The crypto market is crashing today, May 30th, as traders remain concerned about trade relations between the US and China. The Bitcoin price has collapsed below $104,000, continuing a downward trend that began last week when it reached a record high.

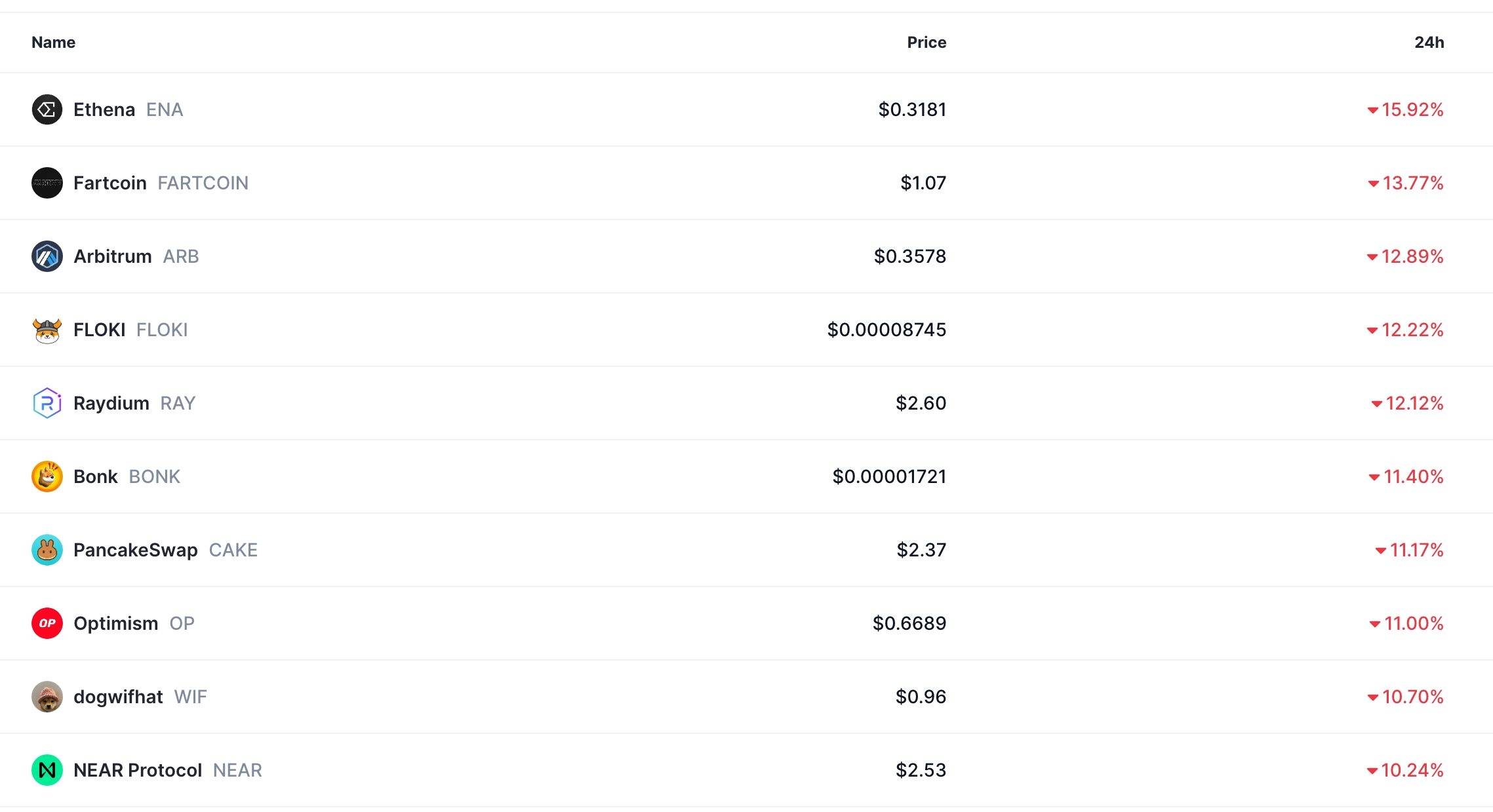

Some of the top laggards in the crypto market were Ethena, Fartcoin, Arbitrum, Floki, Raydium, and Bonk, which plunged by over 11%. Other tokens that crashed hard were popular names like PancakeSwap, Dogwifhat, and Celestia.

Crypto Market Crash Accelerates

The sell-off has been ongoing throughout the week. Still, the pace gained momentum after Scott Bessent, the Treasury Secretary, warned that talks between the US and China had stalled following the last meeting in Switzerland. He suggested that Donald Trump and Xi Jinping discuss a solution to end the gridlock.

In a social media post, Trump said that China was already violating the terms agreed in Switzerland. Although he did not provide details, officials have noted that China has halted shipments of rare earths to the US.

China, on its part, has reacted angrily to Trump’s administration’s decision to start expelling Chinese students from American universities. It is also considering barring the sale of high-tech products to Chinese companies.

The cryptocurrency market performs well when there is certainty on key issues, such as trade and monetary policy.

The Bitcoin price has also imploded due to profit-taking among investors after it surged to a record high last week. Bitcoin and other assets often retreat whenever they hit a milestone, as some investors take profits. Typically, when Bitcoin (BTC) sneezes, the rest of the cryptocurrency market catches a cold, which explains why they are all plunging.

Seasonality is another factor contributing to the crypto market’s decline. Investors are likely positioning themselves for June, which is historically one of the worst months in the crypto industry. The average Bitcoin return in June is minus 2%, while that of Ethereum is minus 7%.

READ MORE: Bitcoin Price if it Hits a $100 Trillion Market Cap as Saylor Predicts

Bitcoin to Drive the Crypto Recovery

Fortunately, Bitcoin, which drives the cryptocurrency market, remains in good shape. As we wrote on Thursday, Bitcoin’s supply continues to dwindle, while demand is rising. Balances on exchanges have dropped from over 3.2 million coins to 1.35 million, while spot Bitcoin ETFs have just crossed the $45 billion milestone in terms of inflows.

The Bitcoin price has also formed a cup-and-handle pattern and is being supported by the 50-day and 100-day moving averages, signaling a potential for further upside. Altcoins will stage a strong surge if Bitcoin bounces back.

READ MORE: Crypto Crash: Why are Bitcoin and Altcoins Going Down?