Bitcoin price remained under pressure on Sunday as investors focused on major risks in the financial market. BTC was trading at $88,600, down from the January high of $98,000. This article explores what to expect this week as the crisis in Japan escalates.

US to Intervene Amid Japan Risks

Bitcoin price is facing fresh macro-driven pressure, with market attention turning to developments in Japan, one of the world’s largest economies. Earlier this year, the yen slid to around 159 per dollar as Japanese government bond yields climbed to multi-decade highs, underscoring stress across the country’s financial markets.

The currency staged a modest rebound on Friday, finishing the week near 155 after reports that Japanese authorities may step in to support the yen, potentially in coordination with international partners. The prospect of intervention has injected new volatility into global markets, with possible spillover effects for stocks and cryptocurrencies.

READ MORE: Gold Price Forecast After Hitting $5K: Brace for a Short-Term Reversal

A US intervention would involve selling US dollars and buying the yen. Still, these decisions are in their early stages and a final decision has not been made. Therefore, there is a likelihood that the Japanese market will be highly volatile in the coming weeks, with spillovers happening in the stocks and the crypto markets.

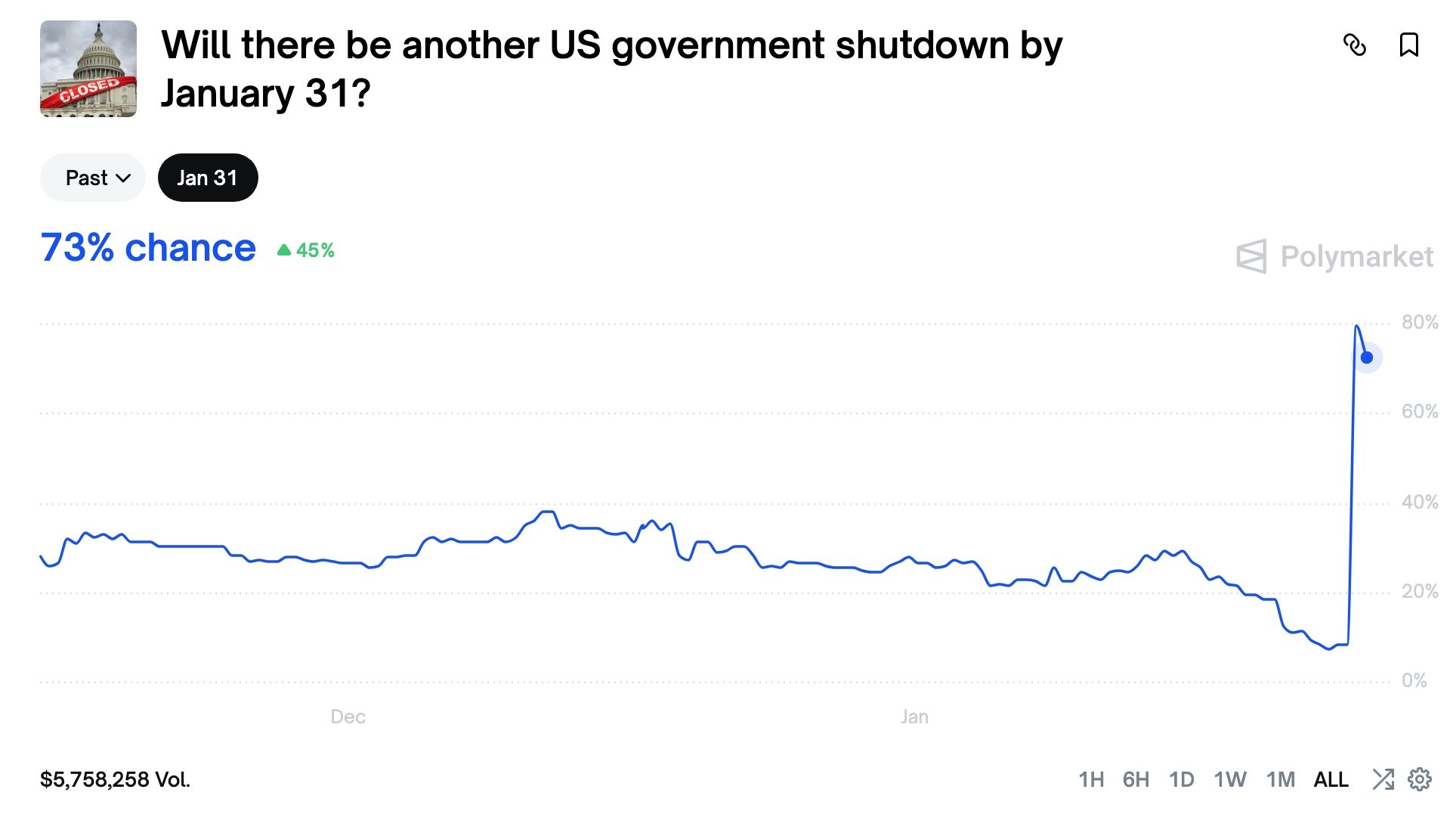

The other major risk that the Bitcoin price faces is the rising risk of a government shutdown. Data on Polymarket shows that there are rising odds that the US government shutdown will happen soon. These odds jump to over 70% on Polymarket and Kalshi, the most popular prediction marketplaces.

The odds of a government shutdown rose after a Border Patrol Agent shot and killed a US citizen on Saturday. Democrats have threatened to shut down the government if the package includes funding for the Department of Homeland Security (DHS). They are arguing that any funding package should be linked to reforms.

Additionally, there is a risk that the Federal Reserve will deliver a hawkish pause on Wednesday due to recent strong macro data from the United States. For example, the GDP expanded by 4.4% in the third quarter, and analysts expect it to expand by 5% in the fourth quarter.

The unemployment rate dropped to 4.4% in December, while inflation rose to 2.6%. In a recent statement, a JPMorgan analyst predicted that the bank will not cut rates soon. He said:

“If the labor market weakens again in the coming months, or if inflation falls materially, the Fed could still ease later this year. However, we expect the labor market to tighten by the second quarter and the disinflation process to be quite gradual.”

A hawkish Federal Reserve interest rate decision would lead to more Bitcoin and crypto market weakness in the near term.

Bitcoin Price Technical Analysis

The daily timeframe chart shows that Bitcoin price could be at risk of a deep dive in the coming weeks. It has remained below the 50-day and 200-day Exponential Moving Averages (EMAs) since forming a death cross pattern on November 16 last year.

The coin has also formed a bearish flag pattern, consisting of a vertical line and a rising channel. It dropped below the Ichimoku cloud and the Supertrend indicators.

Therefore, the most likely BTC price forecast is bearish, with the next key target being at $80,383, its lowest level in November last year. A move below that level will point to more downside in the near term.

READ MORE: Polygon Price Forms Rare Bullish Pattern as POL Burn Rate Jumps