Bitcoin price continues to consolidate and is at an elevated risk of a sharp bearish breakdown in the coming weeks amid ongoing geopolitical challenges. BTC dropped to a low of $88,000 on Wednesday, even as gold and silver prices continued rising.

US Armada Arrives in the Middle East as Odds of an Iran Attack Rise

Bitcoin, often seen as digital gold, has proven it is not a safe haven over the past few months. For example, it crashed in April last year when Donald Trump launched his reciprocal tariff.

Most recently, Bitcoin remained under pressure amid the US President’s threat to invade and take Greenland. On the other hand, gold and the Swiss franc continued to do well during this time, and are now hovering near their all-time highs.

READ MORE: GME Stock Price Outlook: Reasons GameStop is Soaring and What Next

Therefore, there is a risk that the Bitcoin price will crash as the risk of a US attack on Iran rises. Trump, under pressure from neocons, has sent an armada into the Middle East. The USS Lincoln arrived in the region, and the team is expected to conduct exercises over the next few days.

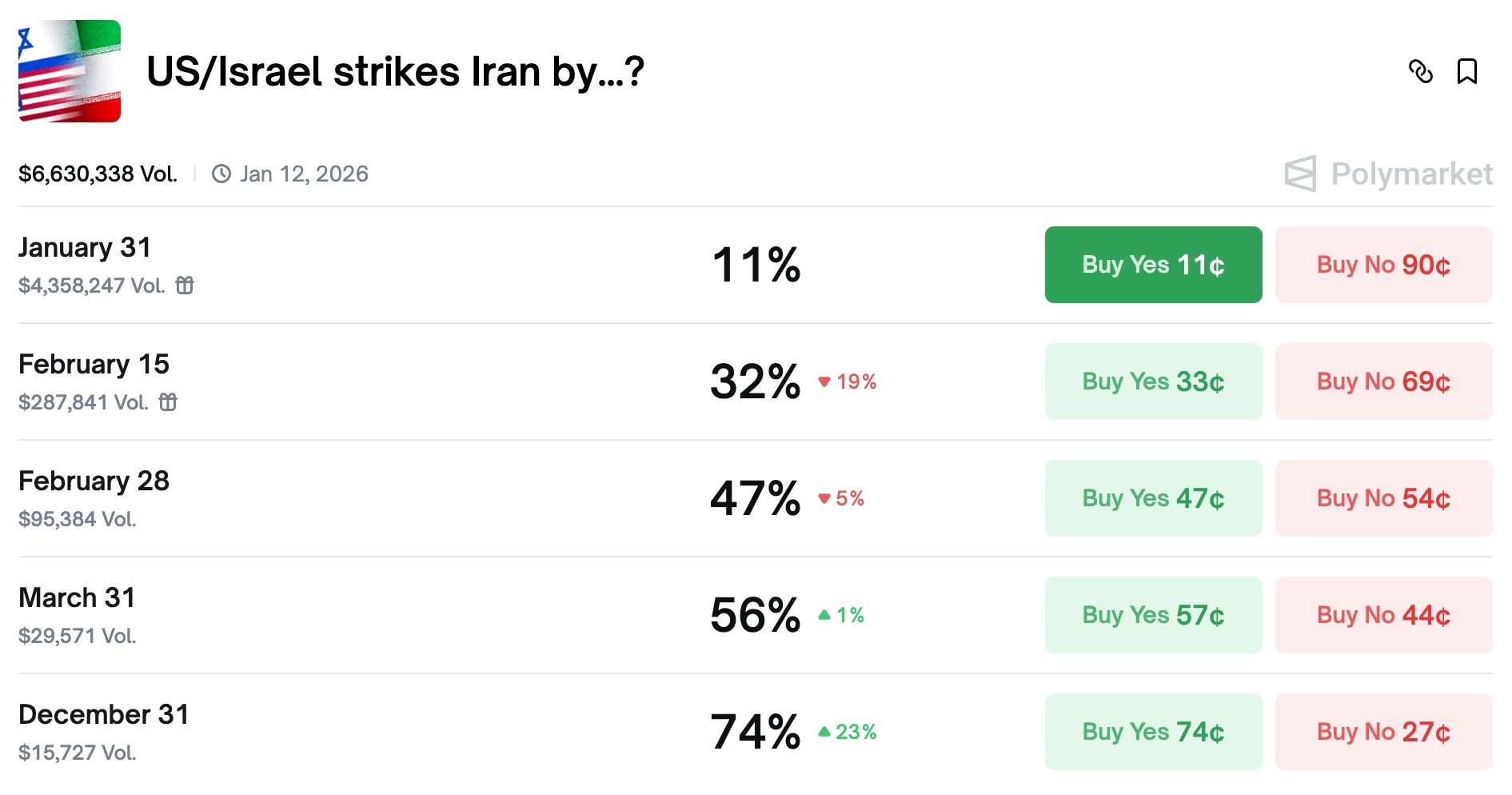

Polymarket data shows that the odds that the US and Israel will attack Iran by December 31st have jumped to 74%. Odds of an attack by March 31st have risen to 56%.

Iran has threatened that it will respond swiftly to an attack, especially one that threatens its supreme leaders. In addition to military strikes, Iran controls the Strait of Hormuz, where most of the world’s oil passes through. As such, that attack will lead to higher oil prices, which will most likely lead to more inflation.

Additionally, an attack will likely lead to a major loss for the Republicans in the midterm elections, which may affect legislation on the crypto industry.

Meanwhile, Donald Trump, under pressure from Secretary of State Marco Rubio, is considering military options for Cuba, a move that would elevate the rising tensions.

These rising risks explain why the Crypto Fear and Greed Index has tumbled to the fear zone of 34. It also explains why the Bitcoin price has wavered as gold and silver prices remain at their all-time highs.

Bitcoin Price Technical Analysis

The three-day chart shows that Bitcoin price has fallen over the past few months, from an all-time high of $126,300 to the current $89,000.

A closer look shows that the coin has remained below the 50-day and 100-day Exponential Moving Averages (EMA).

Most importantly, the coin has formed a large bearish flag pattern, consisting of a large vertical line and an ascending channel.

Therefore, the most likely scenario is where the coin stages a strong bearish breakdown in the coming weeks. If this happens, the next key support level to watch is $80,000, followed by last year’s low at $74,000.

READ MORE: Pi Network Price Vulnerable: Whale Buying Stalls, BTC Pattern Raises Alarms