Solana, the second-largest layer-1 network, is performing relatively well and outperforming Ethereum and BNB Smart Chain (BSC) in several key metrics ahead of the much-anticipated Alpenglow.

Key Solana Metrics are Doing Better Than Ethereum and BSC

Third-party data show that Solana is outperforming its top competitors across several key metrics. First, the network has a much higher staking yield. Its reward rate averages about 6.20%, higher than Ethereum’s 2.85% and BNB’s 0.85%. Its staking ratio of 68% is also higher than ETH’s 29% and BNB’s 18%.

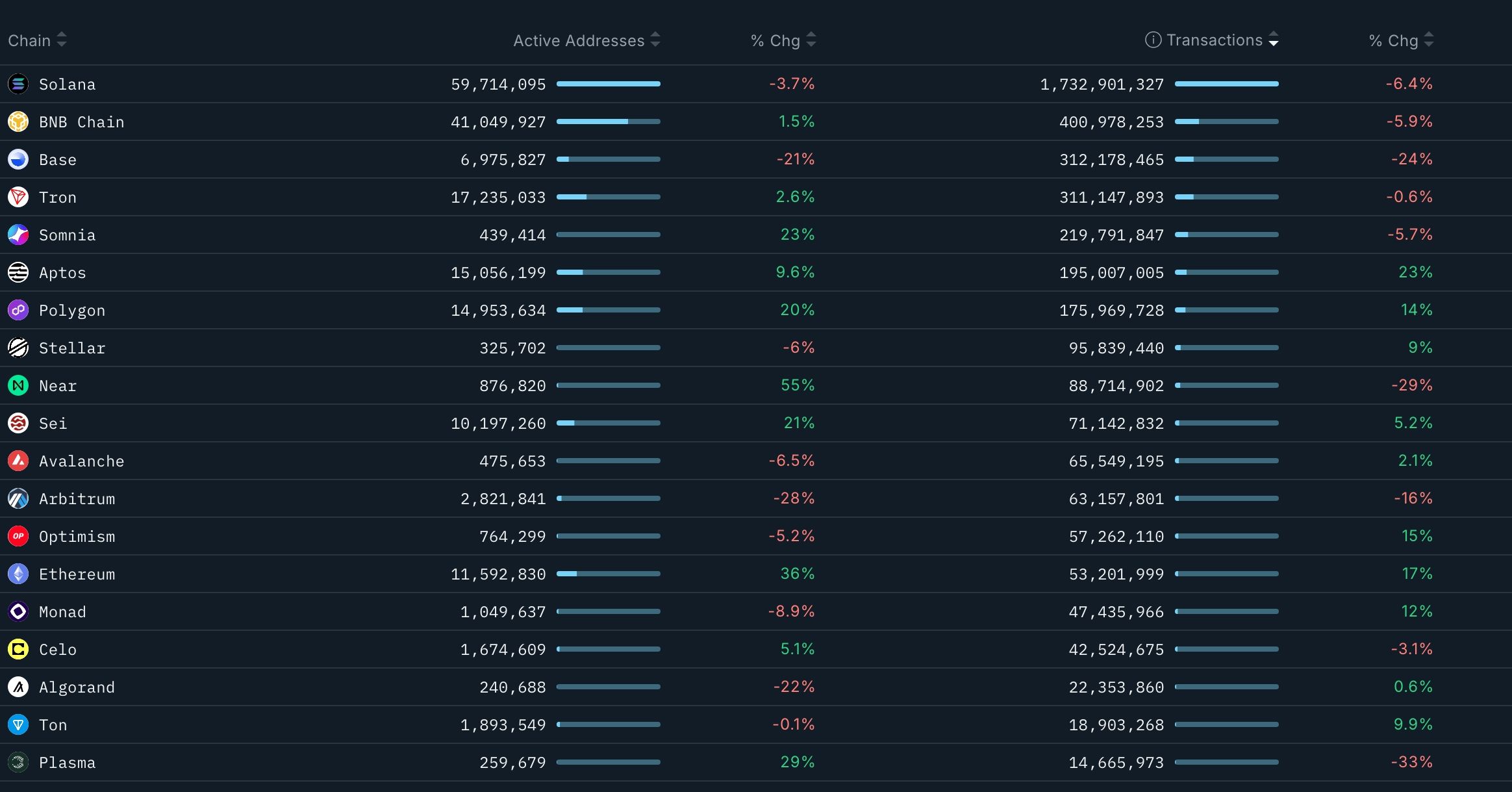

More data compiled by Nansen shows that Solana handles the most transactions in the crypto industry. It handled over 1.7 billion transactions in the last 30 days, much higher than BNB Chain’s 410 million and Ethereum’s 54 million. Indeed, its transactions exceed those of the other 10 chains combined.

READ MORE: Crypto News Catalysts for Next Week: Market Structure Bill, SCOTUS, CPI

Solana is also generating more fees than Ethereum and BNB Chain. It made $15 million over the last 30 days, while Ethereum and BNB generated $10.6 million and $13 million, respectively.

Moreover, data compiled by DeFi Llama shows that Solana’s DEX volume rose to $117 billion. In contrast, BSC and Ethereum’s volume rose to $47 billion and $41 billion, combined.

Solana is also beating Ethereum as the chain of choice for tokenized stocks. Data compiled by TokenTerminal shows that tokenized stocks in Solana have a market cap of over $1.29 billion, higher than Ethereum’s $1.27 billion. This is important because Coinbase’s Brian Armstrong believes the industry is still in its infancy.

Solana’s growth in other industries, such as tokenized stocks and stablecoins, suggests it is gaining broader adoption beyond the meme coin industry.

Alpenglow Upgrade Ahead

Looking ahead, the next major catalyst for Solana’s network will be the Alpenglow upgrade later this quarter.

Alpenglow will introduce numerous features that will make it a better chain. It will boost its network speed from 12.8 seconds to 100-150 milliseconds. It will also raise the maximum transaction speed from 65,000 to 107,000 transactions per second (TPS).

Alpenglow will also slash validator expenses by 50%, encouraging broader participation and decentralization. The upgrade is expected to be activated in the current quarter, with more upgrades scheduled for later this year.

READ MORE: XRP Price Surge Ahead? Ripple CEO Says Company is Firing on All Cylinders