Solana price crashed by over 40% this year, with its market capitalization plunging from a peak of $135 billion to the current $70 billion. This article explores the top reasons why the SOL price crashed and the potential catalysts for 2026.

Reasons Why Solana Price Plunged in 2025

There are a few key reasons why the SOL price crashed this year. The main one is that the crash mirrored the performance of other cryptocurrencies, which plunged by double digits during the year.

Most importantly, the coin dropped amid the poor performance in Solana meme coins, erasing earlier gains this year and plunging. Data compiled by CoinGecko shows that the market cap of all Solana meme coins has fallen from over $25 billion in January to $5.4 billion at present.

Most of these meme coins have plummeted, so none have a market capitalization over $1 billion. Official Trump, which soared dramatically in January, has seen its market valuation drop to $990 million today.

READ MORE: Dogecoin Price Crashed 63% in 2025 — What’s Ahead in 2026?

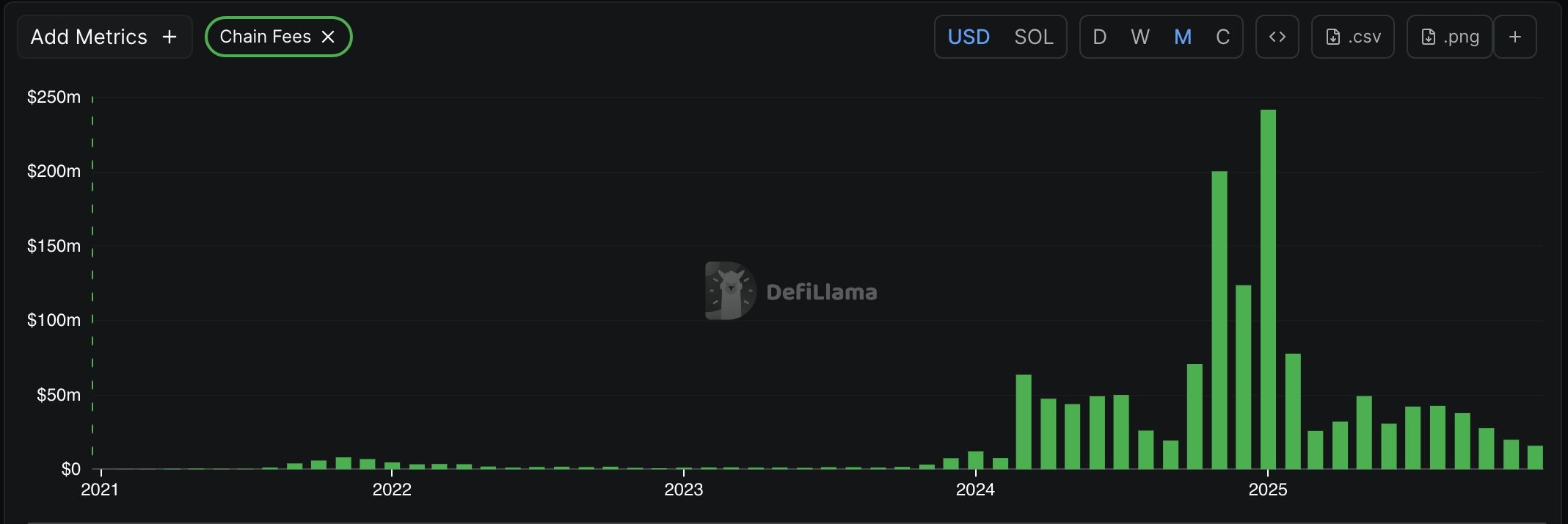

The falling Solana meme coins have had a significant negative impact on their ecosystem. For example, the monthly DEX volume in Solana dropped to $92 billion in December from a peak of $313 billion. Its network fees have also plunged from $241 million in January to $15 million this month.

Additionally, Solana has experienced a sharp decline in futures open interest, which moved to $7.3 billion from the year-to-date high of over $16 billion.

Potential Catalysts for SOL Price in 2026

Solana price has numerous bullish catalysts in 2026. One of them is the ongoing accumulation of the SOL ETF. These funds had $199 million, $419 million, and $137 million in inflows in the last three months, bringing the total to $755 million.

They hold $926 million in assets, equivalent to 1.35% of Solana’s market cap. This means these funds have more upside, as Ethereum and Bitcoin multiples stand at over 5%.

Solana will also unveil the Alpenglow upgrade, which will replace proof-of-history (PoH) and TowerBFT with votor and rotor. Votor will provide a fast, direct validator for block finalization, while Rotor will have an improved data-dissemination protocol.

There is also a chance that the community will vote to reduce its inflation rate, which stands at 8% annually. It decreases by 15% annually, with the long-term goal of reducing it to 1.5%.

Some teams, especially Helium, have made a proposal to double the disinflation rate from 15% to 30%. The goal is to reach the terminal rate of 1.5% in 3.1 years, rather than 6.2 years.

Solana Price Technical Analysis

The three-day timeframe chart shows that the SOL price peaked at $296 in 2025 and then plunged to the current $124.57. A closer look reveals that the token formed a head-and-shoulders pattern. It is now sitting at the neckline, which is along the 61.8% Fibonacci Retracement point.

Therefore, the most likely SOL price prediction is bearish, with the potential target being at $70.45, the 78.6% retracement level.