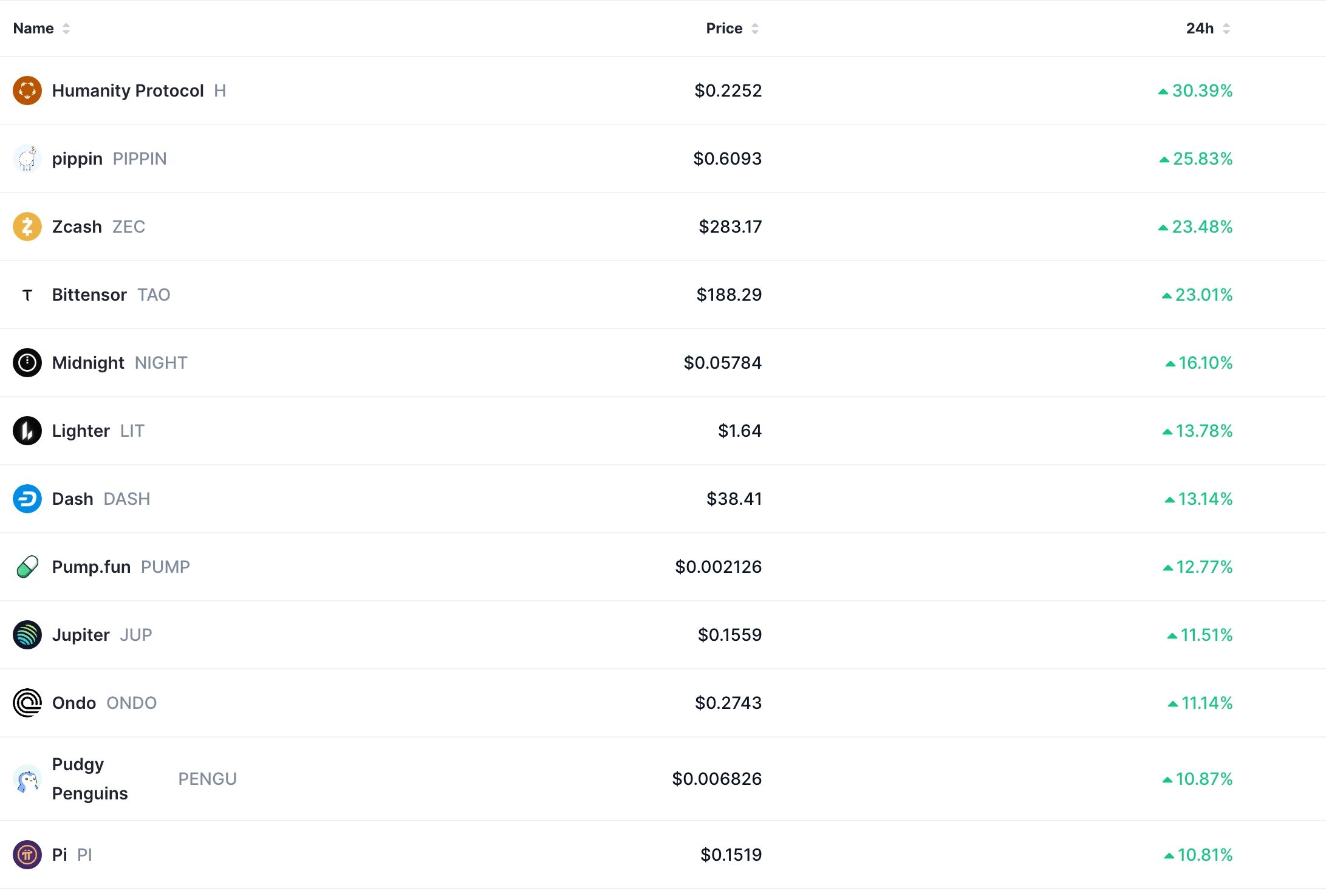

A crypto rally is happening today, with Bitcoin price rising to $68,000, and top altcoins like Zcash (ZEC), Humanity Protocol (H), Lighter (LIT), Hedera (HBAR), and Pippin (PIPPIN) soaring by over 10% in the last 24 hours.

Crypto Rally Happening After US Inflation Data

The market capitalization of all coins jumped by 3.6% to over $2.35 trillion. Other top gainers were coins like Bittensor (TAO), Dash (DASH), Jupiter (JUP), and Ondo Finance (ONDO).

The ongoing crypto rally coincides with the stock market rebound. Data shows that the Dow Jones and the S&P 500 indices rose by 50 points and 10 points, respectively. Some of the top gainers in the stock market were companies like Corsair Gaming, Coinbase, Rivian, and Fastly.

Crypto prices rose after the US released the latest consumer inflation report on Friday. A report by the Bureau of Labor Statistics (BLS) showed that the headline Consumer Price Index (CPI) dropped from 2.7% in December to 2.4% in January, while the core CPI remained unchanged at 2.5%.

READ MORE: BitMine Stock Forms Bullish Pattern as Tom Lee Insists This is No Crypto Winter

The report came after the bureau published the latest non-farm payrolls (NFP) data. This report showed that the economy added 130k jobs in January as the unemployment rate dropped to 4.3%.

The latest inflation report means that the Federal Reserve may cut interest rates more times than expected. Still, some Federal Reserve officials have warned that rate cuts may take longer as long as inflation remains above the 2% target. In a statement, Austan Goolsbee said:

“I think rates can go down more — even several cuts more — from where they are today. But that’s conditional on getting inflation back on the path to 2%. Right now, we are not on a path back to 2%. We’re kind of stuck at 3%, and that’s not acceptable.”

Crypto Futures Open Interest Soared

The crypto rally also happened as the open interest rebounded. Data compiled by CoinGlass shows that the futures open interest rose by 4.12% in the last 24 hours to over $97 billion. Rising open interest is a bullish sign as it means that investors are increasing their positioning.

Still, the main risk is that the ongoing crypto market rally is a bull trap or a dead-cat bounce, where tokens in a downward trend rebound briefly and then resume the downward trend.

These dead-cat bounces have become highly popular in the crypto market recently. A good sign of this is that the Bitcoin price has failed to crack the $70,000 level after the US inflation data.

READ MORE: Cardano Price Sits at a Make-or-Break Level Ahead of Midnight Mainnet Launch