Ethena crypto (ENA) appears to be at a critical pivot point, as both on-chain data and technical analysis suggest a potential price rebound. After weeks of decline, with smart money pouring over $2 million into the token in the last 24 hours, analysts are closely watching for an Ethena price breakout.

Ethena Price Signals Bullish Divergence, Targets $1.20 Mid-Term

On June 7, technical analyst Sjuul pointed out a bullish divergence forming on $ENA’s daily chart. The Ethena crypto has been respecting a long-term diagonal support line, where the price continues to make lower lows while the RSI (Relative Strength Index) begins to form higher lows, a classic bullish signal suggesting weakening bearish momentum.

This divergence often indicates that sellers are losing strength, and a reversal may be near. According to Sjuul, it is a “Very good place for a local bottom,” aligning with what traders call a “bounce zone.”

A day earlier, another analyst, Solberg Invest, provided a broader outlook for Ethena ($ENA). In his mid-term chart, he highlighted a strong support band between $0.35 and $0.45, reinforcing the idea that $ENA might be bottoming out.

READ MORE: Ethereum Price Targets $4k, But Bitcoin Pepe Offers Bigger Upside

More importantly, Solberg is targeting $1.20, with the potential to hit $1.50 if the token breaks resistance. If these targets come into play, then we should be expecting approximately a 263.4% to 354.6% increase from the current level.

His chart shows a clear pattern: support holds, price consolidates, and a breakout follows. He said, “No worries,” implying that this consolidation is healthy before the next leg up.

Data Confirms Ethena Crypto Accumulation

Supporting the bullish case is on-chain data from Nansen, one of the most trusted analytics platforms in the crypto space. Their June 6 post shows $ENA at the top of the smart money inflow list, with over $2.08 million entering the token in just 24 hours.

That’s more than double what any other token saw in that period. This kind of movement from wallets and individual investors with a track record of profits often precedes upward momentum, as these wallets tend to buy heavily at discounted or key support zones.

Technical Indicators Still Cautious

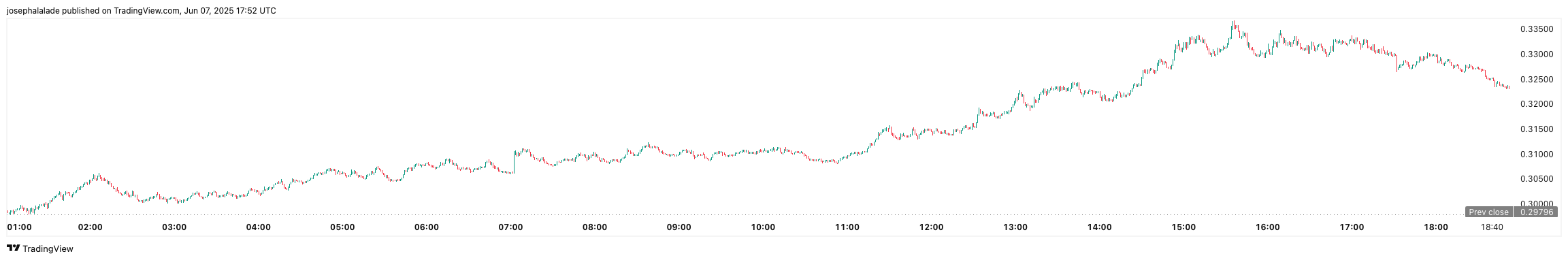

As of June 7, $ENA is trading around $0.3299, up over 10% on the day. In the 24-hour chart from TradingView, the token has bounced from the $0.30 zone and is now trending upward. The pattern shows consistently higher lows forming throughout the day, signaling buyer control.

Similarly, the Ethena price has a monthly increase of 22.77% despite being down over 60% year-to-date. The rebound hints that short-term traders are beginning to front-run a larger move.

However, the weekly technical summary remains mixed. According to TradingView’s technical analysis tool, most moving averages are flashing a “Strong Sell,” especially the 10-day, 20-day, and 50-day EMAs. Oscillators are more neutral, with only the Awesome Oscillator flashing a sell and Momentum showing a buy.

This means that while the short-term signals are turning bullish, the medium-term trend remains under pressure. Traders seeking a long-term reversal will want to see confirmation through higher-time frame moving average flips and increased volume.

READ MORE: Bittensor Price Prediction: TAO Targets $450 as Correction Nears Its End