The Grayscale Bitcoin Premium Income ETF (BPI) and the Grayscale Bitcoin Covered Call ETF (BTCC), which aim to replicate the JPMorgan Equity Premium Income ETF (JEPI), are off to a slow start following their debut.

The BPI ETF has attracted just $2.8 million in assets under management (AUM), while BTCC has $4.6 million. These numbers pale in comparison to the largest covered call ETF, JEPI, which has nearly $40 billion in assets.

What are BPI and BTCC ETFs?

BPI and BTCC ETFs are exchange-traded funds that aim to give investors access to Bitcoin’s price appreciation while generating monthly dividends.

The funds were likely inspired by JEPI, which has become highly popular on Wall Street because of its regular returns.

BPI and BTCC generate returns using the covered call ETF strategy. The first strategy involves investing in Bitcoin Exchange-Traded Products (ETP) and writing call options on them. They primarily invest in the Grayscale Bitcoin Trust (GBTC) and Grayscale Mini Trust (BTC).

The main difference between the BPI and BTCC ETFs is that the former writes out-of-the-money call options whose strike price is significantly above Bitcoin’s current price. The BTCC ETF, on the other hand, prioritizes maximizing income by writing call options that are very close to the spot price.

READ MORE: Bitcoin Price Prediction: Why the Moody’s US Downgrade is Bullish for BTC

As a result, BPI tends to generate a higher price return than BTCC when Bitcoin is in a strong bull run. By placing the call options close to the spot price, BTCC limits its performance as the call option will likely be exercised.

BTCC and BPI ETFs have an expense ratio of 0.66%, higher than JEPI’s 0.35%. In terms of dividend returns, BTCC offers a higher return of 4.43% compared to BPI’s 1.18%.

Are BTCC and BPI Good Investments?

A common question in the financial market is whether covered call ETFs are good investments. In most cases, when examining performance based on price, covered call ETFs often underperform their benchmark assets.

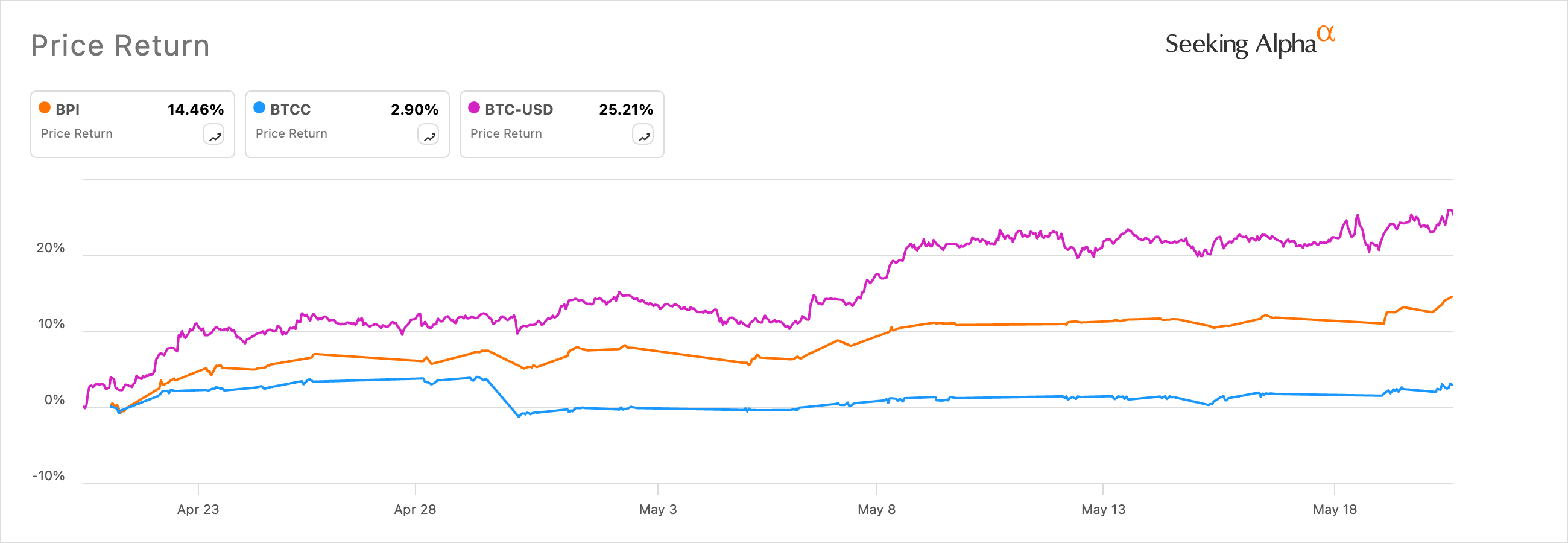

In this case, the Bitcoin price has jumped by 25.2% in the last 30 days, while the BPI and BTCC have risen by 14.46% and 2.90%, respectively.

BPI vs BTCC ETFs vs Bitcoin

The best way to evaluate a covered call ETF investment is to consider its total return, which includes the dividend payment and the price performance. BPI and BTCC are new funds, meaning that their holders have only received one payment. Their total returns are 15.90% and 7.62%, respectively.

One good way to assess whether the covered call ETFs are worthwhile is to compare their performance with JEPI and the S&P 500. JEPI’s total return in the last three years was 31.6%, while the S&P 500 Index returned almost 60%.

Similarly, the Nasdaq 100 Index has had a total return of 83% compared to JEPQ’s 57%. Therefore, using these covered call ETFs as benchmarks shows that Bitcoin will do better than BPI and BTCC in the long term.

READ MORE: Bitcoin Market Cap Flipped Google: Can it Flip Apple, Microsoft, NVIDIA?