Cardano price has remained under pressure this year as it lacks a clear catalyst to push it higher. The ADA price was trading at $0.668 on Thursday, down by 50% from its highest point in November last year. This article explains the top 4 reasons to sell ADA to avoid more losses.

Cardano is a Ghost Chain

The first main reason to avoid Cardano is that it is largely a ghost chain, a blockchain that lacks an active ecosystem. Data shows that Cardano’s decentralized finance (DeFi) ecosystem has a total value locked (TVL) of $411 million.

While this is a significant number, it is much smaller than some of the recently launched networks, such as Berachain, Sonic, and Unichain. Additionally, a closer examination reveals that Liqwid has $103 million in assets. The other remaining dApps on its ecosystem have less than $80 million in assets.

At the same time, the supply of stablecoins on Cardano has dropped to about $30 million, a tiny amount considering that there are over $250 billion in circulation.

READ MORE: Solana Price Prediction as a “New” $1.9 Billion Catalyst Emerges

Bitcoin May Flop

Another reason the Cardano price may crash is that the much-anticipated Bitcoin integration may fail.

For starters, Cardano hopes to integrate with Bitcoin through the BitcoinOS Grail Bridge. It hopes that this integration will unlock over $1.3 trillion in liquidity to flow through its network.

One benefit of this integration is that it will let users stake their Bitcoin. However, there is a likelihood that this integration will not work out as expected. That’s because the technology to stake Bitcoin already exists through platforms like Babylon Protocol and Lombard Finance.

Cardano has Weak On-Chain Metrics

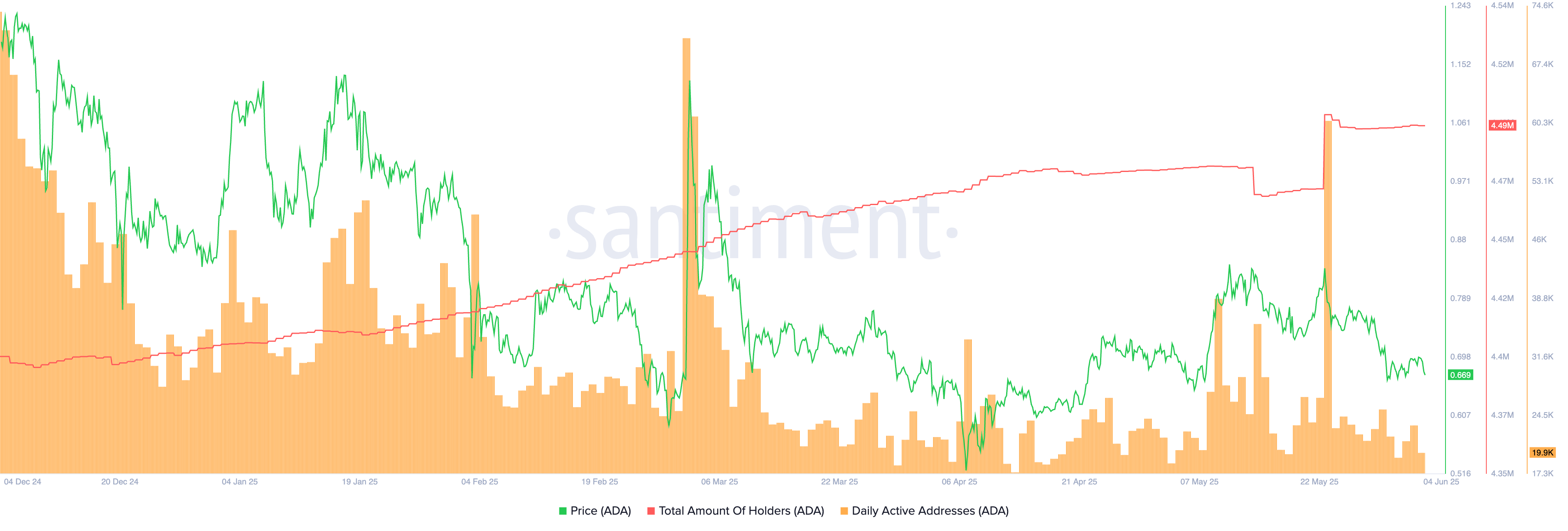

Further, there are indications that Cardano has weak on-chain metrics, which may impact its growth. The chart below shows that the number of holders has dropped to 4.49 million, down from a high of 4.5 million in May.

