Crypto prices crashed today, Dec. 24, erasing most of the gains made earlier this week. Bitcoin dropped from $91,000 on Monday to $87,000, while Uniswap (UNI) retreated to $5.82.

UNI token has plunged by 52% from the year-to-date high, while Hedera (HBAR) slipped to $0.1095 and Dogecoin (DOGE) slumped to $0.178. As a result, the market capitalization of all tokens dropped by 1.35% in the last 24 hours to $2.96 trillion.

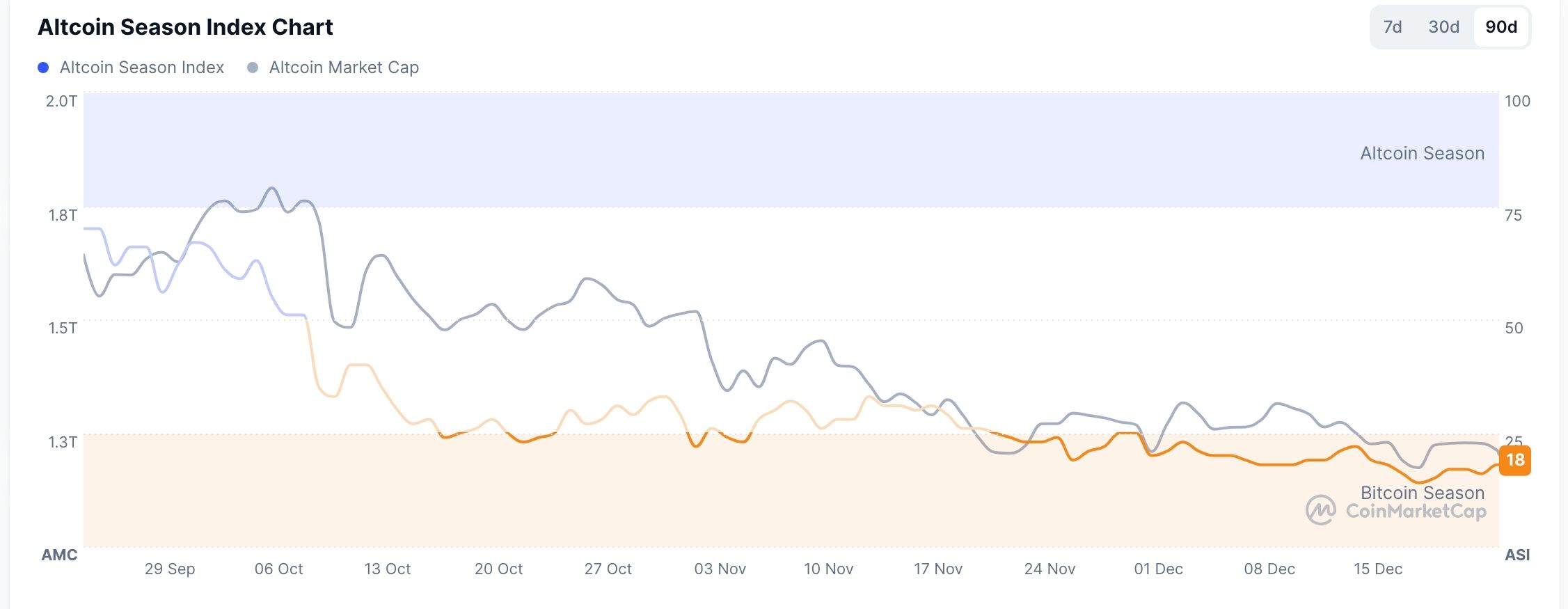

Most importantly, the Altcoin Season Index has dropped to 17, indicating that Bitcoin is the industry’s dominant player.

One main reason why crypto prices are falling is that the US published strong macro data. Data released by the Bureau of Economic Analysis (BEA) show that the economy expanded by 4.3% in the third quarter, higher than analysts expected.

The economy expanded as consumer spending continued to do well and as spending on artificial intelligence accelerated. Therefore, the crypto market declined as investors anticipated that the Federal Reserve would have no urgency to cut interest rates in 2026.

Indeed, Donald Trump chimed in, criticizing the Fed for not cutting interest rates despite strong numbers. He believes the bank should accelerate rate cuts to supercharge the economy.

Bitcoin and other altcoins tend to do well when the Fed is cutting interest rates. In its last meeting, officials slashed rates by 0.25% and hinted that it will deliver rate cuts in 2026.

The crypto market is also slumping as traders wait for the biggest options expiry on record. Tokens worth $28 billion will expire on Friday, which may lead to increased market volatility.

The upcoming expiry is coinciding with a period of low demand for Bitcoin, with spot exchange-traded fund (ETF) inflows stalling. These funds have already shed billions in assets, a trend that may continue in the coming days because of the Christmas holiday.

Meanwhile, cryptocurrencies have made some notable news. For example, Uniswap’s price dropped even as the community voted to switch fees and to burn 100 million UNI tokens in the coming days.

NIGHT, which Cardano owns, has slumped as investors began booking profits after the recent rally.

Hedera token has plunged as the HBAR ETF inflows dried up and its ecosystem growth stalled. The fund has not added any assets in weeks, and its trading volume has largely dried up. Similarly, the Grayscale and Bitwise DOGE ETFs have had no inflows since December 11.