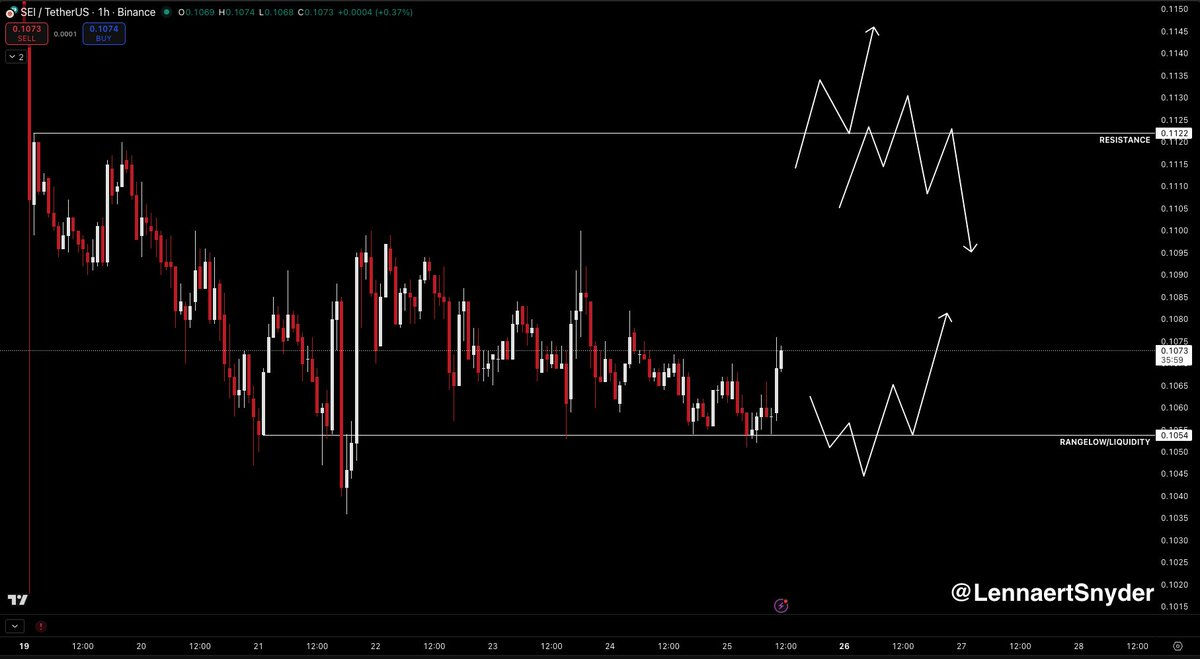

Sei crypto is trading around $0.104, down 1.2% over the past 24 hours, leaving the token little changed as it hovers near the bottom of its recent range. Price has been moving between roughly $0.105 support and $0.112 resistance while sellers attempt to press the range low. Trading activity has expanded sharply, with 24-hour volume up 125% to about $49 million.

This SEI price pause follows a period of heavy on-chain expansion, with the network officially crossing 5 billion total transactions while daily active addresses trend toward all-time highs.

Sei Ecosystem Activity Surges

The primary driver of SEI remains the upcoming Giga mainnet upgrade (SIP-3), scheduled for Q1 2026. This technical overhaul targets a 10–40x performance increase, aiming for 200,000 transactions per second (TPS) and sub-400ms finality to attract high-frequency trading and Ethereum developers.

At the infrastructure level, tokenized treasuries have grown into a $9 billion market, still only about 0.1% of the $8 trillion corporate cash market. Sei Labs has framed this as a structural opportunity, arguing that corporate treasury management requires high-frequency transactions, real-time settlement, and negligible costs at scale. That operating environment is the design target for Sei Giga.

Institutional validation has also tightened, with Bhutan planning to operate a Sei validator in Q1 2026 and Binance joined as a validator in November 2025. Canary Capital has filed for a U.S.-staked SEI ETF that is now under SEC review. Further integration news bolstered sentiment, specifically the launch of Chainlink 24/5 U.S. Equities Data Streams and the introduction of price-based prediction markets via BlitsTrade.

These additions, alongside a 214% YoY growth in daily active users reported by TokenRelations, suggest the network is transitioning from a “park-and-earn” model to a high-frequency financial hub.

Sei Price Consolidates at Support With Upside Still Capped

The Sei coin price is currently near the lower boundary of its established range at $0.105, which traders are treating as key support.

Lennart Snyder notes that price has been grinding lower into the range low and is now attempting to hold that area. His base case is to wait for a sweep below the range low and watch for a reversal if buyers step back in.

If the level fails on higher timeframes, continuation shorts become more attractive. On the upside, Snyder is watching the $0.112 area as resistance, looking for shorts on rejection or longs only if price reclaims the level.

Sjull from AltCryptoGems highlights a recent deviation below support, followed by stabilization and visible buying pressure, calling the area an interesting risk-reward zone.

Sei crypto is currently compressing between defined levels, with support near $0.105 and resistance near $0.112. Volume expansion suggests participation is increasing, but direction remains unresolved. For now, SEI price is pausing at range lows while traders wait to see whether buyers can defend support or whether a higher-timeframe breakdown opens the door to further downside.