BitMine stock price remained in a tight range this week as Bitcoin and Ethereum slipped and futures open interest dived. BMNR was trading at $19.7, much lower than the all-time high of $160. Still, Tom Lee continues to accumulate and argues that this is not a real crypto winter.

Tom Lee Maintains Bullish Crypto Outlook

BMNR stock price has remained under pressure this year because of the ongoing crypto winter that has led to a substantial increase in its unrealized losses.

Still, while most investors are panicking, as evidenced by the Fear and Greed Index, Tom Lee’s company has continued to accumulate Ethereum. He is using the lower price to use the dollar cost averaging (DCA) strategy to buy as many ETH coins as possible ahead of the rebound.

Data shows that Bitmine has bought 157,971 coins in the last 30 days, bringing its total holdings to 4.3 million, which are valued at over $8.4 billion. It now owns 3.58% of all Ethereum supply, meaning that it needs to buy 1.7 million more coins to hit its 6 million target.

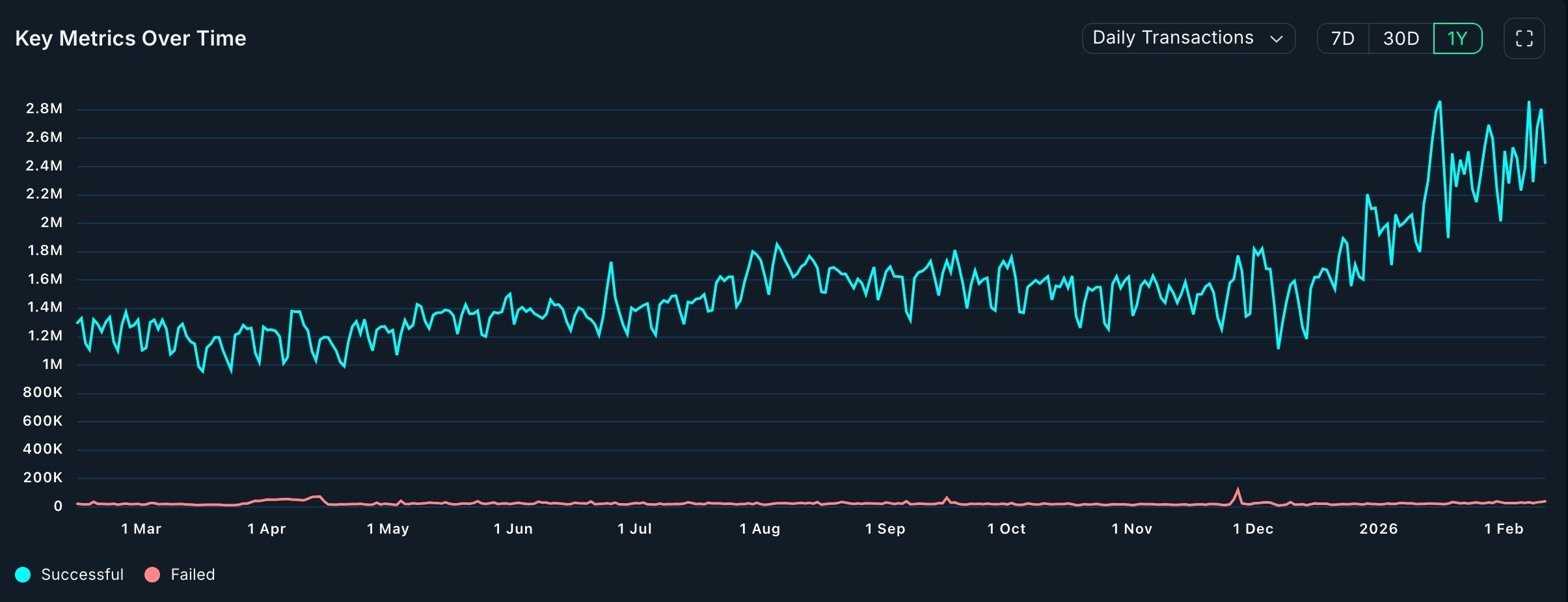

Tom Lee believes that the ongoing crypto bear market is different than the other ones. He even argues that this is not a crypto winter as key internal metrics show strong Ethereum usage.

READ MORE: Cardano Price Sits at a Make-or-Break Level Ahead of Midnight Mainnet Launch

For example, data compiled by Nansen shows that the number of Ethereum active addresses has soared by 30% in the last 30 days to 15.3 million. Also, the number of transactions has jumped by 37%, while the network fees have risen by 105% to $20 million. Fees have slumped even though the average transaction cost has dipped in the past few months.

Meanwhile, Ethereum is still gaining market share across key sectors like Decentralized Finance (DeFi) and real-world asset (RWA) tokenization. Its chain is now being used by big companies like JPMorgan and Franklin Templeton.

At the same time, more investors are moving their coins to staking pools. Data shows that the Ethereum staking queue has jumped to a record high, with a waiting period of 40 days. That is a sign that long-term investors are still optimistic of the coin.

All this is contrary to what happened in the previous crypto bear markets. At the time, staking outflows were soaring, and the number of transactions were falling.

BitMine Stock Price Technical Analysis

BMNR stock chart | Source: TradingView

The weekly timeframe chart points to a potential BMNR stock rebound. It has slowly formed a falling wedge pattern, which is made up of two descending and converging trendlines.

The two lines of this pattern are now nearing their confluence, where rebounds normally happens. Therefore, the most likely BitMine stock forecast is bullish, with the next key target being at $35.

The only caveat is that this Bitmine stock prediction is based on the weekly chart, meaning that its outcome may take time.

READ MORE: Crypto Market Crash Today: Reasons Why BTC and Altcoins are Going Down