The MSTR stock price has continued its strong downward trend in the past few months. Strategy has dived from the all-time high of $542 to the current $164. It is now hovering at its lowest level since September last year. Here are the top reasons Strategy stock may dive soon.

MSTR Stock Price Technicals Point to More Downside

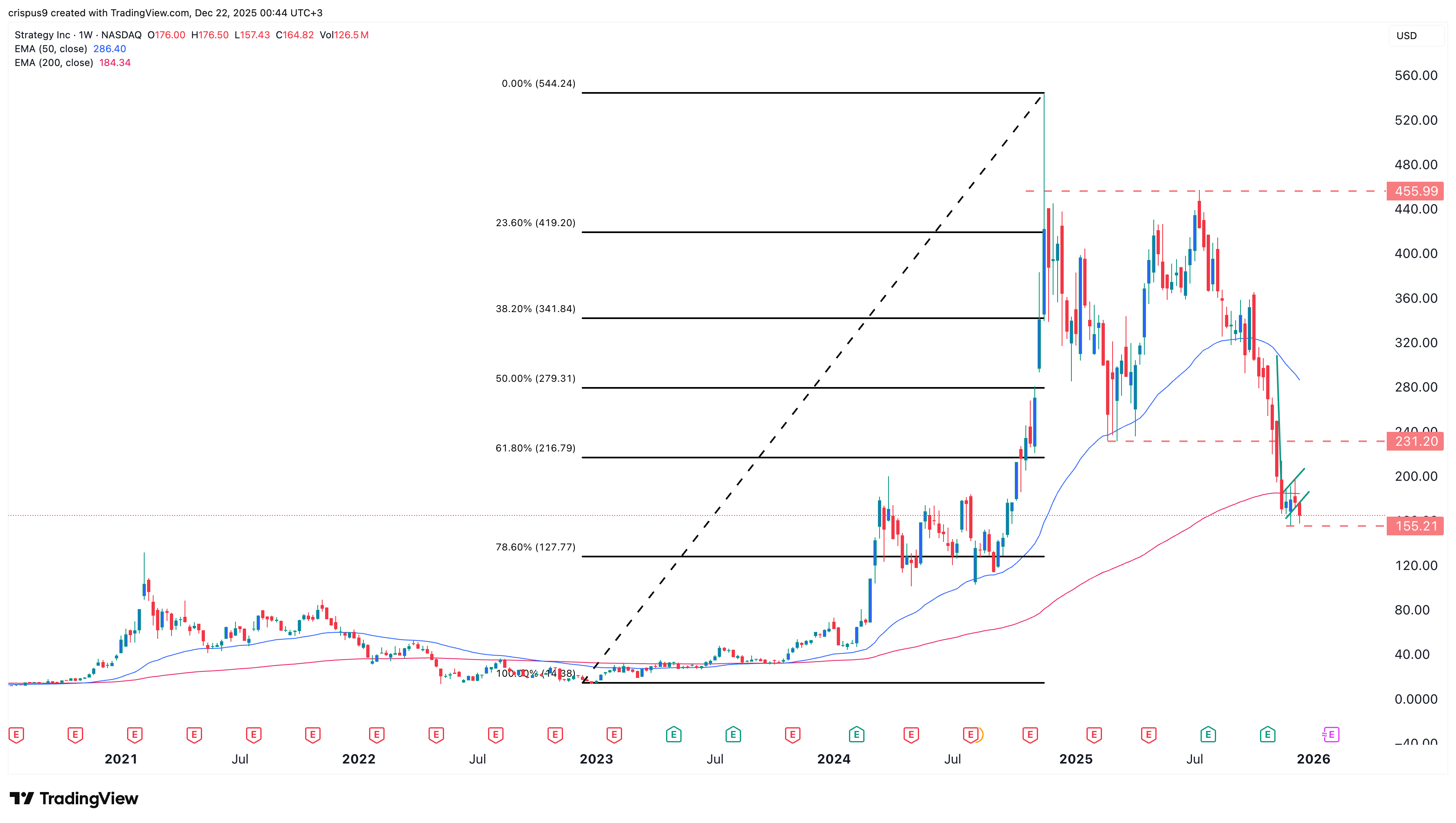

The weekly chart shows that the Strategy stock price has crashed over the past few months, and this trend will likely continue to fall in the coming months.

It has formed a double-top pattern at $455 and a neckline at $231, its lowest level in March this year. This is one of the most common bearish patterns in technical analysis.

Meanwhile, the stock has formed a bearish flag pattern. It has moved slightly below the lower side of the ascending channel, confirming a bearish breakout.

READ MORE: Ethereum Price Prediction as Rare Bearish Pattern Forms

MSTR share price has dropped below the 200-week moving averages and the 61.8% Fibonacci Retracement level. Therefore, the stock will likely continue to fall as sellers target the 78.60% retracement level at $127.7, which is 22% below the current level.

