XRP price continued its strong downward trend, reaching its lowest level since October last year. Ripple token dropped to $1.3778, down by over 60% from its all-time high of $3.65. This article explores what to expect as Ripple maps a plan for more XRP burn.

Ripple Labs Shares Plans for Boosting XRP Burn Rate

XRP supply could start falling in the coming months after Ripple implements a strategy to boost its utility. In a statement, the company said that the XRP token will play an important role in the upcoming initiatives, like permissioned decentralized exchanges (DEX).

The company’s permissioned DEX will have three main pillars, including payments and forex, collateral and liquidity, and credit and financing.

XRP will be used across all these sectors, with every transaction, especially in pDEX burning the XRP token. Also, asset managers deploying tokenized money market funds or high-grade collateral in XRPL will use XRP token, which will also lead to more token burns.

READ MORE: Crypto Market Vulnerable as Goldman Sachs Sounds Alarm on the S&P 500 Index

A good example of all this is Evernorth, which is planning to utilize the Lending Protocol to generate institutional-grade yield on its XRP holdings. The company aims to unlock a multi-billion-dollar yield for the XRP community.

XRP’s growth will likely accelerate ahead of the upcoming permissioned DEX, lending protocol, confidential transfers for MPTs, smart escrows, and Multi-purpose token (MPT) DEX integration, all of which will lead to more XRP activity and token burn.

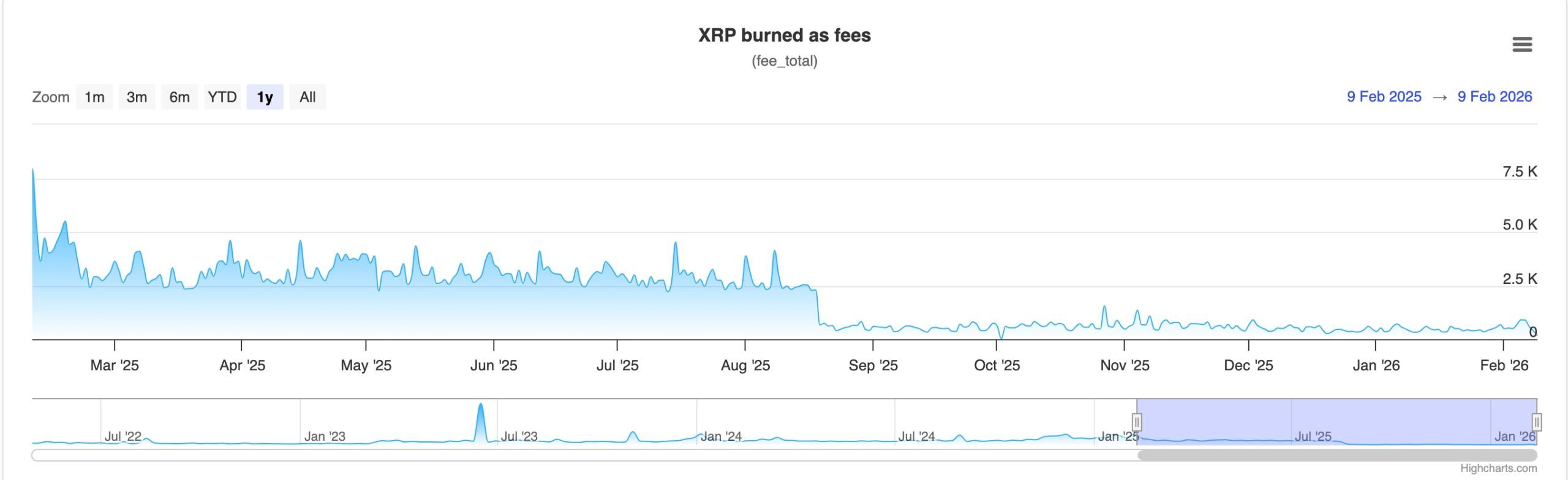

The new developments are happening as the XRP burn rate remains under pressure because of the low transaction fees. Data compiled by XRP Scan shows that the network burned just 394 XRP tokens on Sunday. As the chart below shows, the burn rate has remained in this range since August last year.

XRP Price Prediction: Technical Analysis

The weekly timeframe chart shows that the XRP price has been in a strong downward trend in the past few months as the crypto market crash accelerated.

It has recently moved below the important support level at $1.6107, its lowest level in April last year, and the neckline of the double-top pattern at $3.3712. A double-top is one of the most common bearish reversal signs in technical analysis.

The Average Directional Index (ADX) has continued rising, reaching a high of 33, its highest level since March last year. A rising ADX indicator is a sign that the downtrend momentum is continuing.

XRP price has remained below the 50-week and 100-week Exponential Moving Averages (EMA), while the Relative Strength Index (RSI) and the Percentage Price Oscillator (PPO) have continued falling.

Therefore, the most likely Ripple price forecast is bearish, with the next key support level being the psychological level at $1, which is 30% below the current level.

READ MORE: Solana Price Prediction: Giant H&S Pattern Forms as Transactions Surge