The crypto market remained under pressure on Christmas Day as volume in the spot and futures markets dived. Bitcoin was stuck in a tight range, while top altcoins like Monad (MON), Canton (CC), Conflux (CFX), and Zcash (ZEC) were the top gainers.

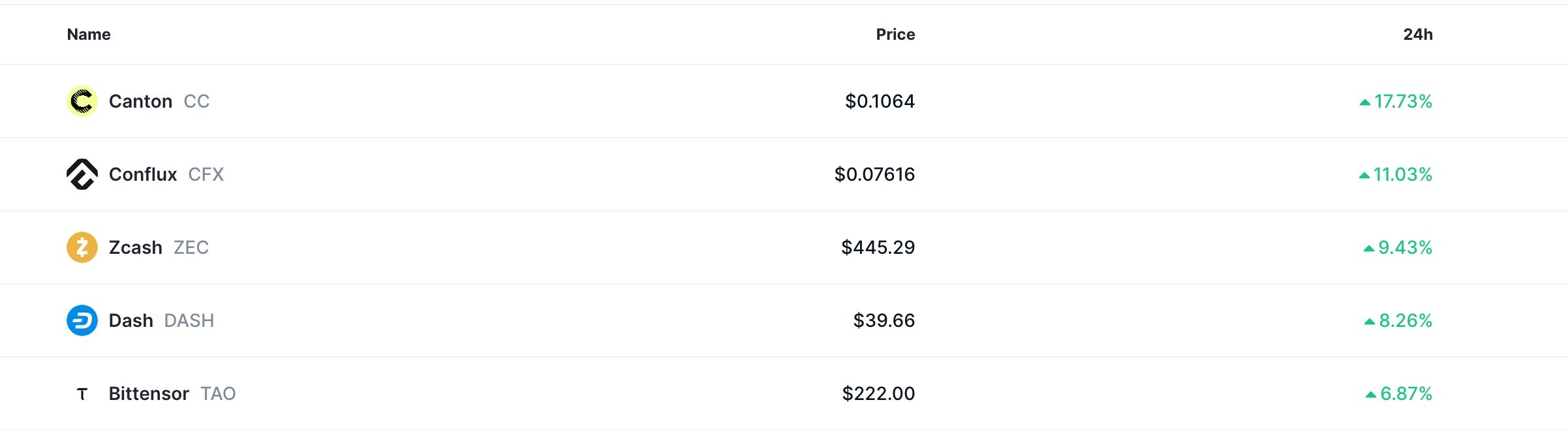

Monad price jumped by 30% to $0.02300, with its 24-hour volume soaring to over $203 million. Meanwhile, Canton jumped by 17%, while Conflux and Zcash jumped by over 10%.

Third-party data show that crypto market volume dropped by over 32% to $68 billion, the lowest level in months. Similarly, according to CoinGlass, futures open interest fell by 83 basis points to $126 billion, well below the year-to-date high of over $255 billion.

The volume in the crypto market also coincided with the activity in the US crypto ETF industry, where demand remained thin. Spot Bitcoin ETFs shed over $175 million in assets for the fourth consecutive day, according to data from CoinShares. These funds have now shed over $804 million in assets this month.

READ MORE: Cardano Price Prediction 2026: Top 5 Catalysts for ADA Token

Spot Ethereum ETFs shed over $52 million in assets on Wednesday. Like Bitcoin, these funds have had over $564 million in outflows this month.

While XRP and Solana ETFs had inflows on Christmas Eve, others like Dogecoin, Hedera, and Litecoin had no inflows.

Looking ahead, the volume and open interest in the crypto market will likely remain under pressure in the coming days as traders activate their holiday mode.

However, the upcoming Bitcoin options expiry will have a significant impact on the industry. Bitcoin positions worth over $25 billion and Ethereum worth over $4 billion will expire on Friday. Historically, such large option expiries have led to greater volatility in the crypto market.

There was no major news that boosted the values of Canton, Zcash, Conflux, and Monad. As such, these jumps are likely part of speculation among traders.

And when they happen, they are usually followed by dumps the following day. Indeed, some of the top laggards today, like Audiera, Animecoin, Midnight, and Huma Finance, were among the top laggards a day earlier.

READ MORE: Ethereum Price Multi-Chart Analysis Points to an ETH Crash