AAVE price is up 3.84% over the past 24 hours, trading at $109.66 as buying activity picked up during the latest session. Price traded between $104.81 and $113.40, while 24-hour volume rose 81.99% to roughly $465 million, suggesting renewed participation. The move followed fresh ecosystem developments tied to Aave’s expansion onto Mantle Network.

Market capitalization stood near $1.68 billion, with TVL at $27.38 billion, keeping Aave among the largest lending protocols by locked value. Despite the intraday advance, the AAVE price remains well below the May 2021 all-time high of $666.86, leaving the longer-term structure defined by recovery rather than extension.

Aave Expands to Mantle as Incentives Target Lending Growth

AAVE strength coincided with the protocol’s deployment on Mantle Network, an EVM-compatible Ethereum scaling solution built as a ZK validity rollup. The new market launched with support for assets including WETH, WMNT, USDT, USDC, USDe, sUSDe, FBTC, syrupUSDT, wrsETH, and GHO, widening collateral options from day one.

Incentives are set to play a central role. Mantle plans to allocate 8 million MNT to stimulate lending and borrowing, while the Aave Liquidity Committee will contribute 1.5 million GHO to support stablecoin liquidity on the network.

Deployment was handled by BGD Labs on behalf of the Aave DAO, with risk analysis from Chaos Labs and LlamaRisk, and price feeds secured by Chainlink. For traders, the setup signals an attempt to pull activity toward a new venue without fragmenting core liquidity.

AAVE Price Trades Sideways as Momentum Signals Remain Mixed

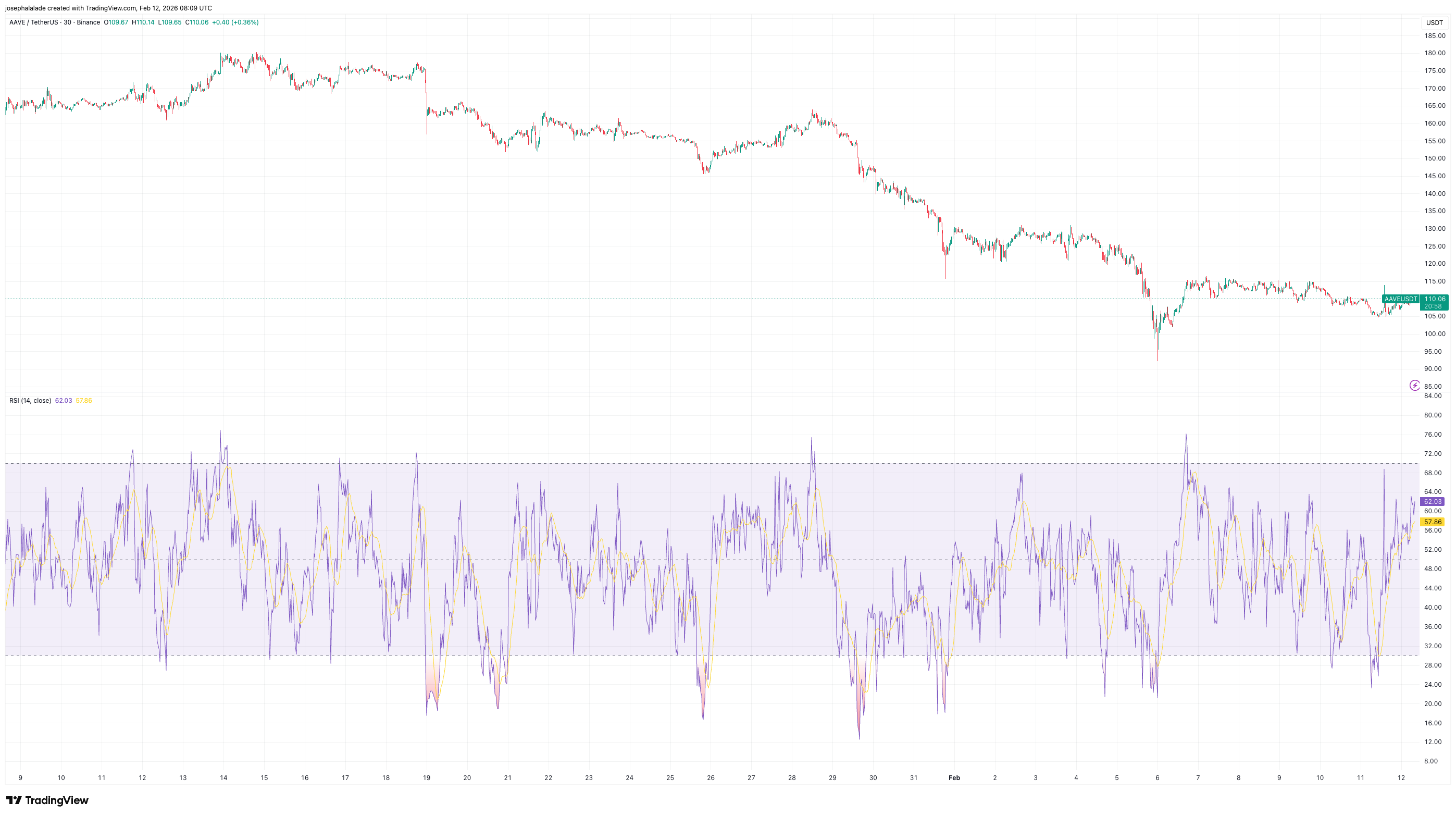

The AAVE price stays around $109–$110 after rebounding from near $100 in early February. Smaller recent candles and reduced volatility suggest selling pressure has eased, but buyers haven’t driven the price higher. It remains below previous breakdown levels, so the short-term trend is neutral.

The RSI (14) has also recovered to around 61, moving out of oversold territory but remaining below overbought levels. That placement points to improving short-term demand without confirming trend acceleration. RSI swings over recent sessions have stayed contained, reinforcing the view that price is pausing rather than trending.

Trend indicators continue to lean cautiously. TradingView’s aggregate signal remains Sell, driven largely by moving averages. Most short- and medium-term EMAs and SMAs sit above spot price and slope lower, leaving rallies exposed to overhead resistance. While some oscillators have turned constructive, MACD and momentum readings remain negative, limiting follow-through.

From a broader structure perspective, Javon Marks continues to frame AAVE within a long-term breakout context, maintaining a projected upside target near $628.5 based on historical price structure. In the near term, however, AAVE price action remains corrective. Until the DeFi token reclaims key moving averages and sustains higher highs, the market appears to be in consolidation rather than a resolution.

READ MORE: Uniswap Price Jumps 40% as BlackRock BUIDL Fund Goes Live on UniswapX