Bitcoin price has already jumped to a record high this year, but a unique chart pattern and falling exchange reserves show why it is on the cusp of more gains ahead. The BTC price was trading at $110,000 on Tuesday, slightly down from the all-time high of nearly $112,000.

Bitcoin Price Cup and Handle Pattern Points to a Surge

Technical analysis can help you determine whether an asset will continue rising or experience a reversal. For example, we used this approach to estimate the surge to a record high in this BTC price forecast.

A keen chart analysis indicates that the Bitcoin price is about to surge to nearly $150,000 in the coming months. The daily chart reveals that it has formed a cup-and-handle chart pattern.

This pattern has two sections: a cup and a handle. In Bitcoin’s case, the upper side of the cup was at its previous all-time high of $109,300, reached in January. It then dropped gradually and bottomed at $74,457, the lower side of this cup.

The Bitcoin price then started to rise gradually and completed the upper side last week. It is now forming the handle section, which suggests that the price may consolidate or even retreat slightly before a potential rebound.

The cup had a depth of about 30%, meaning that measuring the same distance from the cup’s upper side brings the target price to $142,000. A cross above this target will likely lead to more gains of up to $150,000.

READ MORE: Here’s the Ethereum Price Target if It Matches Silver Market Cap

BTC Supply is Falling

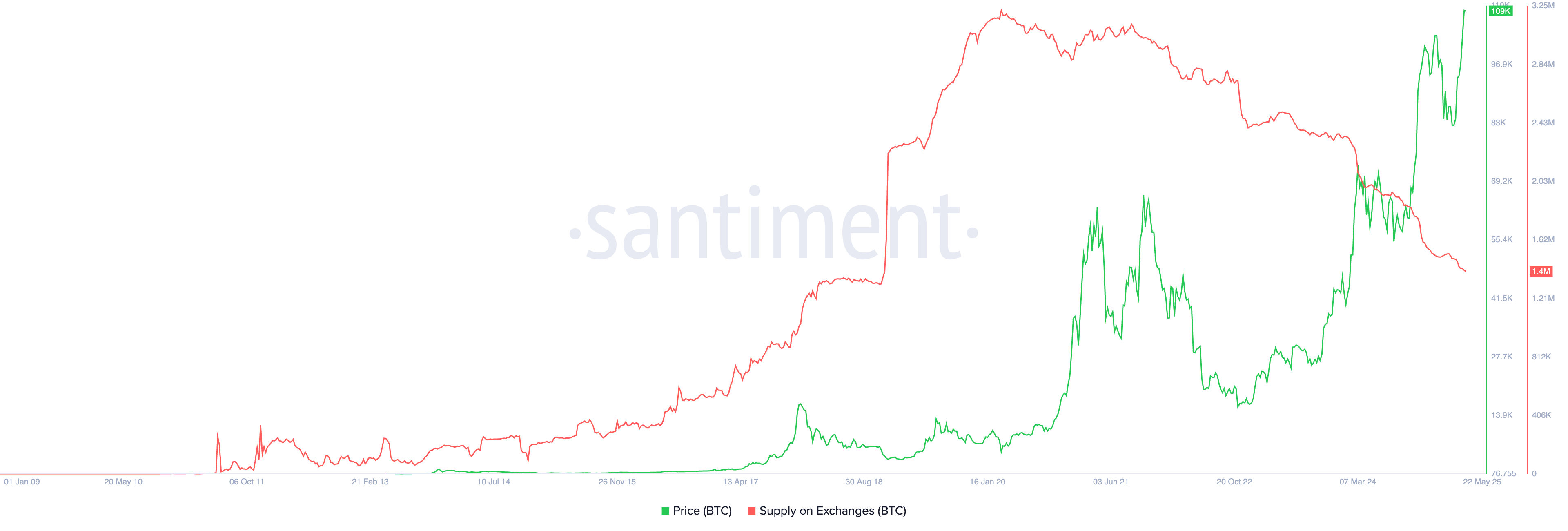

Bitcoin supply on exchanges | Source: Santiment

The main catalyst for the Bitcoin price surge will be the ongoing supply crunch as institutional investors enter the market. The chart below shows that the supply of Bitcoin on exchanges has continued falling in the past few months.

This supply peaked at 3.2 million in 2020 and has now dropped to 1.4 million, the lowest level since November 2018. The supply in the over-the-counter (OTC) market has also continued to decline this month.

This trend is occurring due to the increasing demand from companies and ETFs. Trump Media is preparing to purchase Bitcoin worth over $3 billion as it seeks to position itself in a role similar to that of MicroStrategy.

A partnership between Cantor Fitzgerald, Softbank, and Tether is also buying coins worth over $3 billion, while MicroStrategy continued its buying spree last week. Additionally, spot ETFs have now seen inflows exceeding $43 billion. Consequently, the rising demand combined with falling supply is likely to push Bitcoin prices higher in the long term.

READ MORE: Bitcoin Staking Boom Sparks DeFi Asset Growth in Coffer, Babylon, and Lombard