The Ethereum price continued its strong surge on Saturday, soaring to the critical resistance level at $2,500 for the first time since March of this year. It has jumped for three consecutive days and is up 80% from its lowest level this year.

This article explains whether the ETH price will keep rising to the important resistance at $4,000 as its funding rate remains positive and as smart money investors buy.

Ethereum Price Technical Analysis

The daily chart shows that the Ethereum price hit a low of $1,388 in April following Donald Trump’s tariff announcement on Liberation Day. It then bounced back but remained below the resistance point at $2,000 for weeks.

The ETH price surged this week following developers’ implementation of the Pecta upgrade. It has now jumped above the 200-day Exponential Moving Average (EMA) and the 38.2% Fibonacci Retracement level at $2,425. Moving above that level signifies that the short squeeze is gaining steam.

The Ethereum price is also approaching the major S/R pivot point at $2,525. The Average Directional Index (ADX) has jumped to 25, a bullish sign that the trend is strengthening.

Therefore, the coin will likely continue rising, with bulls targeting the next key resistance level at $3,000, approximately 20% above the current level. However, a brief retreat to the 23.60% point at $2,025 cannot be ruled out.

READ MORE: HBAR Price Prediction: Here’s Why Hedera is About to Surge 60%

ETH Funding Rate and Smart Money Accumulation

There are signs that the ETH price surge is set to continue. Data indicates that the number of smart money investors has increased over the past few days. There are now about 1,800 smart money investors, up from the year-to-date low of 1,620. These market participants are seen as more sophisticated and experienced than retail investors.

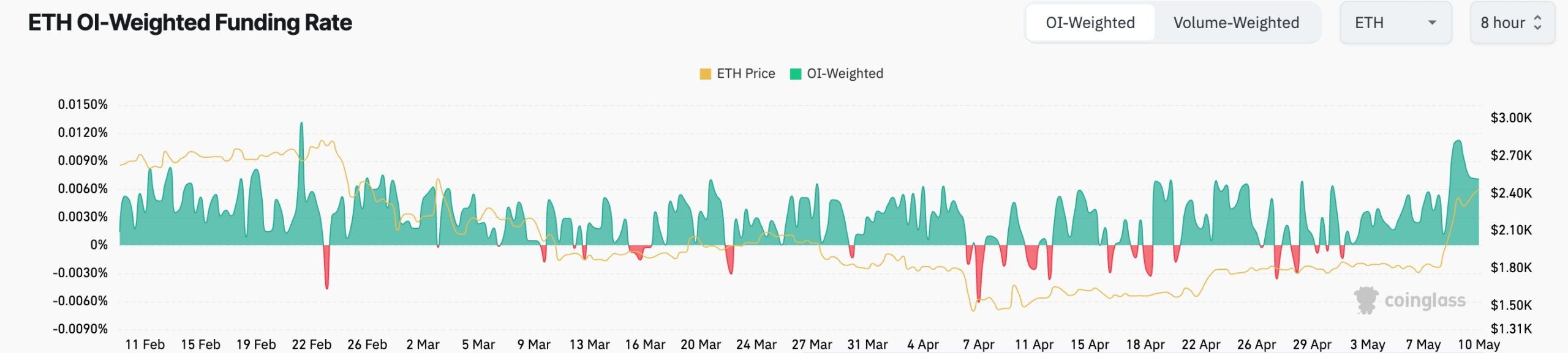

Another dataset from CoinGlass shows that Ethereum’s funding rate has remained positive in the past few days. A funding rate is an important figure in the futures market as it shows that the futures price is higher than the spot market price. In this scenario, long-positioned traders pay the funding fee.

Further data reveals that Ethereum’s futures open interest has risen to $28 billion, marking its highest point since February 2. It has jumped sharply from this month’s low of $17 billion. A high open interest is a bullish sign since it signals high demand in the futures market.

Therefore, the rising futures interest, smart money purchases, and the positive funding rate point to further gains in the near term.

READ MORE: Polkadot Price Could Surge to $10 as Elastic Scaling Launches on Kusama