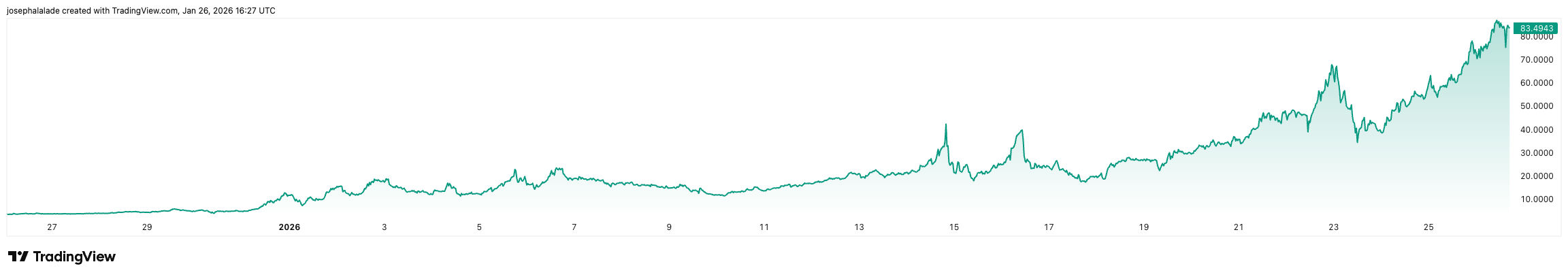

The RIVER Coin is currently trading at $84.60, up 38.44% in the last 24 hours and 210.42% over the past seven days. Trading within a daily range of $61.89 to $86.00, the asset has seen its 24-hour volume climb 37.64% to $108.23 million. This performance is primarily driven by a convergence of high-profile institutional funding and specific protocol milestones.

While the 21x rally from late December reflects intense buying pressure, technical indicators suggest the move has entered a significantly stretched, overheated phase.

Strategic Funding and Product Expansion Drive Demand

Recent capital inflows are the primary catalyst for the current RIVER price action. River recently closed a $12 million strategic round with participation from Tron DAO, Justin Sun, Maelstrom Fund (Arthur Hayes), and the Spartan Group.

This institutional validation coincides with the expansion of the satUSD ecosystem, a chain-abstracted stablecoin system that has reached over $320 million in Total Value Locked (TVL). The system allows users to mint satUSD directly on destination chains like Sui or Base, without using traditional bridges, thereby removing liquidity fragmentation.

Furthermore, the protocol’s Conversion 2.0 mechanism reached a critical threshold on January 24, 2026. This “Day 90” milestone saw the daily marginal gain for point-to-token conversions double, from 111 RIVER per million points to 222 RIVER per million points.

READ MORE: XRP Price Prediction: Here’s Why Ripple is in a Steep Crash

The timing of this emissions shift, alongside the January 19 launch of an HTX Flexible Earn product with additional yield incentives, has successfully thinned sell-side liquidity while attracting yield-seeking capital.

RIVER Coin Indicators Warn Rally May Be Entering Late Stage

Market technicals indicate that the recent rally has entered extreme territory. The Relative Strength Index (RSI) currently sits at 95.12, a level traditionally associated with exhaustion in a vertical trend.

Momentum is at 81.17, confirming an accelerating trend, yet the distance from major averages suggests potential mean-reversion risk. The current price of $84.60 is trading more than 260% above the 10-day Simple Moving Average (SMA) of $23.45.

Traders have identified a key support level at $60. A failure to hold this base could trigger a deeper retrace toward $36, which would invalidate the immediate bullish thesis. Momentum remains accelerating for now, but the project’s time-encoded supply model means any significant profit-taking could test the thin support levels established during this monthly expansion.

READ MORE: Crypto Prices Today: Monero, Zcash, Aster, Pepe Coin, Solana Slump as Fear Spreads