Fidelity’s U.S.-listed spot Bitcoin and Ethereum ETFs fell out of favor with investors on Wednesday amid macroeconomic headwinds that took a toll on the broader crypto market.

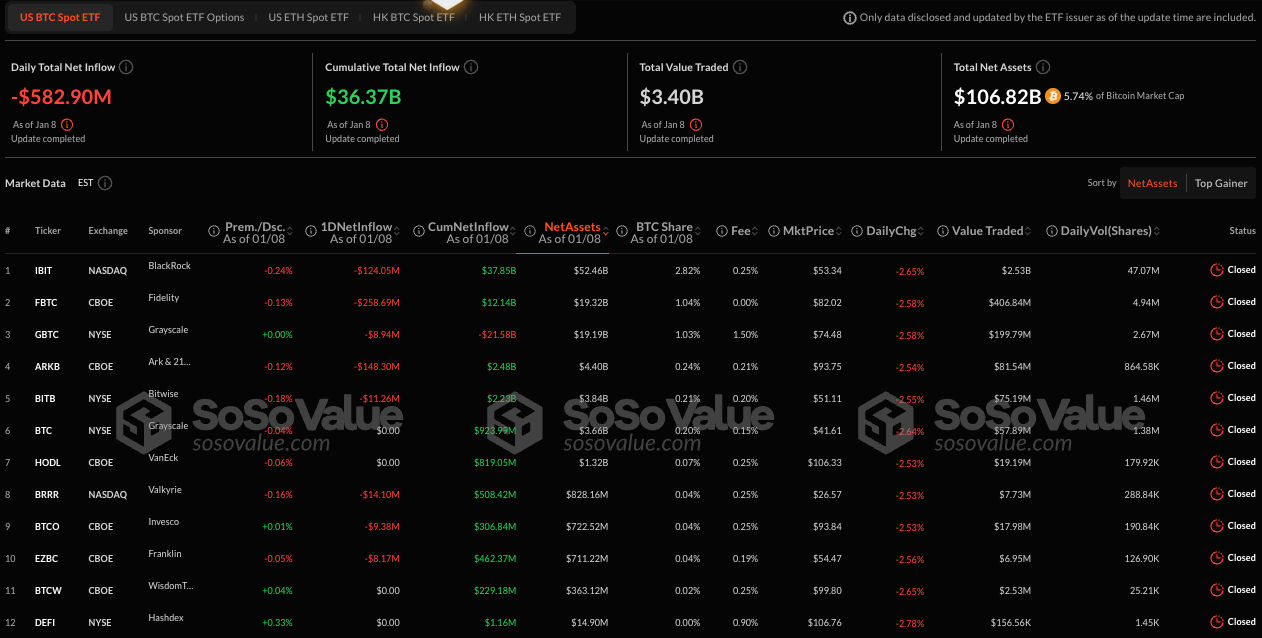

The asset manager’s spot Bitcoin ETF (FBTC) bled hundreds of millions on January 8. Seven of the eleven funds saw a combined outflow of $582.9 million according to data from SoSoValue.

Fidelity’s Crypto ETFs Lead Massive Outflows

Fidelity’s FBTC led Wednesday’s outflows with $258.69 million, as BlackRock’s IBIT, the world’s largest spot Bitcoin ETF by net assets, haemorrhaged $124.05 million to break its three-day positive streak. While FBTC recorded its largest daily net outflow since its inception on January 11 last year, IBIT has witnessed its third largest negative flow, coming barely a week after it posted outflows totaling $332.6 million.

The remaining funds, including Grayscale’s GBTC and BTC, Ark Invest’s ARKB, Valkyrie’s BRRR, VanEck’s HODL, Invesco’s BTCO, WisdomTree’s BTCW, and Hashdex’s DEFI, recorded a combined daily net outflow of $200.16 million.

Meanwhile, U.S.-listed spot Ether ETFs were not spared from Wednesday’s market bloodbath as investors pulled $159.34 million from the three funds, including Fidelity’s FETH, which led the day’s outflows with $147.68 million. Grayscale’s ETHE and ETH saw mild outflows of $8.26 million and $3.4 million, respectively. Despite recording their largest single-day outflows on January 8, Fidelity’s FBTC and FETH are on a positive track. The two funds still claimed the second-largest cumulative net inflows among all spot Bitcoin and Ether exchange-traded funds.

Bitcoin exchanged hands at $92,538 after losing 2.87% in the last 24 hours, while Ether’s price stood at $3,247 after tumbling 3.45% over the same period, CoinMarketCap data shows.

READ MORE: Polymarket Sees Public Outrage After Accepting Wagers on Wildfire Devastation