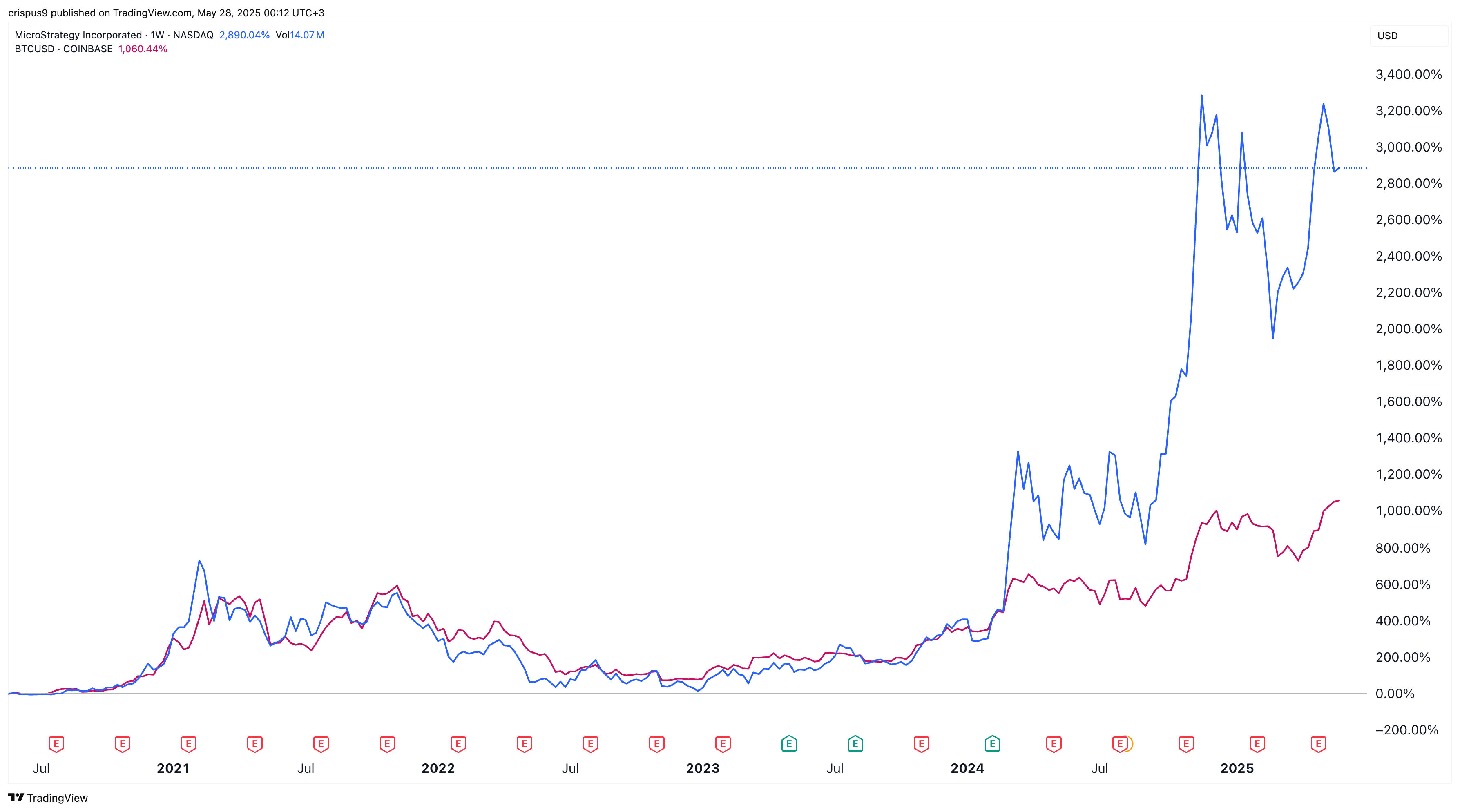

The MSTR stock price remains slightly under pressure even as Bitcoin hovers near its all-time high. On Monday, Strategy was trading at $372, having decreased by over 32% from its peak in 2024. This article predicts where the shares will be in 2030.

How Strategy Works

Strategy, formerly known as MicroStrategy, operates in two business areas: software and Bitcoin. Its software business helps companies like Adidas, AIG, AllianceBernstein, and Cisco analyze large data and make better decisions.

Strategy is known for its Bitcoin acquisition business, which has made it the largest BTC holder among corporations. It now holds 580,250 Bitcoins, equivalent to over 2% of the total supply.

The company plans to hold its Bitcoin forever. It also plans to continue buying more coins for an extended period. Indeed, it has announced that it will ultimately borrow $84 billion to use to buy Bitcoin. At the current price per Bitcoin, its potential purchase would amount to 763,636 coins, bringing the total number of coins held to 1.34 million.

Strategy uses a simple approach in its Bitcoin acquisition strategy. It mostly raises money by selling its shares, a move that has pushed its outstanding shares from 76 million in 2020 to 246 million today.

It also uses convertible bonds to raise cash. A convertible bond is a loan that the borrower can convert into shares, especially when the stock is doing well.

While Strategy’s fundraising approaches are dilutive, it hopes to compensate its investors with a higher share price. For example, while people who held the stock in 2020 were diluted, they benefited as the company moved from a $1 billion entity to a $100 billion firm.

READ MORE: MSTR Stock Forecast: Will Strategy Shares Hit ATH Like Bitcoin?

MSTR Stock Forecast for 2030

It is challenging to predict where the MSTR stock price will be in 2030, as this will depend on the Bitcoin price and the number of Bitcoins in its balance sheet.

Ark Invest estimates that the Bitcoin price will reach $2.4 million by 2030, while Robert Kiyosaki and Donald Trump predict it will get to $1 million. BlackRock believes that the Bitcoin price will surge to $700,000.

For this article, let’s assume that Bitcoin will jump to BlackRock’s target of $700,000 and that Strategy will have 700,000 coins by then. In this case, its Bitcoin holdings will be worth over $490 billion.

Strategy now holds 580,250 coins valued at over $63.82 billion. Since it has a market capitalization of $101 billion, it implies a NAV ratio of $1.58. As such, if the ratio remains intact, the company will have a market capitalization of over $775 billion.

Estimating the Strategy stock price if its market cap surges to $775 billion is challenging, as it will depend on the number of outstanding shares. By using straight maths, we can multiply the current stock price by 7.6, bringing the stock target to $2,827. 7 comes from dividing the market cap in 2030 by the current one.

This Strategy stock price forecast is not perfect because of the many assumptions. However, what is clear is that the MSTR stock price will be significantly higher than it is today, as Bitcoin is generally considered to be a bullish asset.

READ MORE: Bitcoin Price Analysis: Chart Shows Why BTC Will Explode as Supply Crashes