Silver price suffered a big reversal on Friday, a trend that may accelerate in the coming days. It plunged by over 28% in its worst daily performance in years. This crash coincided with the soaring SLV ETF outflows and the nomination of Kevin Warsh to be the next Federal Reserve Chairman.

Silver Price Crashed as SLV ETF Outflows Rose

The price of silver crashed on Friday, as we had predicted here and here. This crash intensified as third-party data showed that American investors dumped their silver holdings in January.

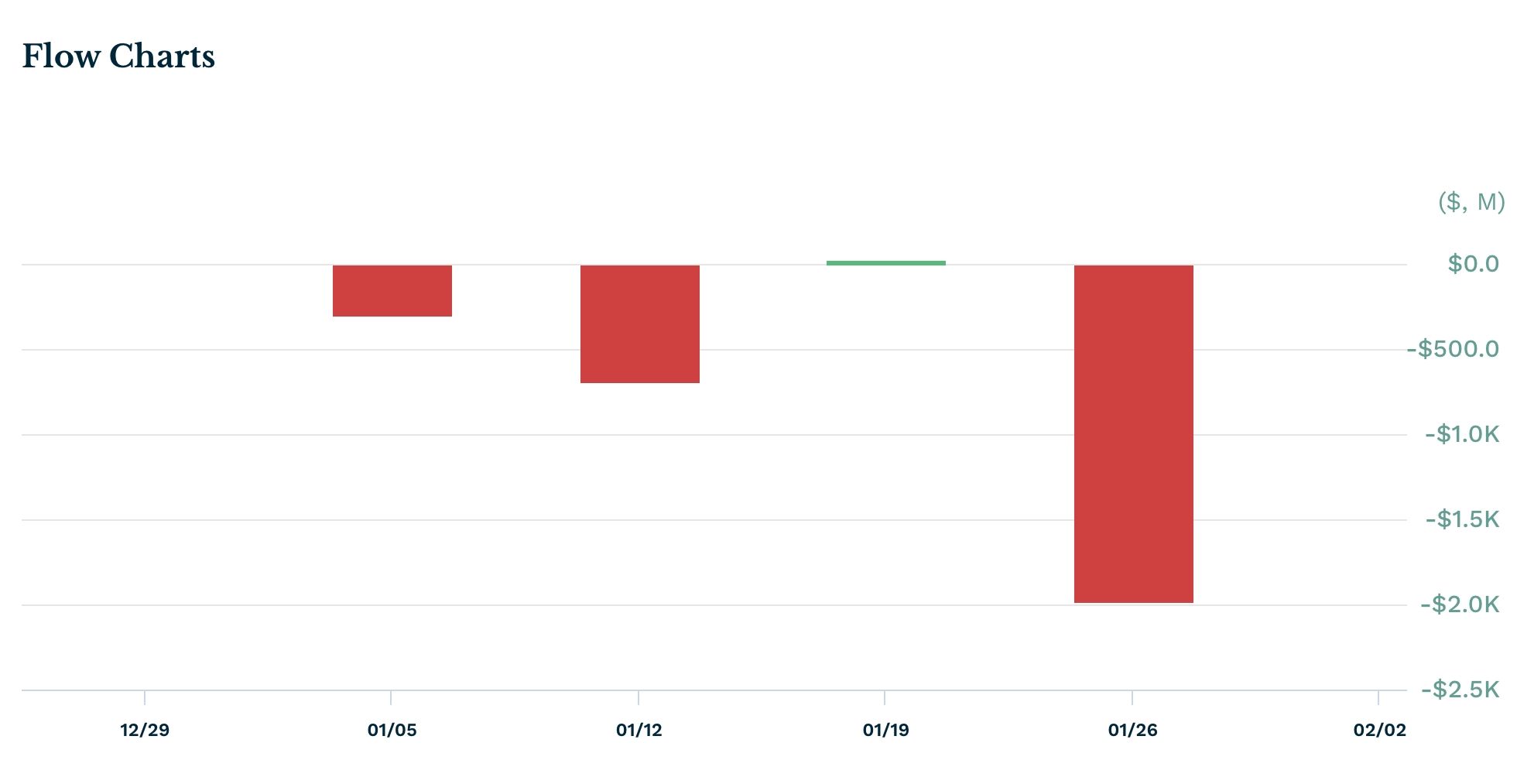

The closely-watched iShares Silver ETF (SLV) had over $2 billion in outflows last week, the biggest weekly outflow in months. In total, it shed over $2.9 billion in January even as the silver price surged. Its performance was a sharp contrast to the closely-watched SPDR Gold ETF (GLD), which has added billions in assets this year.

Silver price will likely drop because of important data that came out on Saturday from China. A report by the National Bureau of Statistics showed that the country’s manufacturing PMI moved into the contraction zone in January. It dropped to 49.3 from the previous 50.1. Similarly, the non-manufacturing PMI dropped to 49.4 from the previous 50.2.

READ MORE: Here’s Why Ethereum Price is Crashing Despite Soaring Network Metric

A PMI reading of less than 50 is a sign that a sector is contracting. This is important for silver because, unlike gold, it is an industrial metal that is used in the manufacturing of key items like solar panels and chips. As such, the contracting manufacturing sector in China could be a sign that its demand is waning.

The other major catalyst for the silver price will be Donald Trump’s decision to nominate Kevin Warsh to become the next Federal Reserve Chairman on Friday. Warsh is widely seen as a more hawkish Federal Reserve official based on his past views. He will likely be interviewed this week by CNBC or Bloomberg, where he will likely share his views on interest rates.

XAG Price Technical Analysis

The daily timeframe chart shows that the silver price suffered a harsh reversal on Friday, moving from a record high of $121 to a low of $74.70. This decline happened after it formed an evening star pattern, which is made up of a small body and upper and lower shadows.

It also moved to the 50% Fibonacci Retracement level, while the Relative Strength Index (RSI) and the MACD indicators have continued falling.

Therefore, the most likely scenario is where the silver price continues falling as many traders start exiting their positions. If this happens, it may drop to the 61.8% Fibonacci Retracement level at $64.

The alternative scenario is where silver rebounds and retests the 61.8% Fibonacci Retracement level at $100. This rebound will be part of a dead-cat bounce, which is a temporary rebound that happens when an asset is in a downward spiral.

READ MORE: Bitcoin Price Prediction: BTC Risks Drop Toward $70K