Bitcoin Price is at Risk of a Big Drop

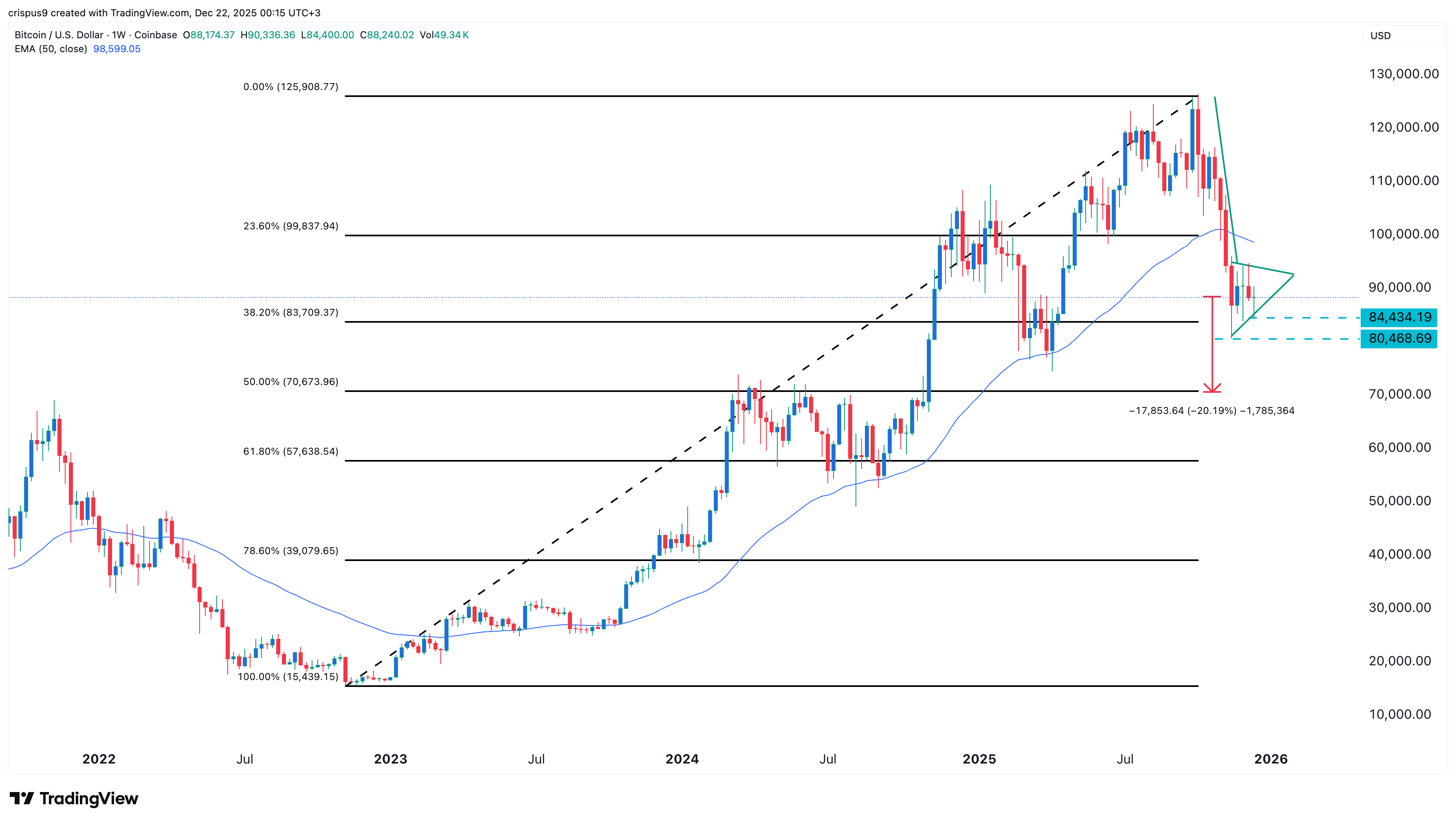

The other main bearish catalyst for the stock is that the Bitcoin price is at risk of a strong bearish breakout. It has formed a death cross pattern as the 50-day and 200-day Exponential Moving Averages crossed each other.

Bitcoin has also remained below the Supertrend indicator, a sign that the bearish trend will continue falling. Therefore, the most likely outlook is bearish, with the next key target to watch being at $70,000, which is 20% below the current level.

A Bitcoin price crash will hurt Strategy, as it is the largest holder. It holds 671,268 coins currently worth about $59 billion. A drop to $70,000 will bring the value of its assets to $46 billion.

READ MORE: The Bizarre XRP Price Crash: Why is Ripple in a Freefall Amid the Good News?

More Bearish Catalysts for the Strategy Stock

There are other reasons why the MSTR stock price may keep falling. First, the company may be removed from MSCI indices, a move that will trigger forced selling by some of the biggest ETFs that hold its shares.

Second, Strategy has continued to dilute its shareholders in the past few months through its at-the-market (ATM) program. Most of its current Bitcoin purchases are made through this program, a move that will continue to dilute investors.

Third, the company’s mNAV multiple will likely continue falling, with the enterprise value multiple moving to 1.027. The basic and diluted mNAV multiples have moved to 0.80 and 0.89, respectively.

Finally, the company’s short interest continues to rise and is currently at 11.5%, much higher than its lowest point this year. This means that more traders are betting against the company.