Another data shows that Cardano’s active addresses have plunged in the past few days. After peaking at 26,660 on May 23, the figure has tumbled to below 20,000 today. That is a sign that users are not interacting with Cardano as they did before.

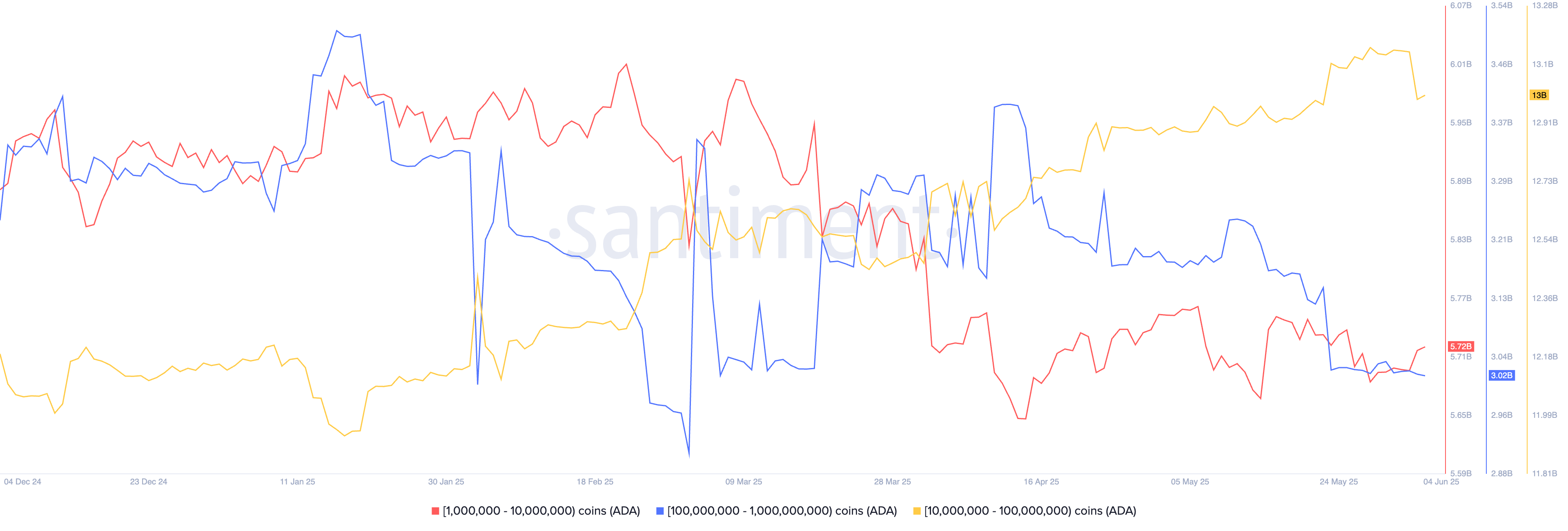

More data shows that whales have continued to sell their Cardano coins in the past few months. Holders with between 100 million and 1 billion coins hold 3.02 billion coins, down from 3.4 billion in April. Similarly, those holding between 1 million and 10 million coins hold 5.72 billion coins, down from 6 billion earlier this year.

READ MORE: XRP Price Prediction: Can Ripple Turn $1K to $10K by 2030?

Cardano Price Technicals

Finally, Cardano has weak technicals that may push it much lower soon. The eight-hour chart shows that the coin formed a double-top pattern at $0.844 and has now moved below the neckline at $0.711. A drop below that neckline is a sign that bears have prevailed.

Cardano price has also formed a bearish flag pattern, a popular negative sign. Therefore, the coin will likely continue falling as sellers target the key support at $0.513, its lowest point in April, which is down 23% from the current level.

READ MORE: New $6.4 Billion Tech Company Joins Hedera Hashgraph (HBAR) Council