Raydium, the top decentralized exchange (DEX) on the Solana ecosystem, has generated more fees this year than other top competitors.

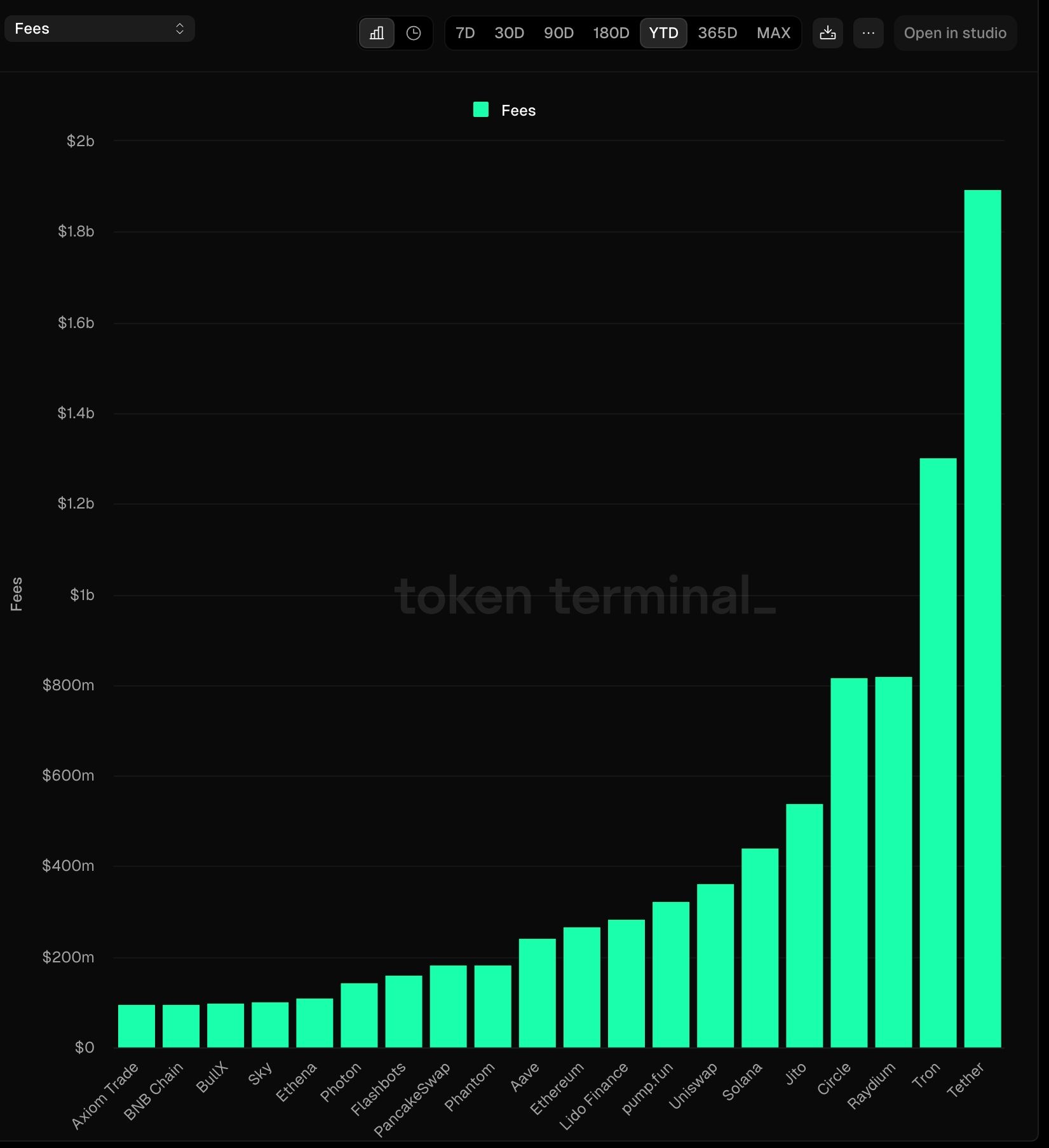

TokenTerminal data shows that Raydium has made $820 million in fees this year, making it the third-biggest money maker in the crypto industry after Tether and Tron.

This performance means that it has surpassed top DEXs like Uniswap and PancakeSwap, which generated $361 million and $182 million in fees, respectively.

Notably, it has generated more fees than Solana and Ethereum, which earned $441 million and $361 million, respectively.

Solana Meme Coins Helped Raydium Grow

Raydium has become one of the most active players in decentralized finance this year, bolstered by the growth of Solana meme coins. Its best month was January, when it processed transactions worth over $124 billion following the launches of the Trump and Melania meme coins.

The volume trajectory has moderated in the past few months as most Solana meme coins have crashed. Their market cap fell from over $30 billion in January to $6 billion in April, before rebounding to $15 billion today.

Raydium’s volume has started to bounce back after the recent surge in Solana meme coins. So far this month, it has handled $17.5 billion, an increase from the $17.1 billion processed last month.

Like other companies in the decentralized exchange industry, Raydium makes money through transaction costs. It charges a 0.25% trading fee for each swap. 0.22% of these funds are distributed to liquidity providers, while the remaining 0.03% is allocated for RAY token buybacks.

The RAY token price has fallen this year despite the strong network growth. RAY price dropped from a high of $8.67 in November to $3.10 today. This decline has reduced its fully diluted valuation (FDV) to $1.7 billion, significantly lower than Uniswap’s $5.94 billion.

READ MORE: Raydium Coin Soars 20%: Analysts Eye $7 to $20 If Bullish Trend Holds