Bittensor’s native token, $TAO, is regaining momentum after weeks of downside pressure, currently trading at $380.60, up 3.65% on the day and 3.42% over the past month.

The rebound appears to be more than just a relief rally, with top analysts calling this the “ideal buy zone” and pointing to a possible bullish reversal in the coming weeks.

Bittensor Price Hits Critical Support and Starts to Climb

Renowned trader Michaël van de Poppe declared that $TAO has hit the ideal dip-buying zone and is “starting to go upwards.”

In a recent tweet, he stated that we are at the end of the correction and anticipate significant growth in the months to come.

His chart analysis supports this, showing that the TAO coin bounced from a key area of prior demand after a long period of lower highs. The reclaim suggests a possible trend shift, especially if Bittensor price can push past the psychological $400 level and hold.

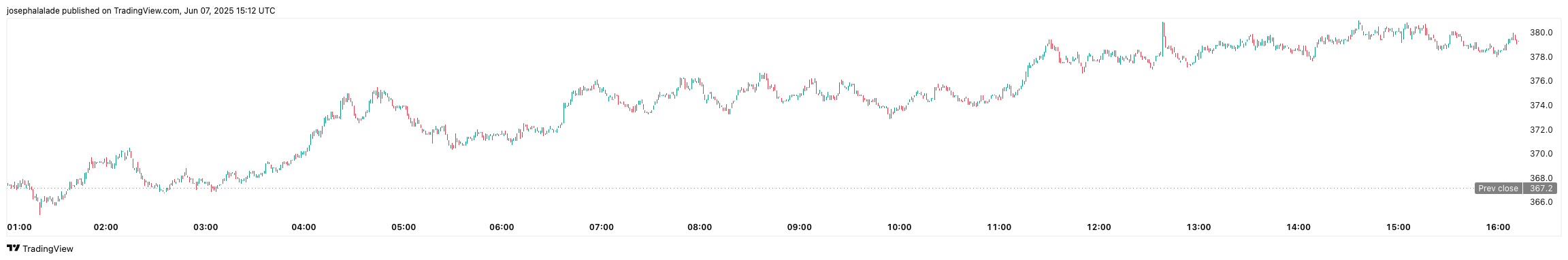

This follows a brutal 46% six-month decline, as shown on TradingView. However, the price action now indicates a slow but steady recovery, with higher lows forming across both the 4-hour and daily charts.

Van de Poppe noted that Bitcoin (BTC) is nearing key resistance and may break out soon, which could boost altcoins like TAO. Bittensor often moves with the broader market, so a BTC rally might trigger renewed interest in AI coins.

TAO Price Technical Analysis

From a technical standpoint, Bittensor (TAO) is showing signs of accumulation. On CoinMarketCap, it saw a volume spike of $81.32M in the last 24 hours despite a 51% drop from earlier peaks, indicating that some whales may have already filled their bags during the downtrend.

Meanwhile, the daily chart TradingView shows steady stair-step gains across the past 24 hours, with today’s breakout candle confirming buyer interest.

Momentum is building, and a breakout above $385–$390 could trigger a run toward $410–$430 in the short term and potentially $450 in the coming weeks. These levels are based on previous local tops and Fibonacci retracements.

However, if the price fails to hold above $365, there’s a risk of sliding back to the $345–$350 demand zone. But as it stands, momentum favors bulls.

Bittensor Subnets Listed on CoinGecko

A major fundamental tailwind is the official listing of Bittensor subnets on CoinGecko. These subnets represent individual projects building within Bittensor’s decentralized AI network and are now recognized under a new category titled “Bittensor Ecosystem Coins.”

Coins like Bitsec.ai, Templar, NOVA, Synth, and ReadyAI, priced between $1.26 and $33.67, are gaining visibility and liquidity, giving more depth to the TAO ecosystem. This development is likely to attract more developers, capital, and speculators into the TAO economy, as each subnet adds utility to the underlying network.

This kind of modular expansion mirrors what we’ve seen in Layer 1 ecosystems like Cosmos or Avalanche, which saw price surges after their respective subnets or zones went live.

READ MORE: Top Analyst Explains Why the Polkadot Price is About to Surge