Ethereum price continues to consolidate this week as buyers remain on the sidelines. The ETH token was trading at $2,500 on Tuesday, within a range it has maintained over the past few days. This price is about 82% above the lowest level this year.

ETH Supply on Exchanges is Crashing

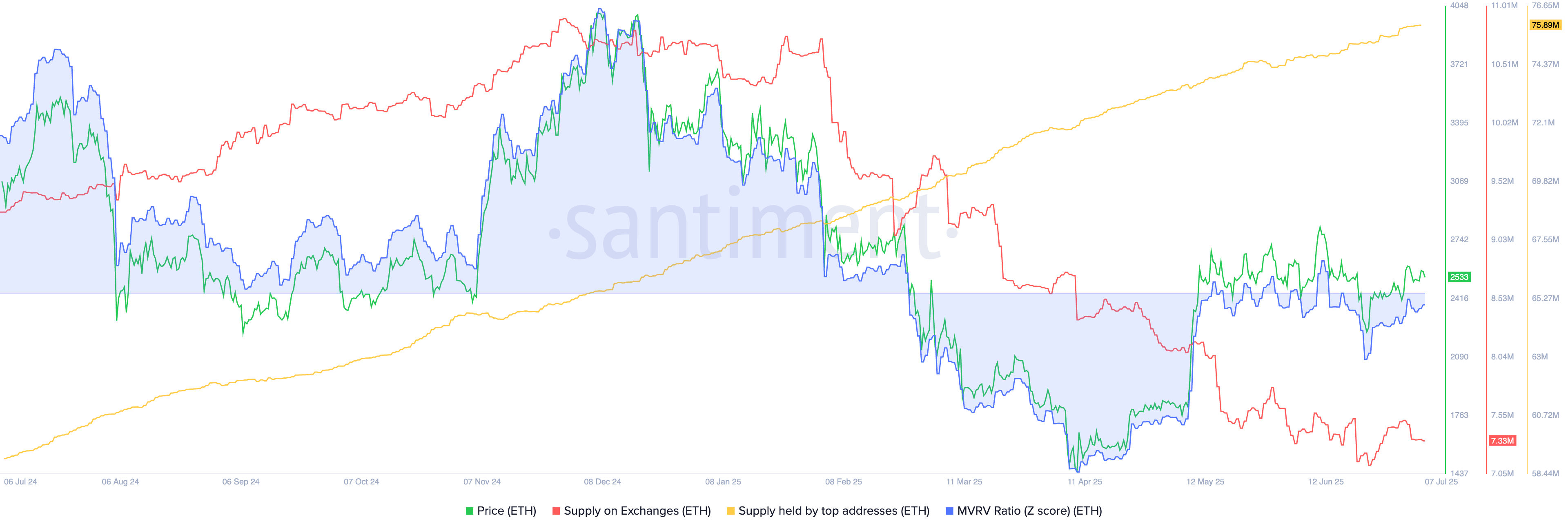

A potential catalyst for the Ethereum price is that the supply in exchanges has been in a free fall in the past few months. There are now 7.33 million coins in exchanges, down from a high of 10.9 million in November last year. Falling ETH on exchanges is a sign that investors are moving their coins to self-custody.

The ongoing accumulation of ETFs is also a reason for the ongoing supply crunch. Spot Ethereum ETFs have experienced positive net inflows for the last four consecutive months, increasing their total holdings to over $10.83 billion. Some of the biggest ETH ETFs are BlackRock’s ETHA, Grayscale’s ETHE and ETH, and Fidelity’s FETH.

READ MORE: Polkadot Price Prediction as Analyst Explains the DOT Crash

More data indicate that top Ethereum addresses are continuing to increase their holdings. They now hold over 75 million ETH coins, much higher than last July’s low of 59 million.

Another bullish catalyst for the Ethereum price is that it remains relatively cheap based on the popular MVRV indicator. It has an MVRV score of -0.06, significantly lower than last year’s high of 1.41. The MVRV indicator stands for Market Value to Realized Value, and it compares an asset’s market value to its realized value. A figure of minus 1 indicates that an asset is undervalued.

ETH supply in exchanges | Source: Santiment

Ethereum Price Technical Analysis

The daily chart indicates that the ETH price has remained within a tight range over the past few months. It has formed a bullish flag pattern and is now in the flag section.

The Ethereum price has moved above the 50-day and 100-day Exponential Moving Averages (EMAs), a sign that bulls are in control. Therefore, the coin is likely to experience a bullish breakout, with the next key point to watch being $3,000. This forecast will be confirmed if it moves above the key resistance level at $2,867, its highest point in May.

READ MORE: Cardano Price Prediction: Here’s Why ADA is on the Brink