LINK price remains in a deep bear market despite the ongoing Real-World Asset (RWA) tokenization hype. After soaring to $30 in November, the Chainlink coin has dropped to $14, a 53% decline from its current price of $14.2. It has also fallen by over 20% from its highest level this month.

Whales Have Dumped Chainlink Coins

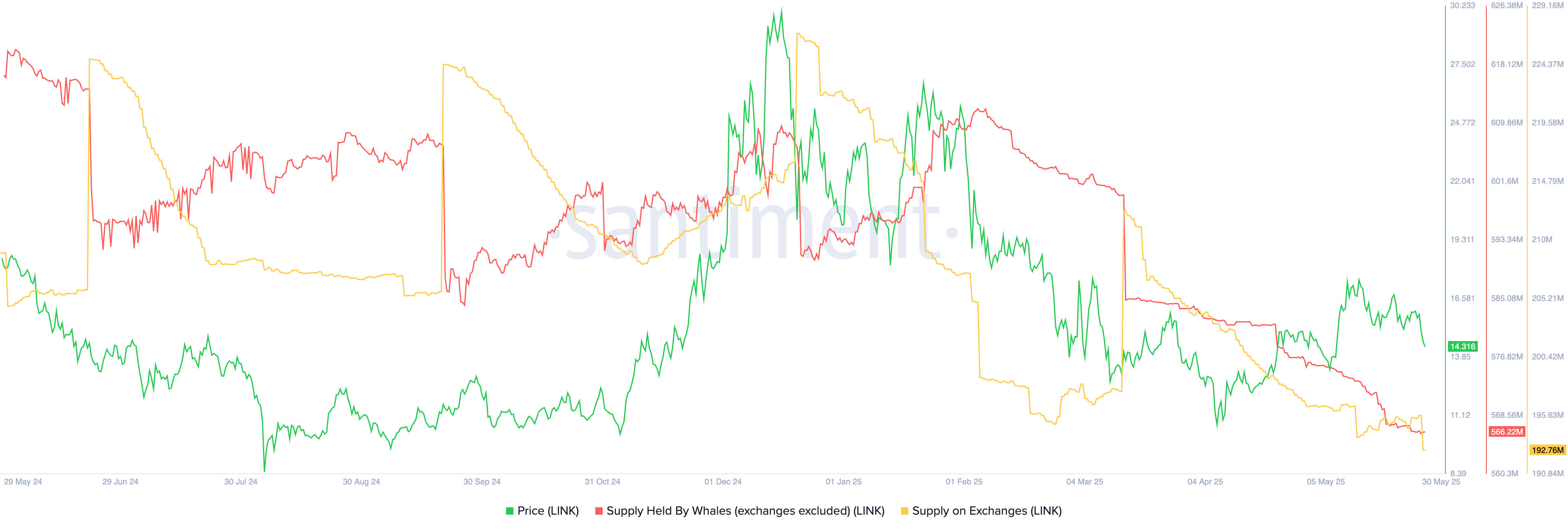

Chainlink whales have been in a selling spree this year. Santiment data shows that the supply held by whales has dropped to 566 million coins today, down from 611.7 million in January. This means that these large investors have sold tokens worth over 45 million coins, which are currently valued at over $630 million.

Whale selling is one of the most popular explanations for a crypto sell-off, as these investors tend to be more experienced than retail investors.

However, on the positive side, there are signs that non-whales have continued to hold on to their tokens. This is evident in the fact that the supply of LINK tokens on exchanges has continued to decline. There are now 192.7 million coins on exchanges, down from 227 million in January. Falling coins on exchanges is a sign that investors continue to hang on to them.

Chainlink has emerged as one of the key pillars of the RWA industry because of its cross-chain interoperability protocol (CCIP). CCIP is a messaging protocol that enables different chains to communicate with each other.

Chainlink boasts one of the strongest slates of partnerships in the cryptocurrency industry. It has a partnership with Swift, a society that handles over $150 trillion in transactions annually. Swift is exploring how to use Chainlink’s technology to simplify cross-border payments.

Chainlink has partnerships with top companies, including Coinbase, UBS, ANZ, Solv Protocol, and JPMorgan, the largest US banking group.

READ MORE: ZBCN Price: Wyckoff, Elliot Wave Point to Zebec Network Crash

LINK Price Technical Analysis

The daily chart shows that the LINK token has experienced a significant decline over the past few days. It has dropped from a high of $17.85 on May 12 to its current price of $13.97, its lowest point since May 8.

Chainlink price has plunged below the 50-day and 100-day Exponential Moving Averages (EMA), a sign that bears are in control. Oscillators such as the Relative Strength Index (RSI) and the MACD have all pointed downward.

LINK price has moved below the lower side of the ascending channel. Therefore, the most likely outlook for the Chanlink price is bearish, with the next key point to watch being at $10, the lowest point reached on April 7, which is approximately 30% below the current level.

READ MORE: Bitcoin Supply Shock Incoming? Why Exchange Reserves Are Drying Up Fast