The Uniswap price surged to its highest point since February, as Decentralized Finance (DeFi) tokens also rose. UNI soared to a high of $8.6858, up by 80% from its lowest level this year.

Why Uniswap Price Could be at Risk

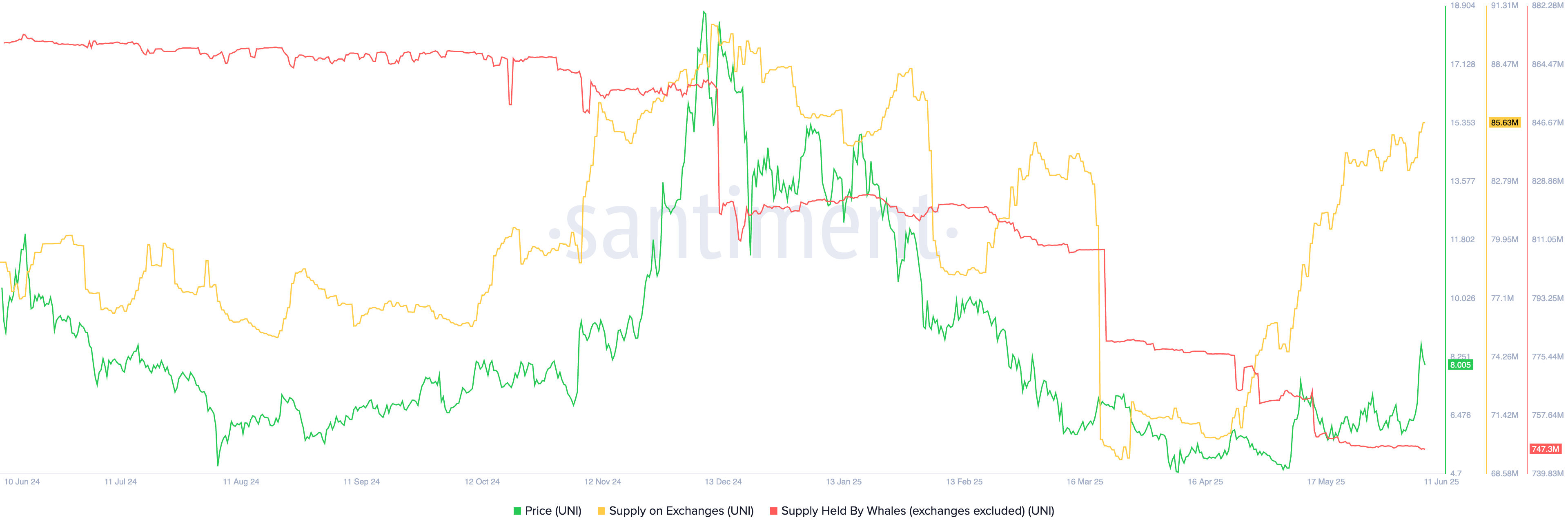

Uniswap price could be at risk, as on-chain data show that exchange supply has surged over the past few days. Per Santiment, the supply of UNI tokens on exchanges jumped to 85.63 on June 12, the highest level since February 3. This supply has jumped from the year-to-date low of 69 million.

Soaring exchange balances indicate that UNI holders are transferring their tokens to exchanges. This is usually the first stage that people use to sell their cryptocurrencies.

More data shows that whales have continued dumping the token despite the recent rebound. The supply of UNI tokens held by whales has tumbled to 747 million, its lowest level in over a year. These whales held over 846 million tokens in October last year.

READ MORE: HBAR Price Prediction: Hedera to Surge Despite Challenges

The other risk is that Uniswap is facing substantial competition. Most of this competition is coming from PancakeSwap, which processed transactions worth over $125 billion in the last 30 days. Uniswap handled volume worth $94 billion in the same period.

More competition is coming from Hyperliquid, a top player in the perpetual futures exchange industry, which handled a volume of $247 billion in the last 30 days and $9 billion in the last 24 hours.

On the positive side for Uniswap, Unichain, its layer-2 network, has become the 6th biggest chain in the decentralized exchange industry. It handled over $9.68 billion in the last 30 days, much higher than popular chains like Sui, Aptos, Polygon, and Avalanche.

UNI Price Technical Analysis

The daily chart indicates that the UNI price rebounded and reached a high of $ 8,685.80 on Wednesday. It was its highest point since February this year.

Uniswap price moved above the important resistance level at $7.5410, the highest swing point on May 10. Moving above that level invalidated the forming double-top pattern.

UNI price has also jumped above the 50-day and 100-day Exponential Moving Averages (EMA), a sign that bulls are in control for now.

Therefore, the most likely scenario is where the Uniswap token retests the support at $7.55 and then resumes the uptrend. If this happens, the next point to watch will be at $11.97, the 50% Fibonacci Retracement level. A drop below the support at $7.54 will invalidate the bullish outlook.

READ MORE: Polkadot Price Rises Amid Crypto Card Vote as Hot Token Surges