ETHFI price has jumped in the past few weeks, helped by its strong token buyback and growing assets on its platform. The Ether.fi token was trading at $ 1.40 on Wednesday, representing a 260% increase from its level a few weeks ago. Let’s explore the factors contributing to the expectation of a major breakout for the ETHFI token in the coming days.

ETHFI Price Technicals Point to a Big Jump Ahead

The daily chart shows that the ETHFI token price bottomed at $0.4085 in April, as most coins experienced a decline. It then went vertical after the developers unveiled the token buyback strategy.

ETHFI price has reached the 38.2% Fibonacci retracement level, currently standing at $1.4583. It has also formed a bullish flag pattern comprising a vertical line and a rectangle formation, often referred to as a consolidation or pullback. This pattern often leads to a strong bullish breakout, which in this case, may see it jump to the 61.8% Fibonacci retracement level at $2.10.

The bullish case is also emphasized because it is about to form a golden cross, where the 50-day and 200-day moving averages are set to cross.

ETHFI price chart | Source: TradingView

READ MORE: Is Maple Finance’s SYRUP a Good Crypto to Buy as its Price Soars?

Why Ether.fi Token Price is Soaring

Ether.fi is one of the largest players in decentralized finance (DeFi), offering staking and liquid solutions. In staking, the company allows users to deposit their Ethereum and earn a monthly return.

Its liquid solution enables users to earn money through three vaults: liquid ETH yield, market-neutral USD, and liquid BTC yield, which yield returns of up to 9.4%, 13.6%, and 10%, respectively.

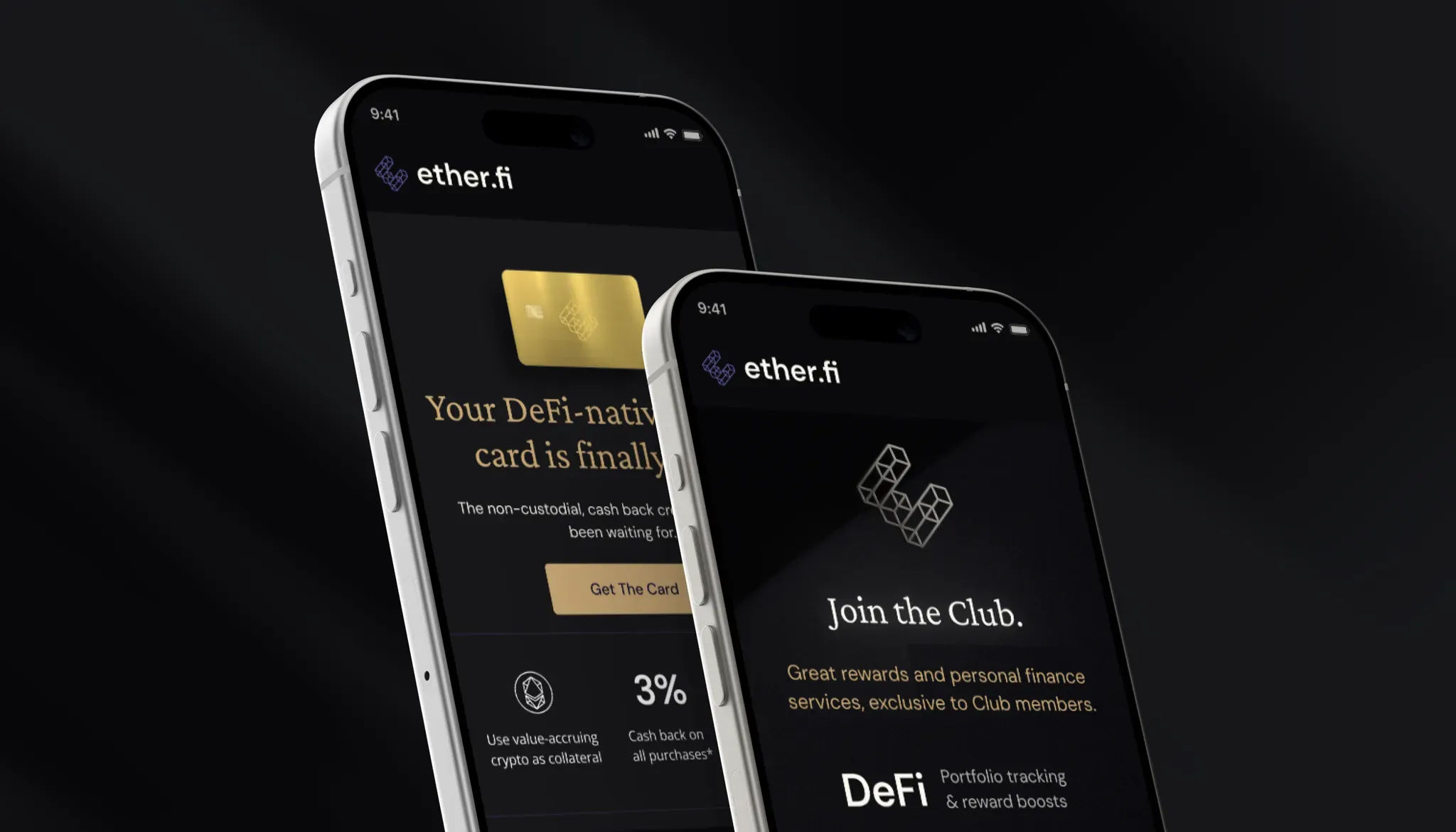

Ether.fi also offers a credit card that allows users to pay using their cryptocurrency at over 100 million locations globally.

The ETHFI price has surged in tandem with the continued growth in total value locked within its ecosystem. It now holds over $6.7 billion, making it the fourth-biggest player in the decentralized finance industry after AAVE, Lido, and EigenLayer.

ETHFI token also jumped as whales started buying the coin in January. These whales now hold 283.32 million coins, compared to a low of 273 million in April, indicating confidence in continued price appreciation.

The price has also risen in tandem with a significant increase in network fees. Data shows that the network’s fees jumped to over $13.1 million this month, up from $11.4 million in April this year.

The developers have committed to using the fees to buy back the ETHFI token, with the purchased ones going to stakers. This explains why the staking market cap has increased to over $33 million, up from the year-to-date low of $7.53 million. Higher staking inflows are a positive sign, as these investors hold their coins for longer.

READ MORE: Bitcoin Price Analysis: Chart Shows Why BTC Will Explode as Supply Crashes