Solana price continued its strong downward momentum on Wednesday, even as bullish catalysts emerged. SOL token plunged to a low of $80, down sharply from the all-time high of $295.92. It is currently hovering near its lowest level since 2024.

Solana Price Has Crashed Despite Solid Fundamentals

The SOL token remained in a strong downward trend, even after Goldman Sachs, a major Wall Street bank, reported holding SOL ETFs valued at over $100 million. These holdings account for a substantial share of total assets, with holdings now exceeding $800 million. Goldman Sachs holds these ETFs on behalf of its institutional clients.

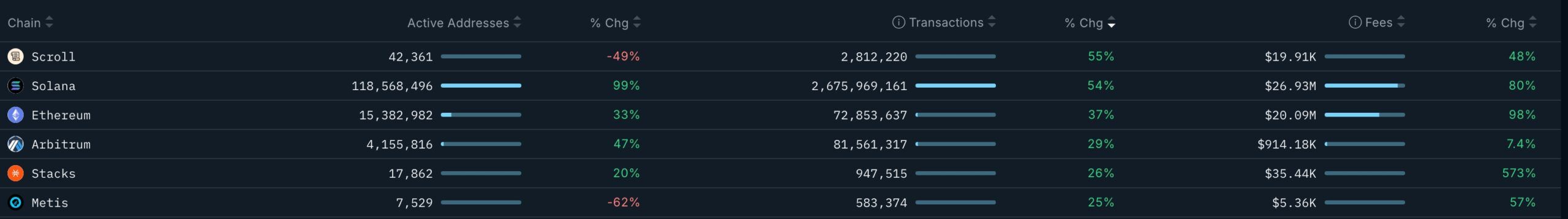

Solana price has also declined despite soaring network metrics, which make it the most active chain in the crypto industry. Data compiled by Nansen shows that active addresses increased by 99% to over 118 million in the last 30 days, while the number of transactions rose to over 2.67 billion. Its network made over $26 million in fees in the last 30 days.

Solana’s network continues to gain traction among developers and users. For example, the total volume of stablecoins processed on the network has increased to over $1 trillion in the last 30 days. Most notably, non-USDT/USDC stablecoin supply on Solana has jumped from $195 million to over $3 billion in the last 13 months.

More companies continue to use Solana’s network to develop their products. Some of these companies shared their plans at the BreakPoint event.

READ MORE: PayPal Stock Has Imploded: Will the New CEO Turn Around the Fallen Angel?

For example, Futu Holdings, a top fintech company, is building its next-gen financial infrastructure on Solana, a move it hopes will bring off-chain liquidity to on-chain applications.

More companies are working on prediction markets in the network, with the most notable names being Kalshi, Gamba, and Moonpool. Polymarket has also expanded on Solana through Jupiter.

SOL Price Technical Analysis

The daily timeframe chart indicates that Solana’s price has been in a pronounced downward trend over the past few months. It has crashed from a high of $295 in November 2024 to the current $80. It also declined from last year’s high of $253, its largest September swing.

The coin has formed a head-and-shoulders pattern and has already moved below the neckline at $120. It has moved below the key support level at $95, its lowest level in April last year.

Solana price has remained below all moving averages, while the MACD indicator remains below the zero line. The most likely Solana price forecast is bearish, with the next key target being at $70, the lowest level last week. A drop below that level will indicate further downside.

READ MORE: Bitcoin Price Prediction as Key Metric Falls to $44 Billion During Crypto Winter