A crypto market crash is happening today, January 25, with Bitcoin and most altcoins being in the deep red. Bitcoin plunged below $88,000, while Ethereum dropped to $2,800.

The market capitalization of all tokens moved below the key support level of $3 trillion, while the CoinMarketCap 20 Index dropped by over 2.2% in the last 24 hours and by 10% in the last seven days. This article explores some of the top reasons why the crypto crash is happening today.

Crypto Market Crash Happening as Bitcoin Forms Bearish Pattern

One main reason why the crypto market crash is happening is that Bitcoin price has formed a series of bearish chart patterns on the daily and weekly charts. For example, the daily timeframe chart shows that the coin has remained below the Supertrend indicator and the 50-day Exponential Moving Average (EMA).

Bitcoin price has also formed the risky bearish flag pattern, which is made up of a vertical line and an ascending channel. It is now attempting to move below the lower side of the flag, pointing to more downside, potentially to the November low of $80,400. A drop below that level will point to more downside, potentially to the April low of $74,000.

BTC price chart | Source: TradingView

Bitcoin is the most important coin in the crypto industry, and its actions tend to affect the broader market. A Bitcoin retreat often leads to more downside, while a rebound leads to a crypto rally.

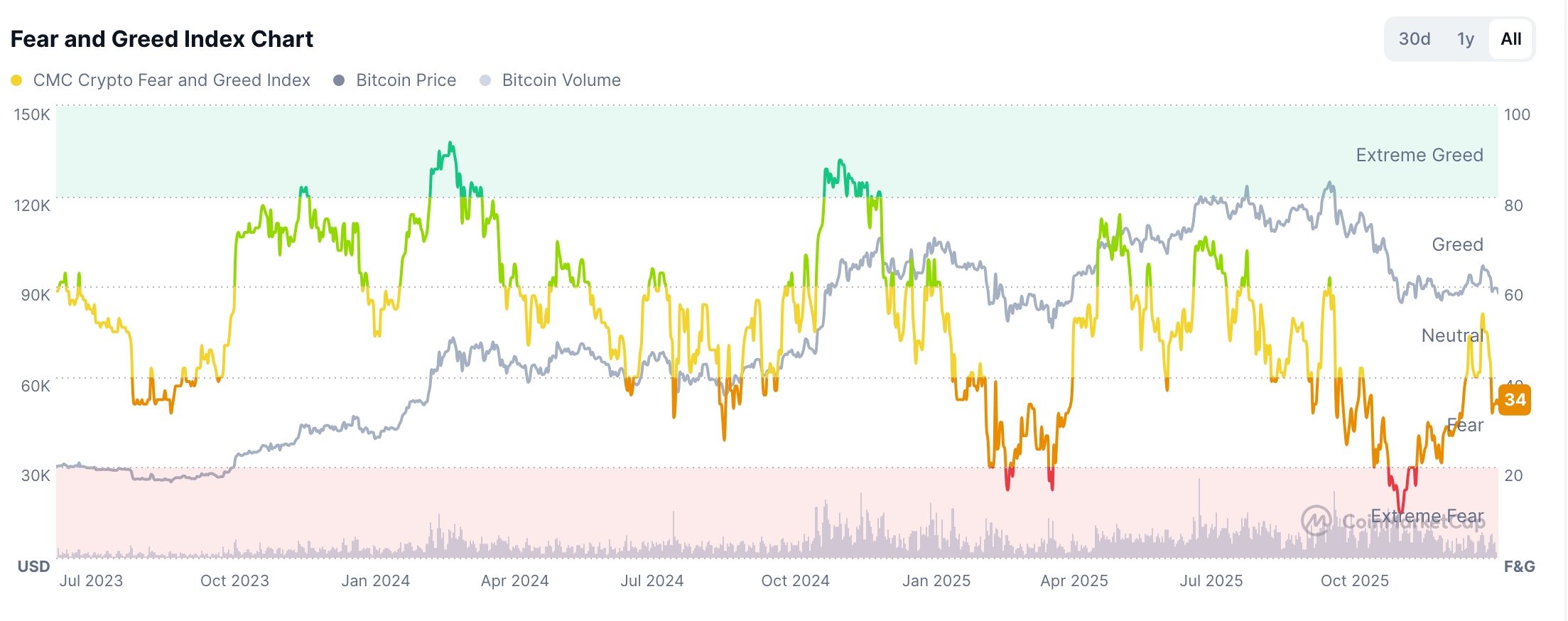

Fear and Greed Index Moved to the Fear Zone

The crypto market crash is also happening as the Crypto Fear and Greed Index continues moving downwards. Data compiled by CoinMarketCap shows that the index dropped to the fear zone of 34 from the year-to-date high of 59.

The index has dropped as the market goes through major risks. For example, there is a risk that the Federal Reserve will maintain a hawkish tone this year after the strong macro data from the United States.

Data released last week showed that the economy continued growing in the third quarter and analysts believe that it grew by 5% in the fourth quarter. More data showed that the labor market improved, while inflation has stabilized

The other risk is that the US has threatened a trade war with Canada, its biggest trade partner. Trump warned that he would impose a 100% tariff on all goods coming from the country, while Canada has hinted that it will retaliate.

Meanwhile, there is a risk that the United States will go through a government shutdown in the coming week because of the ongoing protests in Minnesota. Democrats have demanded for reforms on the Department of Homeland Security (DHS) before passing a bill for its funding.

Bitcoin and the crypto market have dropped as signs emerge that investors are rotating to other, better-performing assets. For example, data shows that spot Bitcoin ETFs have shed over $1 billion in assets this year, while gold and silver ETFs have added billions of dollars in assets.

READ MORE: Polygon Price Forms Rare Bullish Pattern as POL Burn Rate Jumps