The stock and crypto markets are down today, erasing billions of dollars in value and continuing a trend that began last week.

Stock and Crypto Markets Have Crashed

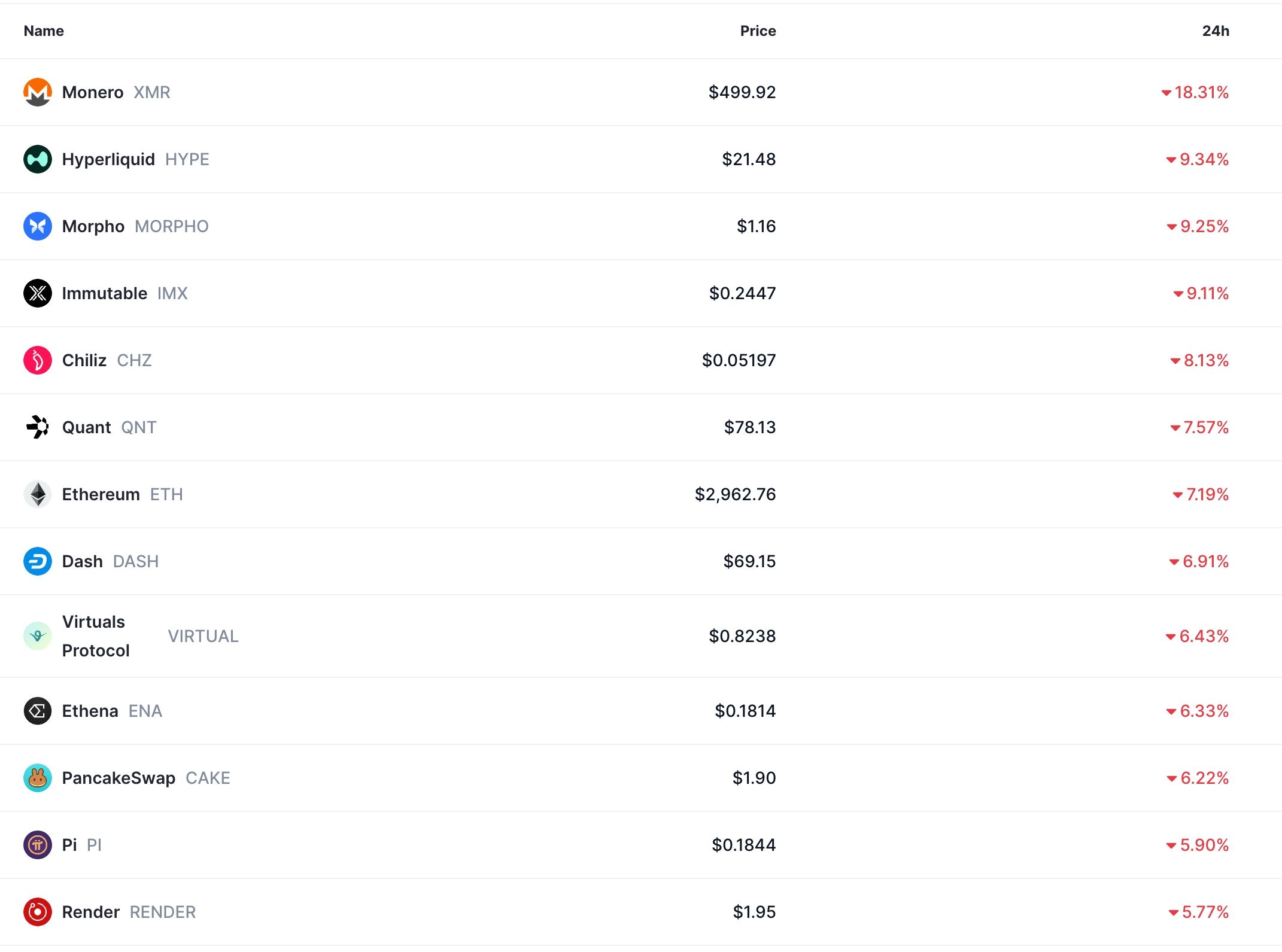

Bitcoin pulled back below $90,000, trading at $88,900 at press time. Similarly, Ethereum price dived below the key support level at $3,000, while the market capitalization of all coins dropped by nearly 4% in the last 24 hours to $3 trillion.

The stock market also dived, with the Dow Jones Industrial Average, S&P 500, and Nasdaq 100 indices falling by over 1%. Global indices like the Nikkei 225 and the Hang Seng have also retreated sharply.

These assets are tumbling amid ongoing geopolitical risks after Donald Trump warned he would impose tariffs on goods from key trading partners such as Denmark, France, and the United Kingdom. He made this threat because of his ongoing pursuit of Greenland, a semi-autonomous island he wants the US to buy from Greenland.

READ MORE: Pi Network Price Forms Bullish Patterns After Hitting All-Time Low

A trade war between the United States and key Nato allies would have major consequences over time. On the positive side, the Supreme Court is considering the legality of Trump’s tariffs, and a ruling against him would remove the leverage that he has been using.

A major risk is that European countries may start selling their American bond and stock market assets as the risks continue.

Odds of Bank of Japan Interest Rate Hikes

The stock and crypto markets are also crashing amid ongoing developments in Japan, the world’s fourth-largest economy. The country’s currency and bond market have fallen sharply this week, raising concerns that the Bank of Japan will deliver more hikes this year.

Citigroup analysts believe that the bank will deliver three hikes this year, bringing the benchmark rate to 150 basis points. Other analysts also expect the bank to hike interest rates as the Federal Reserve slashes rates.

Odds of these hikes rose after Prime Minister Sanae Takaichi called for a snap election and promised to cut taxes and boost stimulus, moves that will widen the budget deficit.

All these factors have led to a sense of fear among investors, with the Crypto Fear and Greed Index falling to 32 and the one tracked by CNN Money falling to 48. As a result, American investors have continued to sell their ETF holdings over the past few days, adding to the selling pressure on these assets.

READ MORE: Ethereum Price Prediction as Staking Ratio Surges and ETH Supply Dips