The Pepe price has pulled back this week, continuing a sell-off that began on May 22, when it peaked at $0.00001620. The token has plummeted to $0.00001070 as the crypto sell-off intensifies.

Pepe Coin may bounce back in the coming days because of its strong technicals, including Elliot Wave pattern, whale buying, and supply on exchanges.

Pepe Price Elliot Wave Points to a Surge

The daily chart shows that the Pepe Coin price bottomed at $0.000005235 in March and then began a slow recovery, which pushed it to a high of $0.00001620.

It has now completed forming the first phase of the Elliot Wave, which ended near the 50% Fibonacci Retracement level.

It has now formed a double bottom pattern at $0.00001055, marking the end of the second phase of the Elliot Wave. This price is notable since it coincided with the 78.2% Fibonacci Retracement level and the 200-day moving average.

Pepe price will now move to the third phase, which is usually the longest one. If this happens, the next point to watch will be the 23.6% Fibonacci Retracement level at $0.00002313, which is about 155% above the current level.

A drop below the key support at $0.000080 will invalidate the bullish Pepe price forecast.

READ MORE: Here’s Why Shiba Inu Coin Price Could Crash Soon

Pepe Coin Has Strong Fundamentals

The potential Pepe rebound is expected to occur due to its strong fundamentals. First, Pepe is one of the most actively traded meme coins in the crypto industry, with a daily volume of over $1.78 billion, much higher than Shiba Inu’s $384 million.

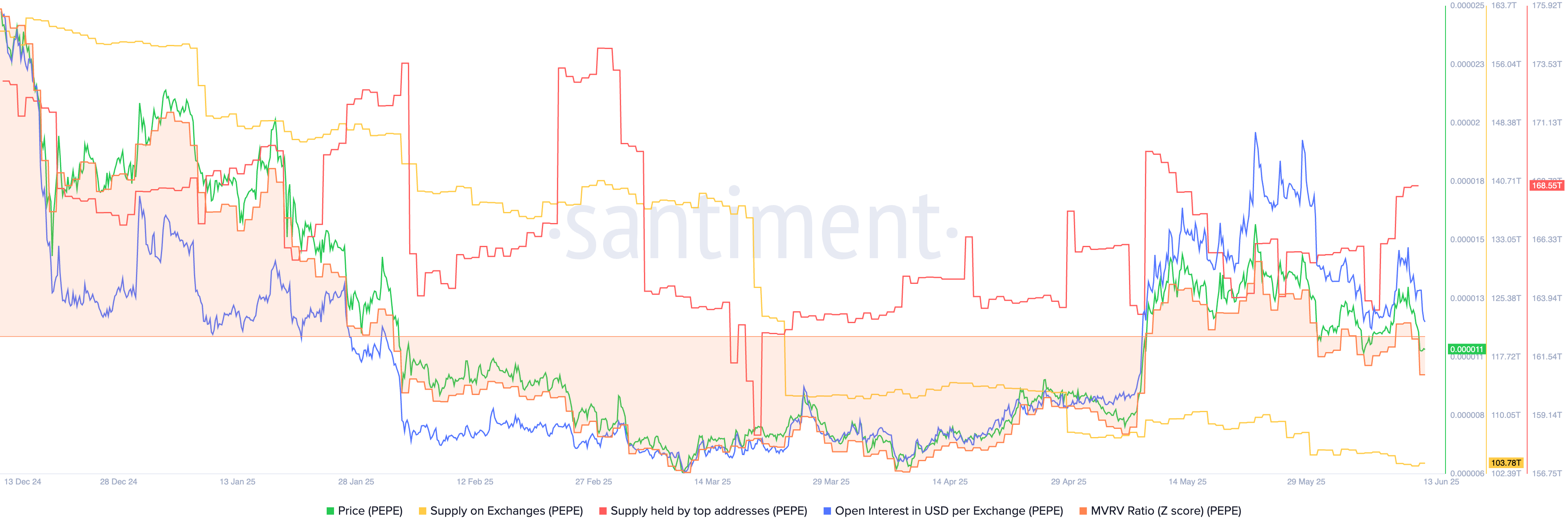

Second, on-chain data reveals that Pepe investors are not selling the token despite its recent underperformance. The supply of tokens on exchanges has dropped to 103.8 trillion, down from the year-to-date high of 170 trillion.

Third, the supply held by top addresses, a proxy for whales, has jumped to 168.55 trillion tokens, up from a low of 163 trillion this month. Rising balances held by these investors are bullish because it is a sign that they expect the price to jump.

Further, as the chart below shows, the open interest and MVRV indicator have moved downwards in the past few days. In most cases, crypto prices rebound after an asset’s open interest drops and falls when it peaks. The same is true when the market value to realized value (MVRV) falls.

Finally, as we mentioned earlier, there is a possibility that the Ethereum price will surge to over $4,000 eventually. That article highlighted a bullish flag pattern and a golden cross, indicating further gains. Pepe price will likely do well if Ethereum surges, as it is the second-largest meme coin in the ETH ecosystem.

READ MORE: Uniswap Price at Risk as Exchange Reserves Rise and Whales Dump