TRON price has traded within a narrow $0.2927 band over the past 24 hours. However, volume increased by 26.98% to $888.7 million, which indicates that Tron (TRX) has been actively traded despite its stable price.

The expansion of the TRON network has been consistent over the past few months. The expansion has been fueled by the adoption of the stablecoin. The monthly active addresses on the TRON network reached 35.5 million in 2025, as per Nansen.

The active address has grown by 24% compared to the previous year. The active address in December 2025 was a record 323 million. The number of transactions per user has also increased, reaching a two-year high of 10.5.

Meanwhile, more data shows a 60% reduction in unit energy prices in August, compressing average transaction fees by 65% to $0.53. That shift intentionally traded fee revenue for higher throughput and usage, with monthly fees declining from $399 million to $183 million before the cut. For traders, the signal is that TRON prioritizes scale and more durable activity over per-transaction monetization.

At the same time, the USDT stablecoin circulation on TRON stands at $82.2 billion, about 42% of the global supply, with an average daily USDT volume of $23.86 billion in Q4.

CryptoQuant report reveals that sub-$1,000 transfers account for roughly 60-74% of flows during Americas and Asia hours, consistent with remittances and peer-to-peer payments, whereas larger tickets cluster in EMEA hours, suggesting institutional and treasury usage. Recognition of USDT in Abu Dhabi’s ADGM adds to its role as a payment rail.

Mixed Momentum as Tron Price Consolidates

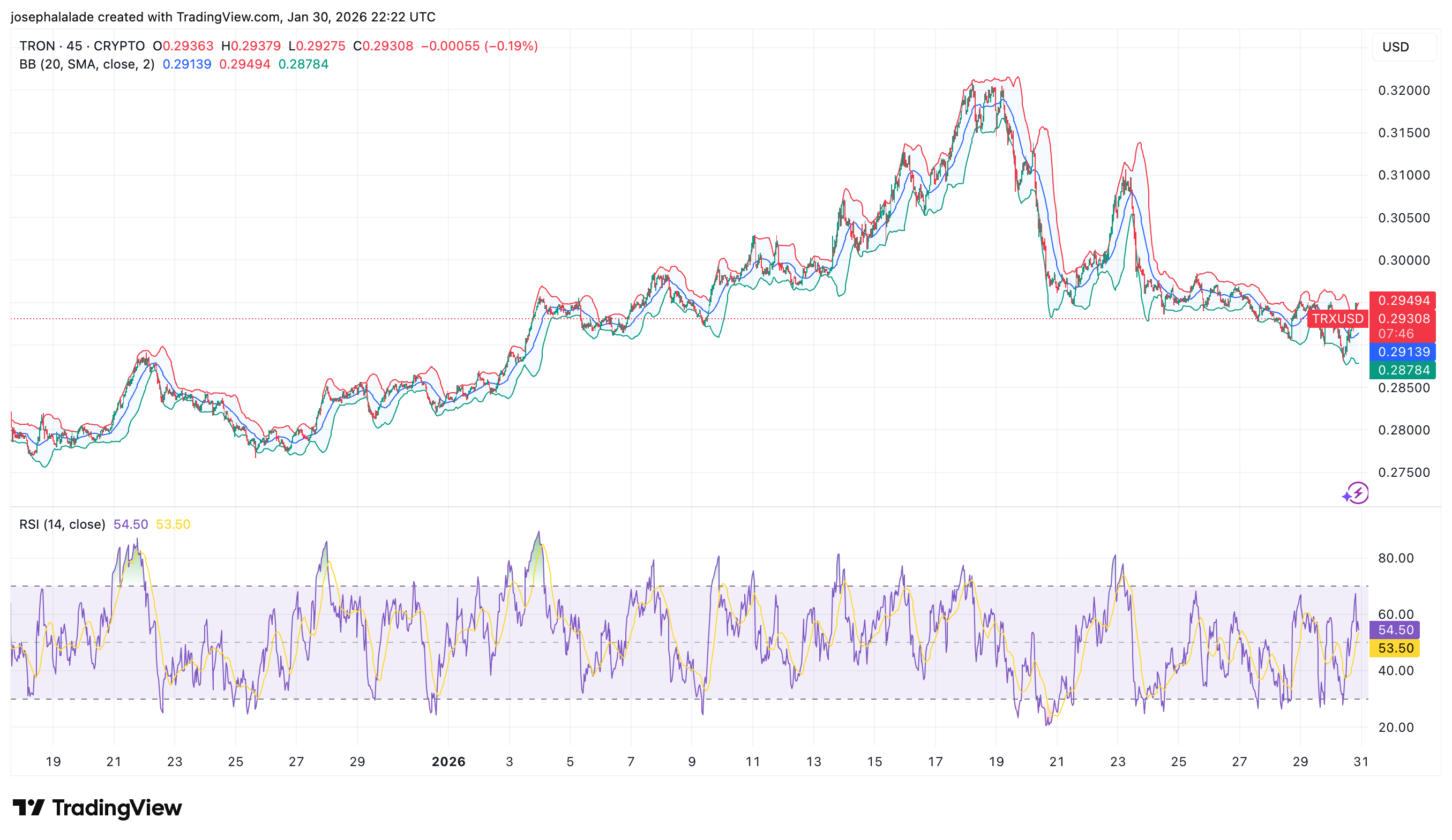

TRON price remains stuck in a tight consolidation around $0.293, with technical signals offering little directional clarity. On the daily timeframe, TradingView’s summary leans Sell, driven mainly by moving averages, while oscillators remain largely neutral, a typical setup for range-bound markets.

RSI at 54.5 places TRX in a neutral region, while an ADX of 18 indicates a weak trend. The MACD is slightly negative, but the Momentum indicator shows a weak buy signal, further supporting a choppy market and two-way trade.

The moving averages are bearish: all EMAs and SMAs indicate a sell signal, except the 50- and 100-period SMAs, which show a buy signal and suggest the market is stabilizing in the medium term.

On the 45-minute chart, Bollinger Bands are tight, and the price is ranging between $0.288 and $0.295, indicating price compression. A break above $0.30 would be required to turn the bias positive, while a break below $0.288 could trigger a fall. Until then, the Tron price is in a strong consolidation phase.

READ MORE: Chainlink Price Slips Despite Strong Revenue Signals