On Tuesday morning, the AAVE price was on the cusp of a strong bullish breakout as its assets increased and the volume on exchanges decreased. The AAVE token was trading at $240, its highest level since February 25. Let’s explore whether the coin is ripe for a strong bullish breakout.

AAVE Price Technical Analysis

The daily chart shows that the AAVE price has been in a consolidation phase for the past few days. This consolidation was part of the formation of a bullish flag chart pattern, which is a popular continuation sign.

The AAVE token has found support at the 200-day Weighted Moving Average (WMA). The spread between the 200-day and 50-day WMA has continued to narrow, raising the possibility that the coin will soon form a golden cross pattern, a popular continuation sign.

The AAVE price is also hovering at the 50% Fibonacci Retracement level. Therefore, the most likely scenario is where it has a bullish breakout as bulls target the December high of $400, about 70% above the current level. A drop below the support at $200 will invalidate the bullish AAVE price forecast.

Reasons Why AAVE Token May Surge Soon

There are a few fundamental reasons why the AAVE price may continue rising in the coming weeks. Firstly, there are signs that users are depositing their funds into the AAVE platform as the network’s total value locked (TVL) has jumped by 33% in the last 30 days to $24.5 billion.

The rising assets on AAVE are a bullish factor because they lead to higher fees. Data shows that the network fees generated by the platform jumped to $1.5 million. AAVE has made over $240 million this year, making it the fifth-most-profitable network in DeFi after Raydium, Jiti, Uniswap, and Lido Finance.

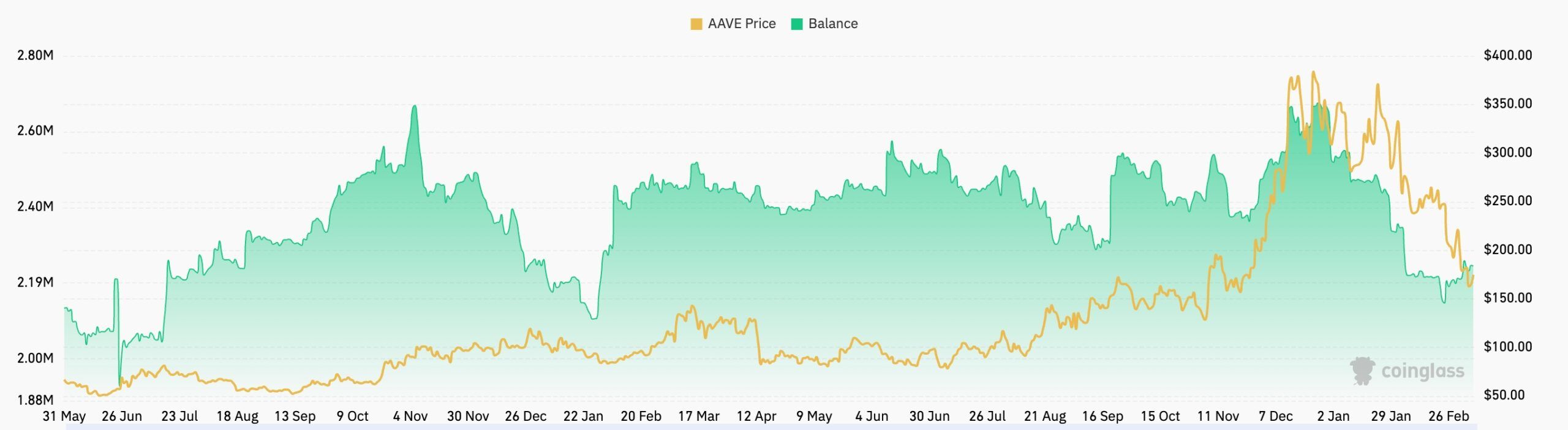

Furthermore, the AAVE price will likely increase as the supply of tokens on exchanges continues to decrease. There were 2.25 million tokens on exchanges in December, down from 2.68 million, a sign that investors are not selling their coins.

AAVE will also continue rising now that it has become one of the most blue-chip players in the cryptocurrency industry. It has survived most black swan events like the Terra, FTX, and Celsius crash, and most recently, it survived over $600 million in liquidations as many cryptocurrency prices crashed.

READ MORE: Aave (AAVE) Eyes $335 as Technicals, Aavenomics Fuels Breakout Hopes