Bitcoin price continues to face substantial resistance below $100,000 as buyers remain on edge amid the rising recession risks. However, some of the top analysts believe that Bitcoin price has a long way to go in the next few years.

Cathie Wood’s Ark Invest made a highly bullish Bitcoin prediction for 2030. Her firm expects that the coin will surge to $2.4 million by 2030. If this happens, the coin will have a market cap of almost $50 trillion, or 45% of the global GDP today.

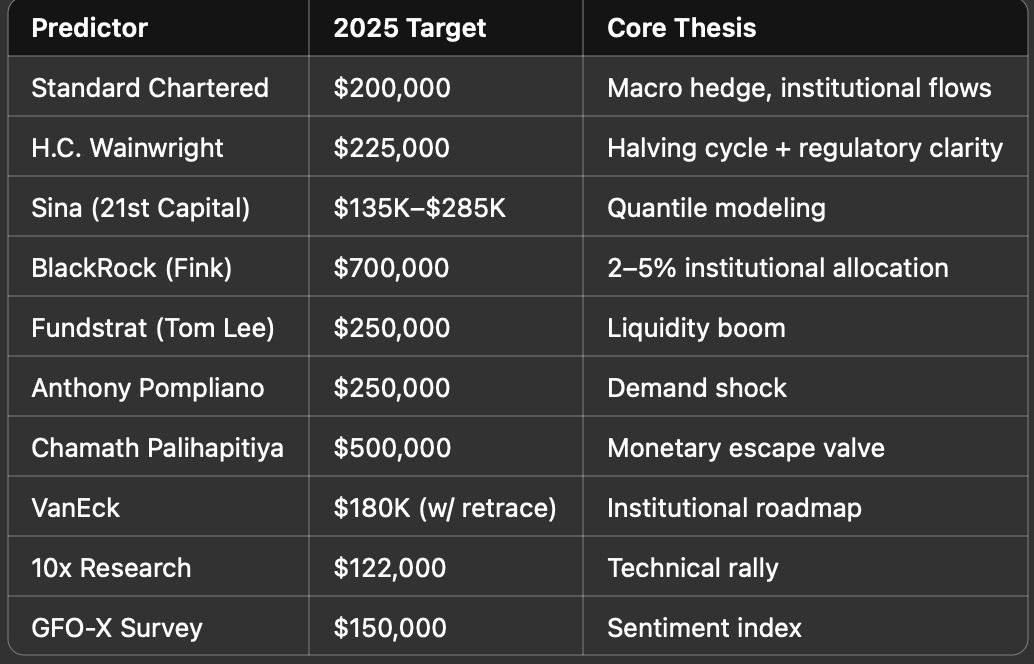

Larry Fink, the founder of BlackRock, predicts that Bitcoin’s price will surge to $700,000 this year. Such a move would bring Bitcoin’s market cap to almost $14 trillion, higher than the valuation of Apple, Microsoft, NVIDIA, Google, and Saudi Aramco combined.

Standard Chartered, a top bank with $850 billion in assets, has a Bitcoin price target of $200,000 this year and $500,000 in the long term. Other analysts, such as Chamath Palihapitiya, Anthony Pompliano, HC Wainwright, and VanEck, believe that the coin will surge to over $122,000 this year.

READ MORE: Bitcoin Price Prediction: Will BTC Surge to a New ATH This Week?

Catalysts for a Bitcoin Price Surge

Analysts have identified numerous catalysts for the soaring Bitcoin price. One of the main ones is that it has become a sort of safe-haven asset because of its strong demand and the fact that supply is not growing as fast.

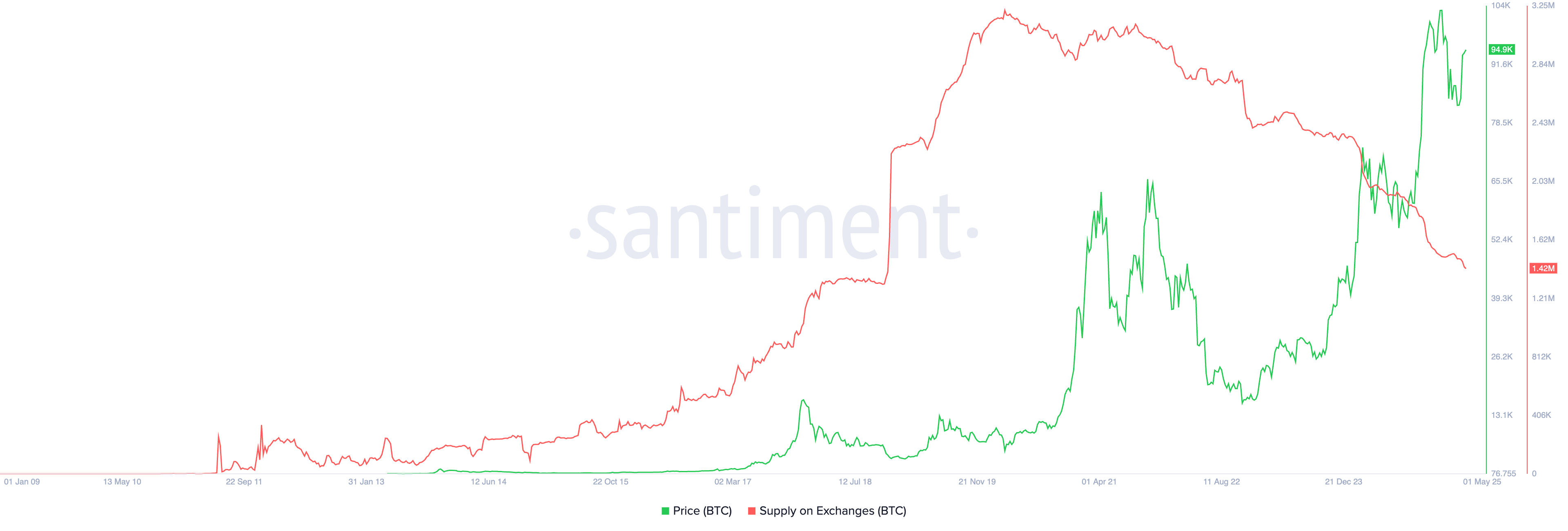

For example, the chart below shows that Bitcoin exchange balances have dropped to a five-year low. This happened at a time when spot Bitcoin ETFs have accumulated over $40 billion in inflows since January 2024.

Further, analysts note that Bitcoin has a long track record of doing well, as its price has jumped from less than $1 in 2009 to $94,000 today. During this period, it survived the COVID-19 pandemic, the fastest Federal Reserve hikes in years, the collapse of FTX and Celsius, and Gary Gensler’s crackdown.

Another catalyst is that more companies will continue allocating a small portion of their treasury to Bitcoin. According to Bernstein, these inflows will jump to over $330 billion by 2029, about 8.25 times the amount of ETF inflows today. As such, while retail investors led the initial BTC price surge, the next phase will be led by institutions.

Other catalysts for Bitcoin will be the surging US public debt, monetary easing by the Federal Reserve and other central banks, and the four-year halving cycle.

READ MORE: Bitcoin Price Prediction: 3 Charts Explaining the Coming BTC Surge