Hedera’s native token, HBAR, is discreetly preparing for a potential breakout after rebounding from a crucial weekly demand zone. Trading at approximately $0.188, the Hedera price has maintained strong support and is showing early signs of reversal, echoing a fractal pattern seen in Cardano’s explosive 2021 rally.

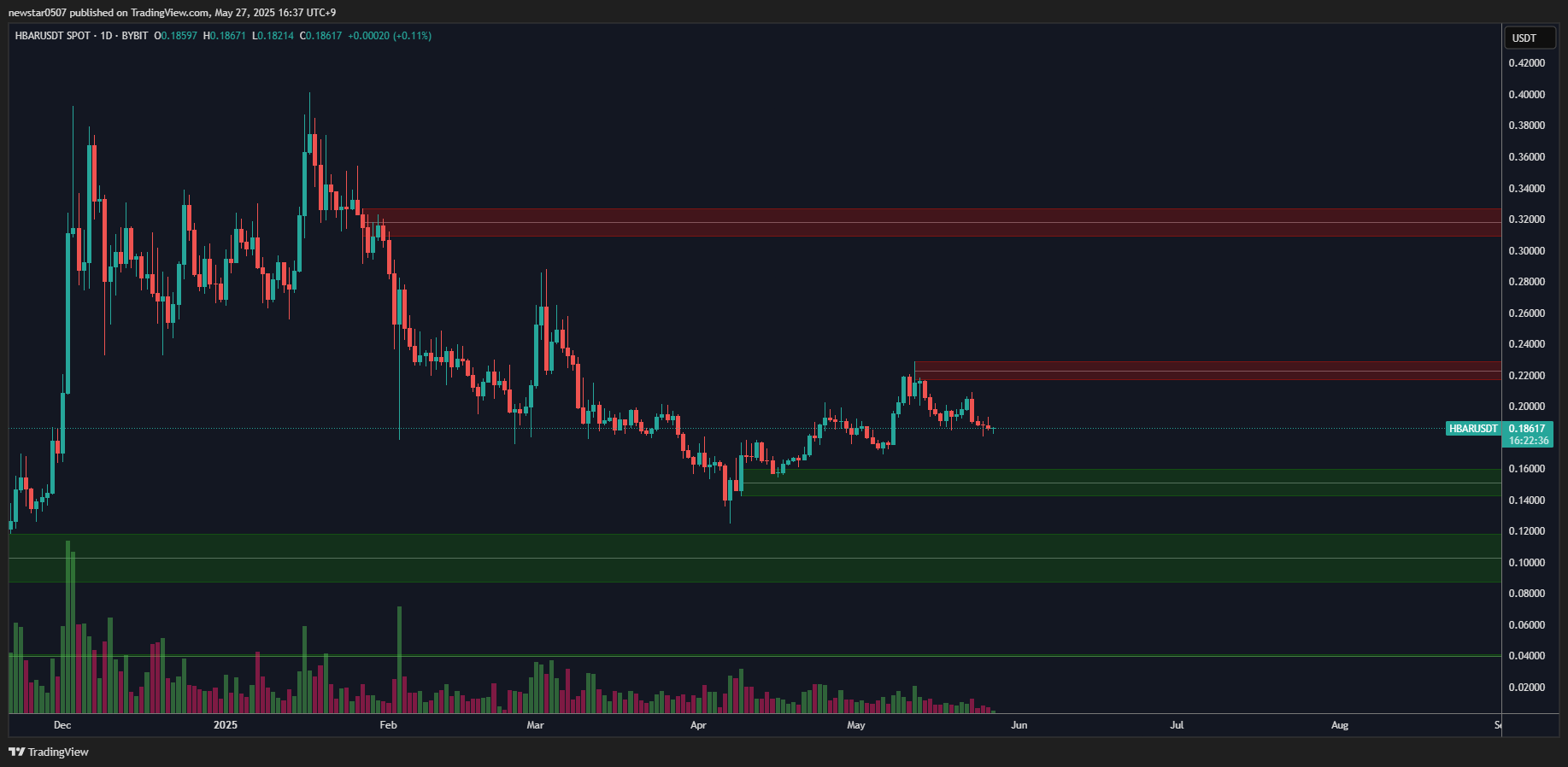

Analysts are watching closely as the HBAR coin consolidates below a critical resistance at $0.22, which, if broken, could trigger a run toward $0.32.

Hedera Price Echoes Cardano’s 2021 Bull Run

As shared by crypto analyst Maelius, the HBAR coin recently broke out of a long-term diagonal resistance and successfully retested the accumulation zone around $0.17–$0.19. This range has historically served as strong support and now forms the foundation for potential bullish continuation.

With HBAR’s current price at $0.1882, according to CoinGecko, the token shows a slight decline of 2.58% over the past week; however, a broader perspective suggests a more optimistic outlook.

On May 23, the token briefly reached $0.2081, with daily volume hitting $231 million before correcting downward. The 24-hour volume has since stabilized at $137.58 million, indicating healthy market participation.

This pullback to support is viewed as a necessary consolidation, with analysts expecting an impulsive move once the resistance wall is broken.

Perhaps the most compelling argument for HBAR’s potential upside comes from fractal analysis. In a side-by-side chart comparison, Maelius compared HBAR’s recent price action to Cardano’s (ADA) 2020–2021 structure.

In his tweet, he mentioned that both tokens followed a nearly identical trajectory: a long-term downtrend, a transition of the accumulation zone, consolidation, and finally, a significant increase.

“Despite not liking fractals, I’ve found $ADA had a pretty much similar structure in 20/21,” Maelius wrote. “HBAR is now doing pretty much the same.”

He highlights that the pattern includes a clean breakout from diagonal resistance, followed by a retest of the accumulation zone, an event that historically precedes major price expansions in altcoins.

Key Levels to Watch on HBAR Coin

Another cryptocurrency analyst @CW8900 emphasized the importance of the $0.22 resistance level, referring to it as the “sell wall.”

His chart suggests that a clean break above this zone could open the gates for a swift rally toward $0.32, especially in the absence of major overhead resistance.

This aligns with the Hedera price structure in late 2021 when a similar breakout triggered a multi-month rally that sent the token above $0.50. The market is now looking for that pattern to repeat, but much depends on short-term consolidation and confirmation of volume.

From a macro perspective, the HBAR coin still holds a $7.95 billion market cap, with 84% of its 50 billion token supply already in circulation. This provides a relatively fair valuation and sufficient liquidity to support significant price movements without much friction.

The long-term chart also indicates that the next significant resistance level, after $0.32, lies around $0.50, which corresponds to the peak from September 2021. If bullish momentum builds and mirrors Cardano’s past behavior, that level could eventually become a realistic target.

READ MORE: Bitcoin Price Analysis: Chart Shows Why BTC Will Explode as Supply Crashes