The Bitcoin price continued its strong decline this week, reaching its lowest level since 2024. It was trading at $76,250 on Wednesday morning, a few points above the year-to-date low of $73,000. This article discusses why the BTC price will rebound and potentially reach a record high once this crash ends.

The Bullish Case for Bitcoin Price

Bitcoin price remained under intense pressure this week, erasing all gains made during the first year of the Trump administration. This crash happened even as the stock and precious metals markets remained near their all-time highs.

Still, there are several reasons why the Bitcoin price will rebound and possibly reach an all-time high later this year.

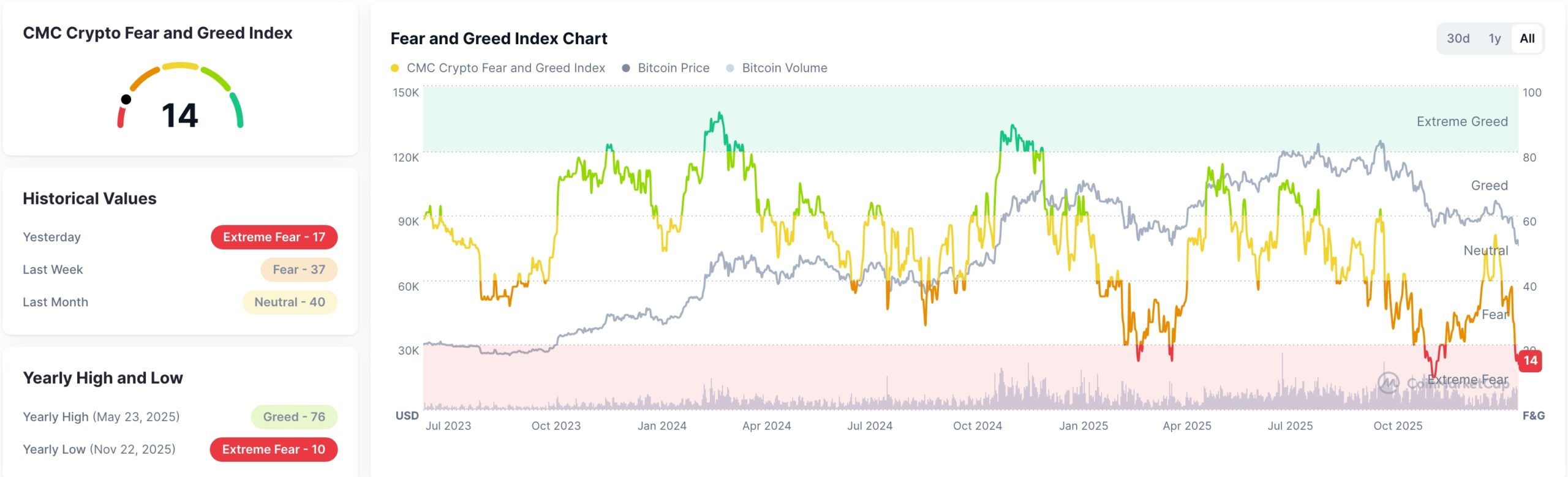

First, the Crypto Fear and Greed Index has moved to the extreme fear zone of 14, a few points above last year’s low of 10. In most cases, crypto market rallies start when the index plunges.

For example, Bitcoin and the crypto market rebounded early this year when the index dropped to the extreme fear zone near 10.

A closer look shows that the index is repeating the pattern observed last year. It fell to the extreme fear zone of 15 in March, rebounded to 34, and then retreated to the extreme fear zone of 17 in April. It then rebounded as Bitcoin reached a record high.

The same pattern has happened recently. It dropped to 10 in December last year, rebounded to 54 in January, and then retreated to 14. Therefore, it will likely decline further and then rebound, which will push Bitcoin above $100,000.

BTC History is Made Up of Crashes and Rebounds

Second, the history of Bitcoin is characterized by spectacular bull runs followed by large dips and recoveries. For instance, the Bitcoin price has declined by more than 30% from its peak on several occasions. It fell from $108,930 in January last year to $74,380 in April, then rebounded to a record high a month later.

READ MORE: Pi Network Coin Sits at All-Time Low: Buy the Dip or Sell the Rip?

Similarly, Bitcoin declined from $74,157 in May 2024 to $48,900 in August 2024, and then rebounded a few months later. Most importantly, it moved from $69,284 in 2021 to $15,600 in December 2022 and then rebounded. This crash coincided with numerous crashes, including FTX, Celsius, and OKX. In a statement on Tuesday, Michael Novogratz said:

“I do think we are at the lower end of the range. What I would say is we have been here before, anyone who has been in crypto for more than five years realizes that part of the ethos of this whole industry is pain.”

The most likely Bitcoin price prediction is that it declines further as the crisis in Iran escalates, and then begins to rebound.

BTC Price Prediction: Technical Analysis

The weekly chart shows that the Bitcoin price continued to drop this week. This retreat occurred after the coin formed a giant rising wedge pattern, characterized by two ascending, converging trendlines.

The coin also slipped after forming a bearish flag pattern, which consists of a vertical and a channel.

A closer look shows that the Relative Strength Index (RSI) is nearing the oversold level of 30. The last time it oversold was in June 2022, which marked a bottom that led to a record high a few years later.

Therefore, the Bitcoin price will remain under pressure for a while and then rebound as investors start buying the dip.

READ MORE: Solana Chain Fees are Soaring as it Closes the Gap With Justin Sun’s Tron