Ethereum price could be on the verge of a strong bearish breakdown despite having some of the best fundamentals. ETH token was trading at $3,000, higher than this week’s low of $2.790.

Ethereum Network Metrics Have Soared

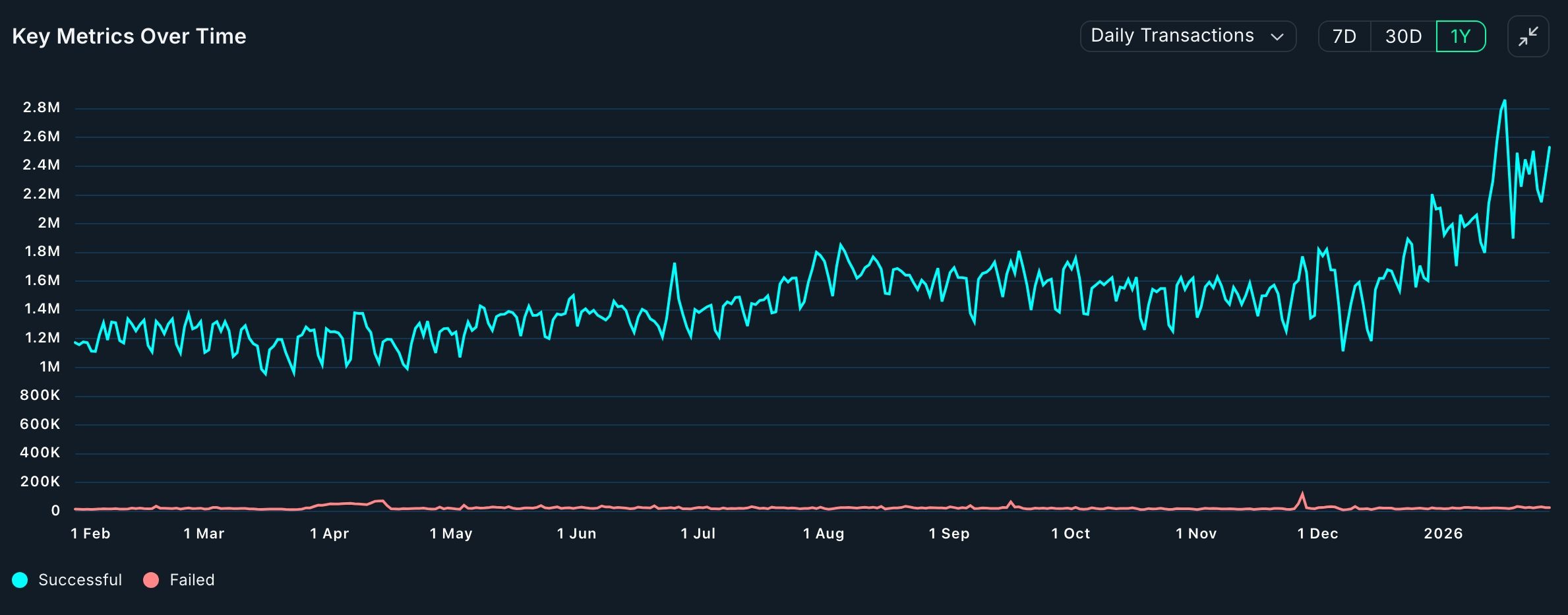

Data compiled by Nansen shows that Ethereum is firing on all cylinders even as the ETH price remains in a bear market after falling by 40% from its highest level in 2025.

The data shows that the network growth has accelerated after the Fusaka upgrade in December last year. Transactions have soared by 40% in the last 30 days to over 66.3 million.

This transaction growth was mostly driven by the activity in the stablecoin and decentralized finance (DeFi) industries. Also, the number of active addresses rose by 55% to over 14.6 million. Transactions and users have continued accelerating, a trend that may keep growing.

Ethereum network has boomed in the past few months as the number of stablecoin users and activity has soared. For example, the network handled over $8 trillion in stablecoin transactions in the fourth quarter. It handled over $1 trillion in stablecoin volume in the last 30 days.

READ MORE: XRP Price Prediction: Is it a Buy as Ripple Lands at a Key Support?

Ethereum usage will likely continue accelerating in the coming months after the developers launch more upgrades this year. The most notable of these upgrades will be Glamsterdam, which will improve Maximum Extractable Value (MEV) and parallel transactions processing, which will lead to faster speeds.

Therefore, the Ethereum price has remained under pressure despite these challenges because of the ongoing performance of gold and silver prices, which have jumped to a record high. Their performance has pushed more investors to these metals.

On the positive side, Ethereum and other cryptocurrencies often rally after strong gold and silver surges. This likely explains why spot Ethereum ETFs have continued accumulating assets. Also, the staking ratio has continued rising this year.

Ethereum Price Technical Analysis

Technical analysis suggests that the Ethereum price has more downside in the near term. It remains below the Supertrend indicator, a sign that bears remain in control.

The coin formed a death cross pattern on November 24 as the 50-day and 200-day Exponential Moving Averages (EMA) crossed each other.

Ethereum has moved below the 50% Fibonacci Retracement level at $3,175. It has also formed a bearish flag pattern, which is made up of a vertical line and a channel.

Therefore, the most likely scenario is where ETH price has a major bearish breakdown. If this happens, the next key level to watch will be at $2,500. A move above the upper side of the channel at $3,400 will point to more gains by invalidating the bearish flag pattern.

READ MORE: Bitcoin Price at Risk as US Armada Arrives in Middle East as Attack Odds Jump