The Securities and Exchange Commission (SEC), under Paul Atkins, delivered a major victory for the crypto industry this year by approving several crypto ETFs, including Ripple (XRP), Solana (SOL), Hedera (HBAR), Dogecoin (DOGE), and Litecoin (LTC).

Some of these ETFs – Solana and XRP – have become highly successful, with their cumulative inflows rising to $1.14 billion and $755 million, respectively.

Dogecoin, HBAR, and Litecoin ETFs Have Flopped

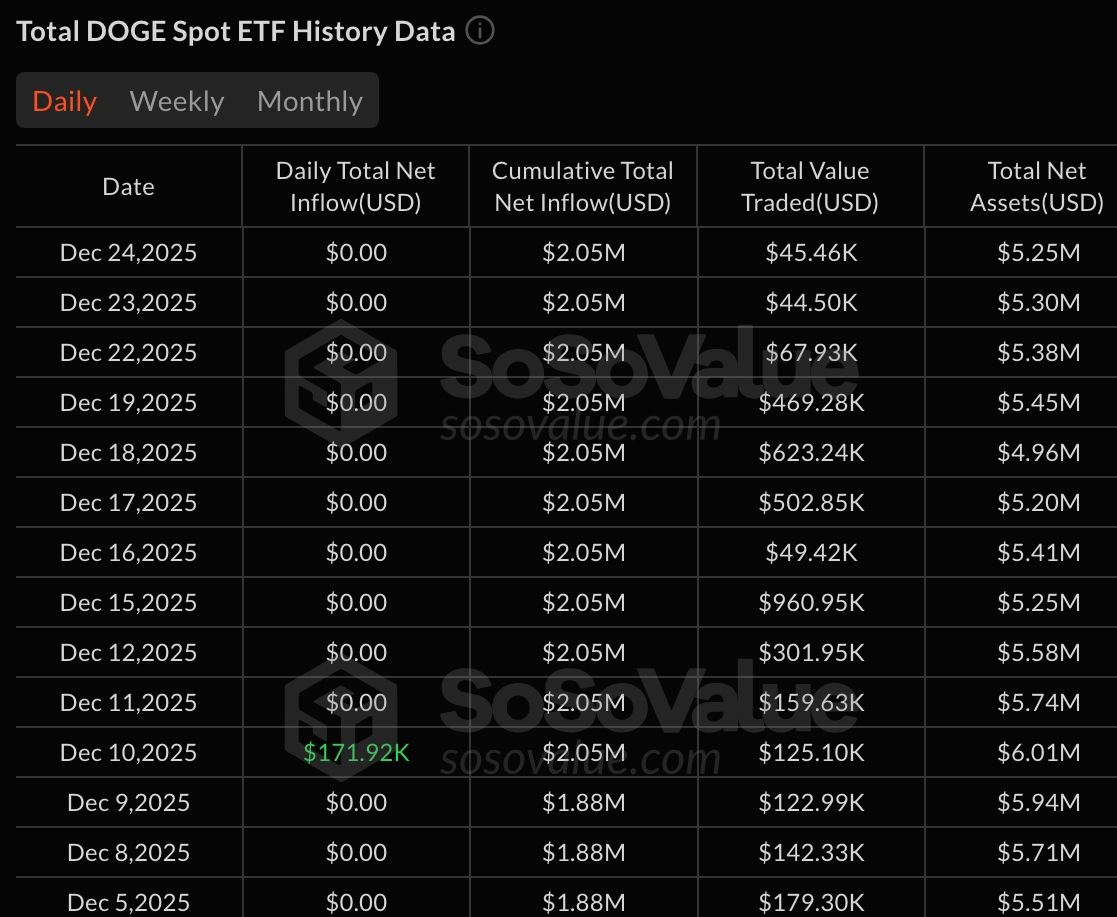

Others, however, especially Litecoin, Hedera, and Dogecoin, have flopped, with investor demand drying up. The Grayscale and Bitwise DOGE ETFs have had no inflows since December 11.

They have accumulated just $2 million in inflows and now have $5.25 million in assets, a tiny amount for a coin with a market capitalization of over $21 billion.

Similarly, the Canary HBAR ETF has had $88 million in cumulative inflows and now has $51 million in assets. It has had no inflows in the past few weeks.

The Canary Litecoin ETF has had just $7.67 million in inflows and has $6.87 million in assets, which are equivalent to 0.12% of the market capitalization.

READ MORE: Monad, Canton, Conflux, Zcash Prices Jump as Crypto Volume Drops on Christmas Day

There are a few reasons why the DOGE, Litecoin, and Hedera ETFs have flopped since their launch earlier this year. One of the main reasons is that these ETFs launched during a crypto market crash when demand for Bitcoin and most altcoins dropped. Indeed, Bitcoin and Ethereum ETFs have had major outflows in the past few months.

These Tokens are No Longer as Popular as They Once Were

Another reason is that Litecoin, Hedera, and Dogecoin are no longer as popular as they were a few years ago. Dogecoin gained popularity in 2021 when Elon Musk pumped it, something he is no longer doing.

Recent data show that demand for Dogecoin has dropped sharply over the past few months, with 24-hour volume at about $500 million. Historically, the token had volumes in its billions.

Dogecoin has faced substantial competition from other meme coins, such as Shiba Inu and Pepe. Most importantly, it has no major catalyst that will push it higher in the long term.

Like Dogecoin, Litecoin is seeing weak demand, with its daily volume below $300 million. It has no major catalyst that will push it higher in the near term.

Hedera, on the other hand, as we have covered here, has had no major catalyst in the past few months. Its ecosystem growth has largely dried up, while its stablecoin supply has plunged to below $100 million.

Finally, these ETFs have flopped because of the rising demand for the XRP and Solana ETFs, which have numerous catalysts. This explains why these funds have never had net outflows.

READ MORE: Ethereum Price Multi-Chart Analysis Points to an ETH Crash