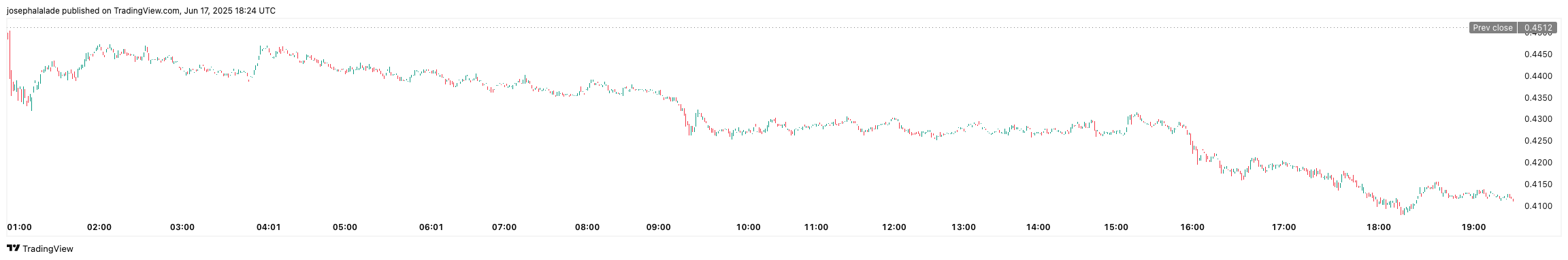

Immutable (IMX), a popular token in Web3 gaming and NFTs, has dropped nearly 10% in the last 24 hours, now priced at $0.427 as of June 17, 2025. This sudden decline is due to a mix of structural factors, technical challenges, and negative market sentiment, which has created intense selling pressure on the IMX token.

Despite ongoing improvements to the network and a growing gaming community, the Immutable token has struggled to attract buying interest. The outlook remains weak unless it can reclaim important support.

Why Immutable Price Is Dropping: Token Unlock and Market Shift

The biggest trigger behind the decline of the IMX coin was a $12.44 million token unlock on June 13, which released 1.33% of the total supply into circulation. Historically, such unlock events have sparked short-term selloffs, especially when market sentiment is lukewarm.

At the time of the unlock, the IMX token was already down 34.7% over the previous 30 days. With the broader market leaning neutral (CMC Fear & Greed Index at 53/100), there wasn’t enough momentum to absorb the new supply, causing a wave of selling.

Compounding the pain is Bitcoin’s rising dominance, now at 63.91%, pulling capital away from altcoins like IMX. Traders are opting for perceived safety in Bitcoin (BTC) during uncertain market phases.

IMX Token Loses Key Support

From a technical standpoint, the IMX coin has entered a bearish phase. It broke down below the critical $0.439 Fibonacci swing low, which has now flipped into resistance. This breakdown coincides with a broader rejection of the 10-day ($0.49), 50-day ($0.563), and 200-day ($0.796) exponential moving averages.

The most recent technical summary from TradingView gives IMX a “Strong Sell” designation, as 14 out of 26 indicators are showing a bearish alert.

Among the key negative signals are the RSI (Relative Strength Index) at 36.27, nearing oversold territory, but without any divergence observed yet, the MACD histogram is deep in the negative at -0.00726, and all moving averages are trending downward with no “Buy” indications present.

Moreover, the trading volume over the past 24 hours surged by 119% to reach $67 million, indicating that the decline isn’t solely due to low liquidity; holders are also actively selling off their positions.

Interestingly, this bearish sentiment arrives just days before a potentially bullish development: MEXC will officially support IMX deposits on the Immutable network starting June 18, 2025. This could boost access and demand, particularly from Asian retail markets.

READ MORE: XRP Price Prediction: Top 3 Reasons Ripple Will Surge 46% Soon