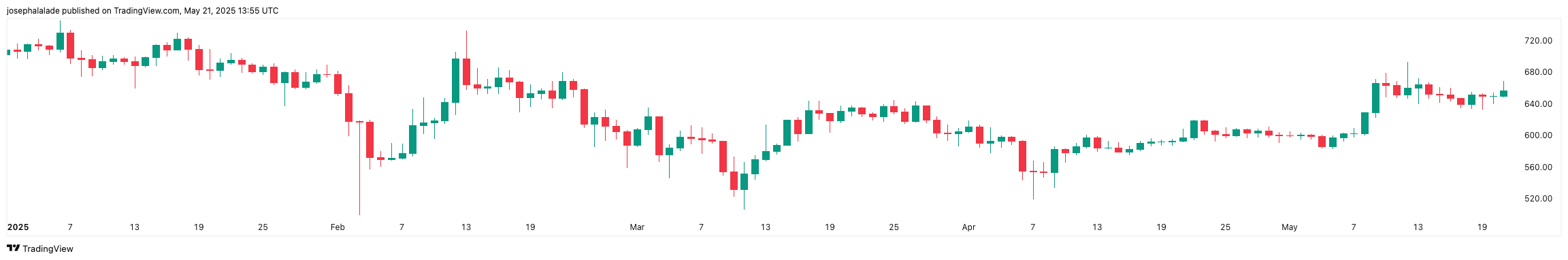

Binance Coin (BNB) is seeing increased momentum following a technical breakout, leading its current price to around $655. This surge, supported by a bullish chart pattern and improved sentiment, has ignited renewed enthusiasm among traders and analysts.

Many experts now believe the BNB price is poised for a rally toward four figures, at least the $1,000 level.

Binance Coin Breaks Out from Falling Wedge

In a tweet from popular crypto trader BATMAN, BNB was shown flipping a long-standing downward trendline. The chart indicates a bullish breakout from a falling wedge, a pattern often associated with strong upward reversals.

“Don’t bet against BNB,” he wrote. “It’s going to have a big rally soon.”

The tweet highlights an accumulation zone where the BNB price was consolidating. With that phase now likely over, the Binance Coin is entering a breakout structure supported by Elliott Wave patterns, suggesting a multi-leg rally could develop.

Hidden Bullish Divergence Hints at Massive Upside

Adding to the bullish case, analyst JAVON MARKS shared a separate chart noting that the Binance Coin price has formed a Hidden Bullish Divergence, a rare and powerful signal, highlighted by the popular cryptocurrency analyst.

This kind of divergence typically occurs when the price creates higher lows while an indicator like RSI forms lower lows, signaling momentum is shifting upward beneath the surface.

“One of the last times this sequence happened, prices climbed over +2,000%,” Javon wrote, drawing parallels to past explosive BNB price rallies.

The analyst suggests that if history repeats, the BNB price could break above $1,000, entering new territory as long-term holders and institutional investors resume accumulation.

What’s Next for BNB Price?

If BNB maintains momentum above the flipped trendline (~$650), the next resistance is at $665–$680. A breakout above this could quickly extend toward $750, a psychological level and the previous resistance zone.

From there, technical projections and wave analysis support a rally toward $1,000, especially if broader market conditions remain favorable.

However, a failure to hold above $650 would risk retesting lower support levels between $620 and $630. This would not invalidate the bullish structure but could delay any upward surge and trap investors expecting a breakout. A break below $600 would likely invalidate the current setup and reintroduce bearish pressure.

READ MORE: Trump Coin Price Prediction: Buy or Sell Ahead of the Dinner?