Bitcoin and other altcoins are at risk as the Federal Reserve delivers its interest rate decision on Wednesday. This risk explains why BTC and top altcoins like Cardano, Jasmy, Dogecoin, and Shiba Inu have all retreated this week.

Economist Issues Dire Fed Warning

Jim Bianco, one of the most popular experts, has issued a major warning. In an X post on Tuesday, he warned that the Federal Reserve will deliver fewer interest rate cuts than expected this year.

He expects the Fed to leave rates intact at 4.50% today, and in its June meeting, with the first cut coming in July. In his statement, he warned that the elephant in the room was inflation.

Although recent data showed a drop in headline and core inflation in March, he expects Trump’s tariffs to push them higher. He cited the recent inflation expectation data, which showed that many people expect that prices will surge to the highest level in over 40 years.

While energy prices have dipped, there are signs that inflation will continue rising as companies adjust their prices to maintain their margins.

Still, other analysts have a different opinion on the path of interest rates, with Goldman Sachs expecting three cuts this year. 20% of Polymarket traders anticipate three rate cuts this year, while 19% anticipate two.

Read more: Chainlink Price Hidden Catalyst: $150 Trillion SWIFT Opportunity

Impact on Cardano, Jasmy, Dogecoin, and other Altcoins

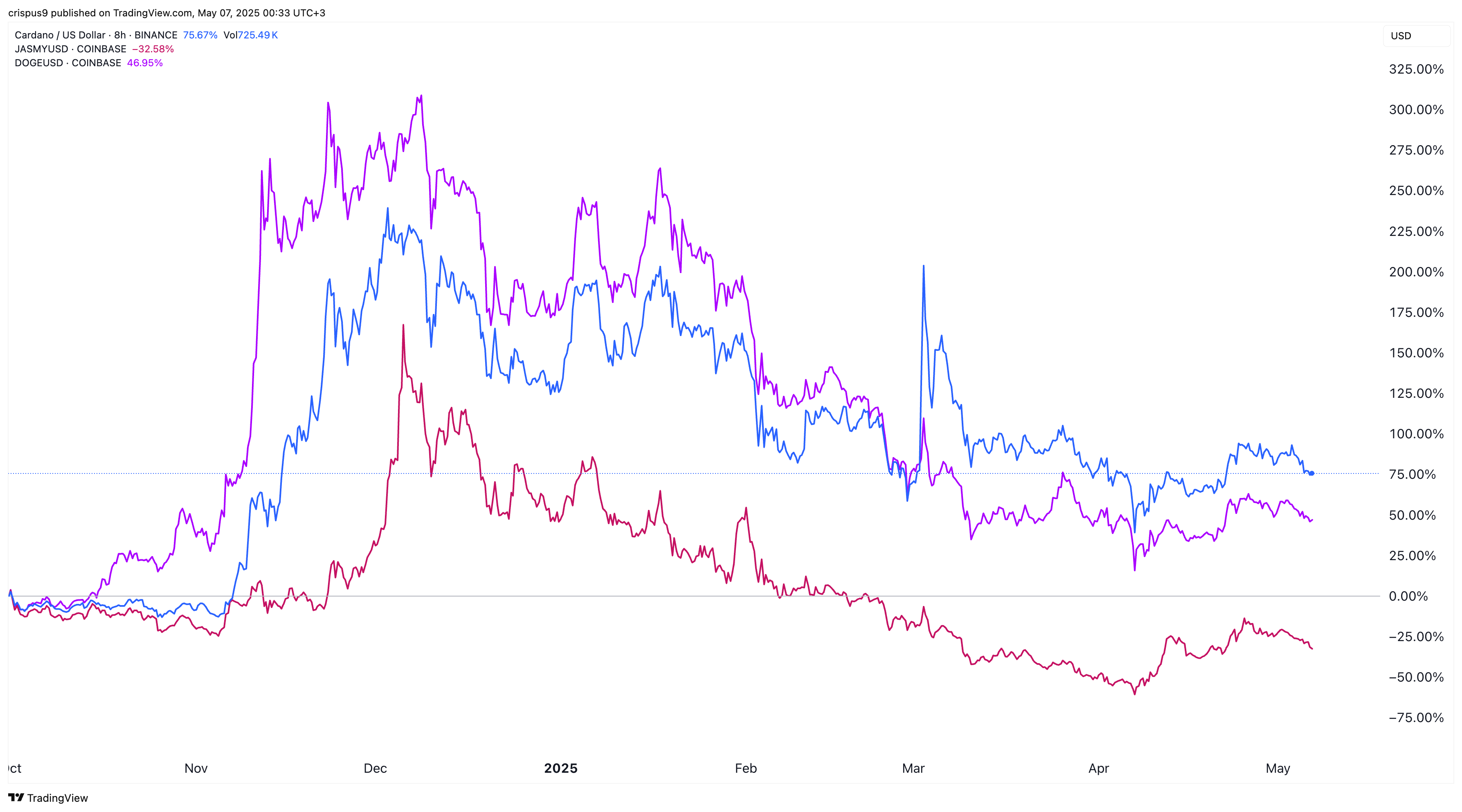

Bitcoin and altcoins like Jasmy, Dogecoin, and Cardano have wavered this week as investors remain divided on what to expect from the Fed.

Historically, these assets perform well when the Federal Reserve cuts rates or signals future cuts. For example, all these coins surged during the COVID pandemic as the Fed slashed interest rates to zero and launched a quantitative easing policy.

They all plunged in 2022 as the Fed hiked interest rates to deal with the rising inflation. Most recently, the rally was because of the Fed cuts. Therefore, a dovish tone on Wednesday will likely lead to more altcoins gaining, while a more hawkish tone will lead to lower prices.

Bitcoin Catalysts to The Rescue

On the positive side, as previously mentioned, Bitcoin has numerous catalysts like the rising ETF inflows and technicals that may push it to a record high later this year.

All Bitcoin price needs is for its price to move above the key resistance at $100,000 and FOMO will set in, pushing it to a record high. This also explains why most analysts are highly bullish on Bitcoin, with BlackRock expecting Bitcoin to reach $700,000 in the long term.

Such a bullish Bitcoin price forecast would lead to higher altcoin prices that would benefit the likes of Cardano, Jasmy, and Dogecoin.

Read more: Buffett Cash Pile Hits $347B: What if Berkshire Bought $1B in Bitcoin in 2015?