The Altcoin Season Index jumped this week, reaching its highest level in months, as the January Effect continued and Bitcoin consolidated.

CoinMarketCap data show the index jumped to 42, well above the December low of 12. This rally was driven by the recent gains of top altcoins like Pippin, Monero, Virtuals Protocol, and MYX Finance.

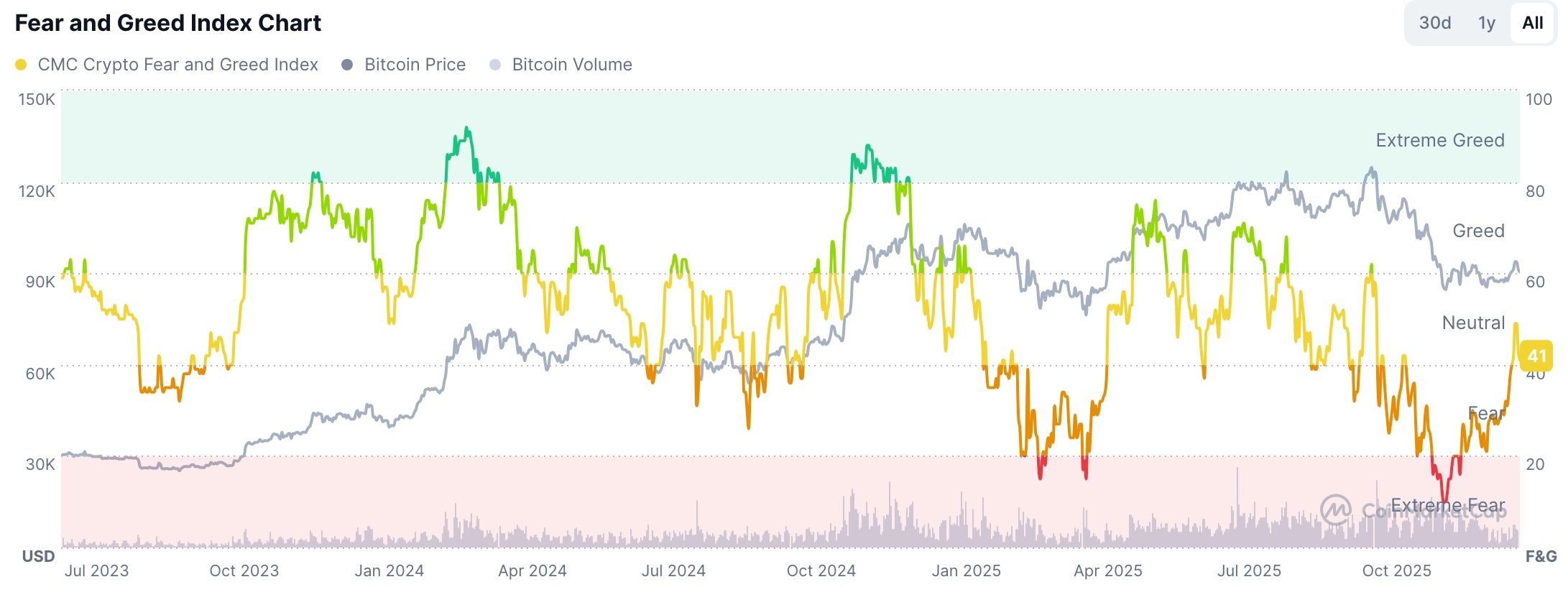

Altcoin Season Index to Rise as Fear and Greed Index Jumps

One main reason the Altcoin Season Index may keep rising is that the Crypto Fear and Greed Index is rising. Data show that the index has jumped from last year’s 10 to the current 41, its highest level since October.

This index measures sentiment in the crypto market by tracking key metrics. For example, it examines Bitcoin’s performance, volatility, and data from the derivatives market. It is likely to move to the greed zone. In most cases, altcoins do well when the index is rising.

Meanwhile, the CNN Money Fear and Greed Index has exited the fear zone and moved to the neutral point at 50. This is a big increase, as it was in the extreme zone earlier.

READ MORE: Polygon Price Prediction: Here’s Why POL is Ripe for a 45% Surge

Futures Open Interest Has Bottomed

There are signs that activity in the futures market is stabilizing. Data compiled by CoinGlass shows that the interest stood at $137 billion on Friday. A closer look shows it has moved sideways over the past three months, a sign of a bottoming.

A rebound in futures open interest would be a good thing for the crypto industry as it would be a sign that investors are embracing risk. The futures open interest crashed in October as trades worth over $20 billion were liquidated within a day.

Federal Reserve Interest Rate Cuts

Meanwhile, there are chances that the Federal Reserve will continue cutting interest rates this year. A report released on Friday showed that the economy added 55k jobs in December, lower than the median estimate of 70k.

The report also showed that the unemployment rate improved to 4.4%. These numbers indicate that the labor market has softened, while inflation has started to decline. The recent report showed that inflation dropped to 2.6%.

Therefore, a combination of a lower inflation rate and a higher unemployment rate means that the bank may deliver more cuts this year. At the same time, the M2 money supply has continued rising, and Americans will receive the biggest tax refund in years.

READ MORE: Top Altcoin Flops in Crypto: Pi Network, HMSTR, Cardano & Others