The crypto market crash intensified today, Feb. 5, with Bitcoin approaching the key support at $70,000 and the valuation of all tokens falling to $2.5 trillion, down from a peak of $4.3 trillion in 2025. Ethereum is nearing $2,000, while other blue-chip coins like Solana, Cardano, and XRP are all in a bear market. This article explores whether a Trump strike on Iran can spark a crypto rally.

Odds of a Trump Attack on Iran Have Jumped

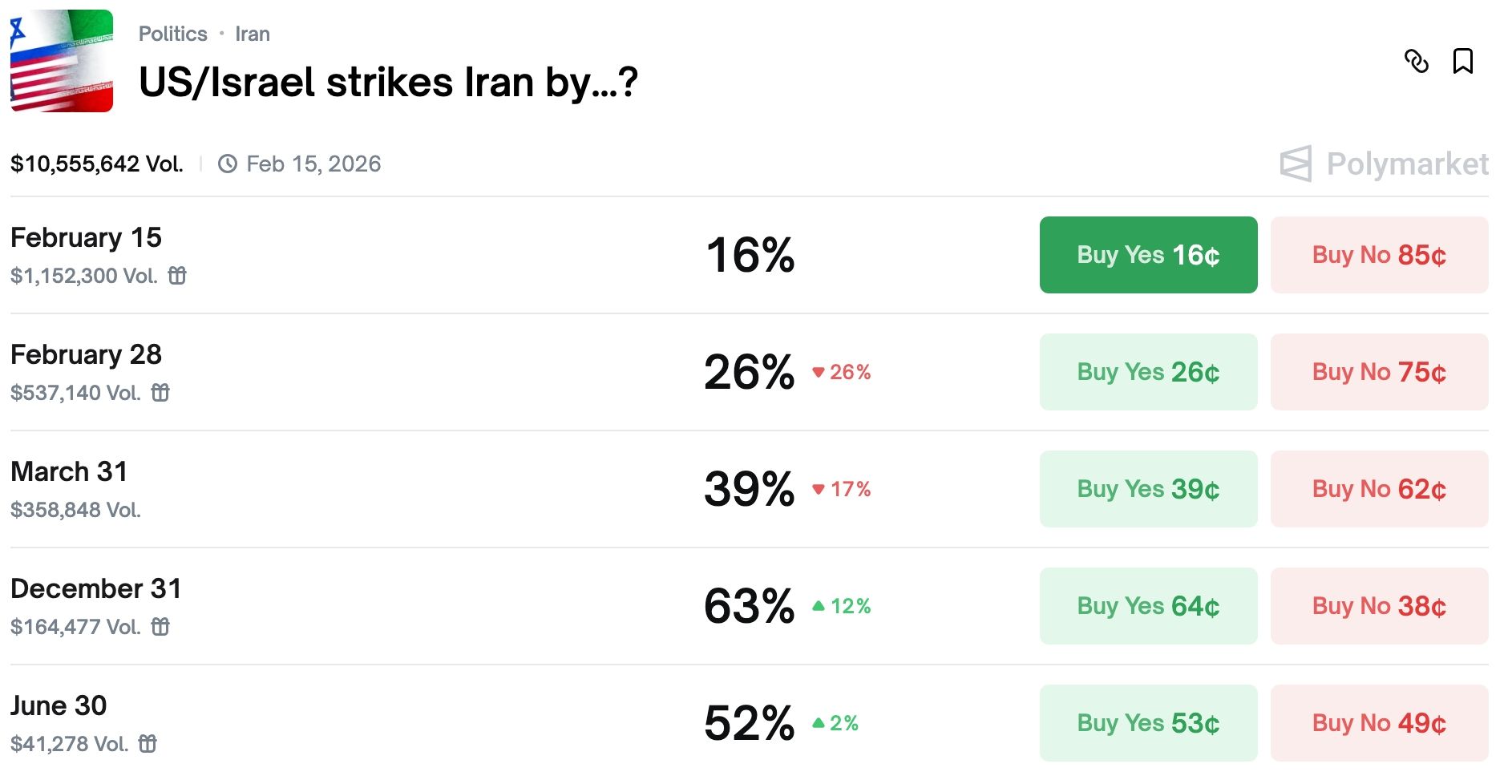

Polymarket traders and geopolitical experts believe that Donald Trump will use his “beautiful armada” to strike Iran soon. The odds of a strike by December have jumped to 63%, while the odds of a strike by June 30 have risen to 52%.

Trump has reasons to strike Iran, and possibly end a 40-year conflict. For example, Iran is weak, with its regional allies like Hezbollah, Hamas, and Houthis largely neutralized. Its economy is struggling, with the local currency trading at a record low.

At the same time, he is under pressure from top neocons like John Bolton, Mike Pompeo, Mark Levin, Lindsey Graham, and Marco Rubio to strike Iran and conduct regime change.

In theory, an attack on Iran would be bad for risky assets like cryptocurrencies and stocks. For one, Bitcoin’s role as a safe-haven asset has been invalidated. Also, a regional war would drive up crude oil prices, making it harder for the Federal Reserve to cut interest rates.

READ MORE: Stock Market Today: Here’s Why the Nasdaq 100 Index, QQQ, and JEPQ ETFs Are Tanking

Why an Iran Attack Would Trigger a Crypto Market Rally

On the positive side, an attack on Iran may trigger a stock and crypto market rally for a few reasons. First, one of the top reasons behind the ongoing crypto crash is the fear of an attack. As such, if it happens, the most likely scenario is that Bitcoin and altcoins continue to fall before rebounding. The rebound would happen as investors buy the news.

A good example of this is what happened last year during the 12-day war. Most assets dropped and then rebounded, with Bitcoin price hitting a record high a few months later.

At the same time, according to The Economist, an attack could end a conflict that has been ongoing for half a century. The paper notes that an attack may lead to regime change and the end of sanctions against Iran. An end to these sanctions would help to reduce oil prices and reduce inflation.

The attack would also come at a time when the Crypto Fear and Greed Index is in the extreme fear zone. In most cases, as we saw in January, crypto prices start to rebound when the index moves into the extreme fear zone.

READ MORE: IREN Stock Price Forecast Ahead of Earnings: Buy the Dip?