Quant price surged on Tuesday, reaching its highest level since January 2022 as whales started buying and exchange reserves fell. The QNT token jumped to a high of $114.10, up by 92% from its lowest level this year.

Whales are Buying QN, and Exchange Reserves are Falling

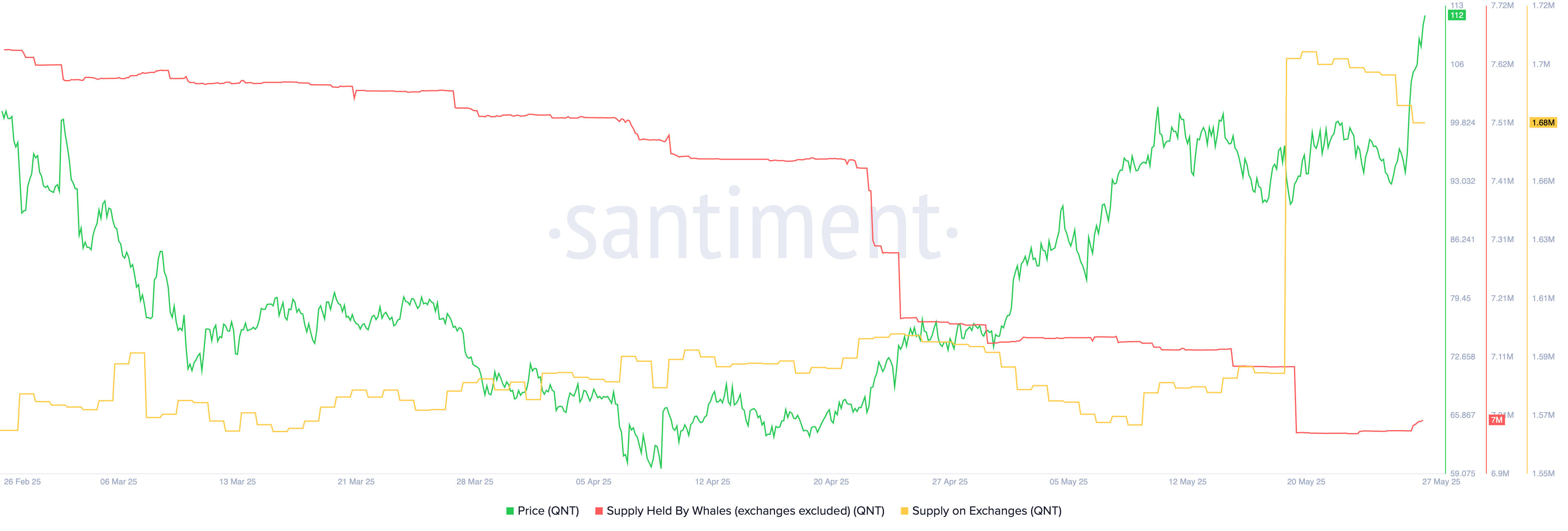

Santiment data show that whales have bought 200k Quant tokens in the past few days. The supply held by these big investors rose to 7 million today, May 27, from this week’s low of 6.8 million tokens.

The whale purchases are occurring after months of selling, following a reduction in their holdings from over 7.6 million in February to 6.8 million last week. This is a sign that they have started to capitulate, expecting the price to continue rising for a while.

Another set of data shows that balances of QNT tokens on exchanges have dropped to 1.68 million today from last week’s high of 1.7 million. Falling exchange balances indicate that investors are transferring their tokens from exchanges to self-custody wallets.

Many crypto investors are still unfamiliar with Quant, despite its $1 billion market capitalization. That’s because, unlike other crypto projects like Solana and Ethereum, Quant’s solutions are not specifically designed for retail investors. Instead, it builds complex solutions that companies and other institutions use.

Its main product is Overledger, a chain-agnostic communication protocol playing a crucial role in the real-world asset (RWA) industry. It is being used by the European Central Bank (ECB) in the creation of a digital euro.

Oracle, a large technology company, is using Quant to build the Oracle Blockchain Platform Digital Assets Edition, which aims to streamline tokenization and digital asset applications. Oracle plans to offer these solutions to companies in the financial services sector.

Quant Price Technical Analysis

The ongoing Quant price surge is in line with our recent prediction, as you can see here. The daily chart shows that the coin bottomed at $58.45 on April 7 and has since rebounded by 96.45% to its current price of $114.65.

QNT price has formed a golden cross chart pattern, a bullish pattern that forms when the 50-day and 200-day moving averages cross each other. Quant has also jumped above the 50% Fibonacci Retracement level, while oscillators have all continued rising.

Therefore, the coin is likely to continue rising as bulls target the next key resistance level at $171, the highest point reached in November last year. A move above that level is about 50% above the current point.

READ MORE: Quant Price Forms a Rare Bullish Pattern as CEX Reserves Fall