, which grew 63%, and the crypto market, which fell broadly by 11%. This article explores why the XAG price soared and why it may retreat in 2026.

Why Silver Price Surged in 2025

Silver, one of the top precious metals, soared to a record high, driven by rising demand, institutional demand, Federal Reserve interest rate cuts, supply constraints, and the Fear of Missing Out (FOMO).

One major catalyst for the ongoing silver price surge is its close correlation with gold, which surged to a record high. Gold’s demand was driven by safe-haven demand after Donald Trump introduced significant tariffs and changed the world order to some extent. He even attempted to remove Jerome Powell from the Federal Reserve, a move that would have failed.

READ MORE: The Bizarre XRP Price Crash: Why is Ripple in a Freefall Amid the Good News?

Gold price also jumped due to rising central bank demand, with countries like China intensifying their accumulation over the past few years amid concerns about the safety of the US dollar.

Most importantly, Tether became a major gold whale, accumulating tons of gold throughout the year. The company holds over 116 tons of gold, currently valued at over $16 billion. These gold holdings back the USDT stablecoin and Tether Gold.

Silver often performs well when gold is soaring because it correlates with gold and its much lower price, making it more attractive to retail investors.

Meanwhile, some major silver mining companies, such as Fresnillo, reduced production this year, leading to a squeeze as demand rose. As a result, there was a supply deficit of about 150 million ounces as demand from solar, electronics, ETFs, and electric vehicles rose.

Another primary reason the Silver price jumped was the US dollar’s drop, with the closely watched DXY Index falling from the year-to-date high of 110 to the current 100. Most metals do well when the dollar is falling, as many of them are priced in the currency.

Fundamentally, these demand and supply drivers may boost the silver price in 2026. Most importantly, US inflation is falling, and the unemployment rate is rising, which means the Federal Reserve will likely deliver several interest rate cuts during the year.

Technical Analysis Suggests that Silver Prices May Retreat in 2025

The daily timeframe chart shows the silver price has been in a strong uptrend this year and is now at an all-time high. This surge made it a top gainer, beating other top assets such as stocks, commodities, and crypto.

The risk, however, is that silver has become highly overbought, with most oscillators remaining above their overbought zones.

Additionally, silver remains above the 50-day and 200-day Exponential Moving Averages. While this is a bullish catalyst, there is a risk that it will undergo mean reversion.

Mean reversion is a situation in which an asset in a bull run retreats and moves closer to its historical moving averages. A good example of this is what happened to the Zcash price recently, when it plunged from its all-time high. The decline will also occur as it moves to the distribution and markup phases of the Wyckoff Theory.

READ MORE: Ethereum Price Prediction as Rare Bearish Pattern Forms