IREN stock price has been in a strong freefall over the past few months as the recent bull run was undone. It has crashed by 50% from its November 2021 high to the current $37. So, will the shares rebound as short interest soars and Wall Street analysts remain bullish?

IREN Stock Falls as Short Interest Rises; Analysts Remain Bullish

More American investors are taking bearish bets on IREN, a company at the intersection of the fast-growing AI data center industry and Bitcoin mining.

Data compiled by Seeking Alpha shows that the company’s short interest has jumped to 15%. That is a big increase from last year’s low of 5% and signals that market participants see the downtrend accelerating.

One reason for the short interest is the ongoing Bitcoin price crash, which has affected most mining companies. Indeed, other top Bitcoin mining companies, such as MARA, Riot Platforms, and Cipher Mining, have all plunged.

READ MORE: Chainlink Price Prediction as Strategic LINK Reserve Buying Soars

IREN’s short interest has also jumped as investors sour on the AI data center industry following Oracle’s and Broadcom’s recent earnings. Nebius’ short interest has risen to 16%, while CoreWeave’s figure has jumped to 12%.

A major issue among analysts is that the company may struggle to attract new hyperscalers as customers. It has already inked a $9.7 billion deal with Microsoft.

Top hyperscalers have alternatives, including popular companies like TeraWulf, Bitfarms, and CoreWeave. As such, the most important clients may opt for these firms or negotiate less favorable deals.

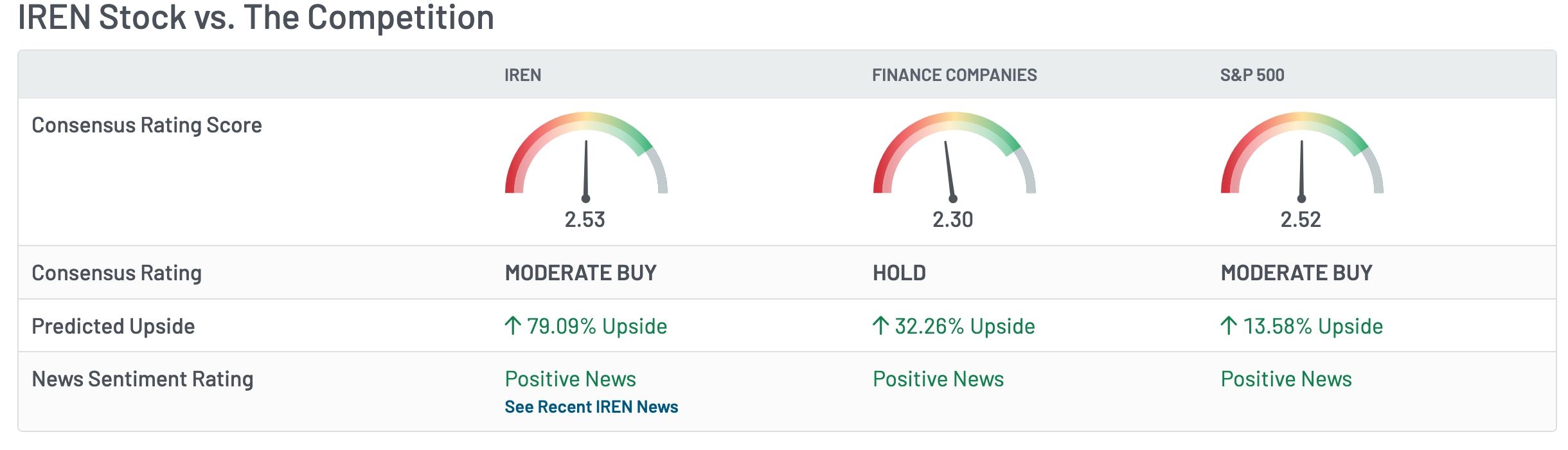

On the positive side, however, Wall Street analysts are bullish on the company, with a consensus target price of $67 from 19 analysts, representing a 79% upside from the current level. A year ago, the estimated target was just $19.

The most bullish analyst is JMP Securities’ Greg Miller, who has a target of $80, up 63% from the current level. Compass Point, Canaccord Genuity, and Roth Capital have a bullish outlook.

The most recent results showed that its Bitcoin mining revenue rose by 129% to $113 million as it mined 1,347 coins. Its AI cloud revenue rose to $3.2 million from $2.7 million in the same period last year.

IREN Share Price Technical Analysis

The daily chart shows that the IREN share price has crashed in the past few months. It has slumped from a high of $76 to the current $37, forming a series of lower lows and lower highs.

The stock has moved below the 50-day Exponential Moving Average (EMA) and the key support at $48.40, its lowest level on October 22. It also forked a double-top pattern and currently remains below the Supertrend indicator.

Therefore, the stock will likely continue falling as sellers target the ultimate support level at $25. Such a move will be a 35% drop from the current level.

READ MORE: NVIDIA Stock Price Forecast 2026: Reasons it May Hit $300 Soon