Bitcoin price rose for two consecutive days, moving from this week’s low of $84,430 to the current $88,355. This rebound accelerated after the Bank of Japan (BoJ) hiked interest rates to the highest point in three decades. Still, technicals suggest that the BTC price will resume the downward trend in the near term.

Bitcoin Price Technical Analysis Points to a Decline

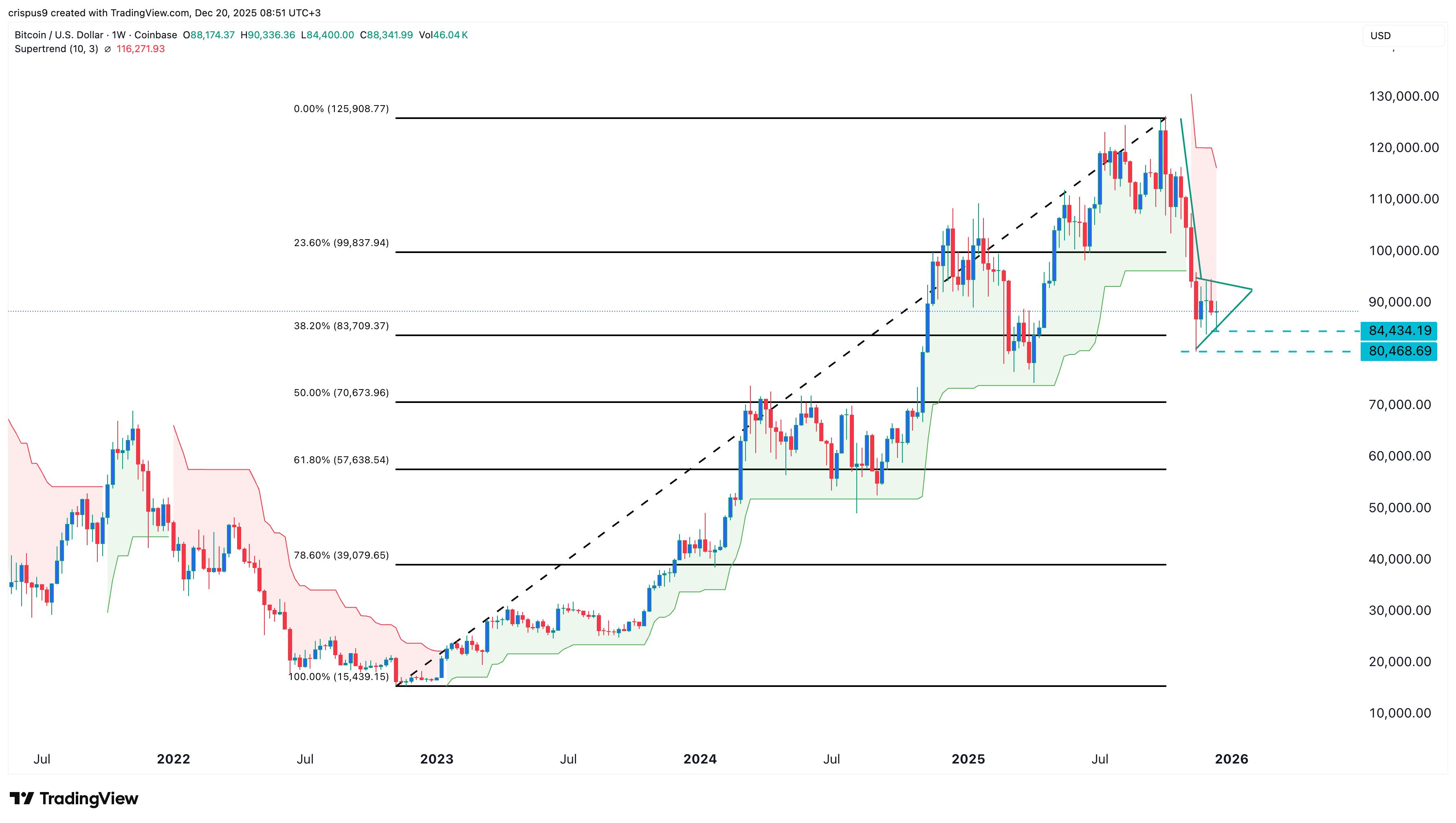

The weekly chart shows the BTC price has slumped over the past few weeks. It plunged from a high of $126,198 in October to the current $88,350. Its recent rebound has found substantial resistance at the $90,000 level.

The risk, however, is that the coin has formed a bearish pennant pattern, which is characterized by a vertical line and consolidation. It is now in this consolidation phase, which means a strong bearish breakdown may occur soon.

READ MORE: Coinbase Stock Price Risks $200 Crash Despite Prediction Market Debut

Bitcoin price has also moved below the Supertrend indicator, one of the riskiest tools in technical analysis. It also dropped below the 50-week Exponential Moving Average (EMA) and the 23.6% Fibonacci Retracement level.

Therefore, the most likely BTC price forecast is bearish, with the next important support level at the 50% Fibonacci Retracement at $70,000. This retreat will be confirmed if the coin drops below last month’s low of $80,468.

BTC Price is Facing Substantial Risks

There are several risks that may drag the BTC price lower in the near term. One of these headwinds is that some of the top Bitcoin treasury companies may start to sell their coins if their underperformance continues.

Strategy recently sent shockwaves in the crypto industry by hinting that it may sell its Bitcoin if the mNAV drops below 1. This is a strong possibility as the mNAV based on the enterprise value has tumbled to 1.04.

The only benefit is that Strategy has over $1 billion in cash to handle its obligations. Many Digital Assets Treasury (DAT) companies don’t have this luxury, meaning that they may start selling.

The other risk is that demand for BTC ETFs has continued to wane this month. Bitcoin ETFs had a net outflow of over $156 million on Friday and $161 million a day earlier. Their cumulative inflow stands at $57 billion, well below the all-time high of $65 billion.

On the positive side, some macro factors are highly supportive of Bitcoin and the broader crypto market. One of them is that the Federal Reserve will likely slash interest rates more as inflation falls and the unemployment rate rises.

Additionally, the global M2 money supply has jumped to a record high. This trend may accelerate as Japan and China launch their stimulus packages. The easy-money policies will likely boost the crypto and stock markets.

READ MORE: The Bizarre XRP Price Crash: Why is Ripple in a Freefall Amid the Good News?