A crypto rally is happening, with the market capitalization of all tokens surpassing $3.1 trillion today, January 2. Pepe Coin (PEPE) jumped by 32.3%, with its 24-hour volume soaring to $1.5 billion.

Monad price jumped by 20% to $0.02650 with a 24-hour volume of $247 million. Floki and other meme coins like Mog Coin, SPX6900, Popcat, and Memecoin jumped by double digits.

Crypto Rally Boosted by Meme Coins

The ongoing crypto rally is underway as investors pile into meme coins, which were among the industry’s top laggards last year.

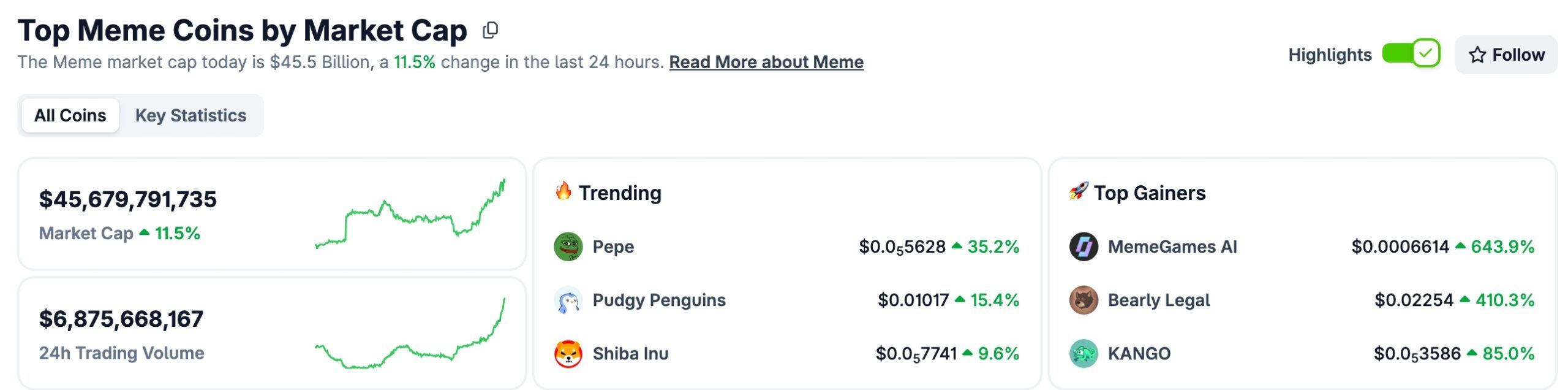

Data compiled by CoinGecko shows that the market capitalization of all meme coins rose 11% over the last 24 hours to $45.1 billion, while volume rose to $6.4 billion.

This surge is happening as investors buy the dip after most of these tokens plunged by double digits from their 2025 highs. As such, these investors likely see these tokens as big bargains.

READ MORE: Chainlink Price Prediction as Strategic LINK Reserve Buying Soars

Crypto Boosted by Stock Market Increase

The other reason behind the ongoing crypto market rally is that stocks are also soaring, with the Nasdaq 100, Dow Jones, and S&P 500 indices rising by 1.02%, 0.25%, and 0.56%, respectively.

Other global indices also jumped on Friday, with the Hang Seng soaring by 2.6% and the Euro Stoxx, Shanghai Composite, and Nikkei 225 indices continuing the bull run.

These assets are likely rising because of the January Effect, which is characterized by a rally in assets at the beginning of the month as the December tax-loss selling season ends.

Stocks and crypto prices are also rising as investors brace for a better year for risky assets, with inflation continuing to fall and the Federal Reserve slashing interest rates.

Also, there are hopes that the crypto industry will gain more clarity as the Senate passes the closely watched CLARITY Act. The SEC will also have a crypto regulatory exemption this month.

Rising Futures Open Interest

The crypto rally is also happening as investors continue to deploy leverage, a sign that they expect the rebound to happen for a while. Data compiled by CoinGlass shows that futures open interest rose 3.5% over the last 24 hours to $131 billion, with short liquidations exceeding $222 million.

There is a likelihood that futures open interest will continue to rise after being oversold, following the crash from over $255 billion in October to $125 billion in December.

Indeed, the Crypto Fear and Greed Index is exiting the fear zone. It has jumped to 34, meaning that it will move to the neutral phase as soon as today.

However, there is a risk that the ongoing crypto rally is a dead-cat bounce, as we have seen several times in the past few months. A dead-cat bounce, also known as a bear trap, is a situation where an asset in a free fall rebounds briefly and then resumes the downtrend.

READ MORE: MSTR Stock Was the Top Laggard in Nasdaq 100 Index: Will it Rebound in 2026?